The forex markets are largely in tight range in Asian session today. Dollar is currently the strongest one for the week, after the rally attempt overnight. But traders are still holding their bets ahead of today’s non-farm payroll data. For now, Canadian Dollar is the second best, followed by Aussie. Yen is the worst performer, followed by Kiwi and Euro. In addition to NFP, much attention would be on Eurozone CPI flash and Canada employment. Reactions on today’s data release could set the tone for the rest of the month.

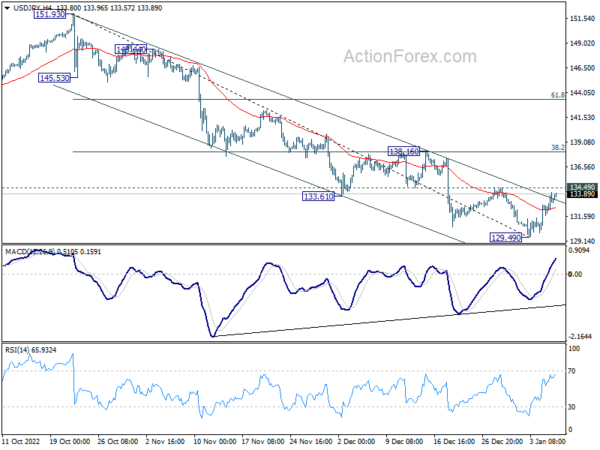

Technically, the conditions for a near term rebound in USD/JPY are there, with break of channel resistance and bullish convergence in 4 hour MACD. Firm break of 134.49 resistance should bring rise to 138.16 cluster resistance (38.2% retracement of 151.93 to 129.49 at 138.06), with prospect of further rally to 61.8% retracement at 143.35. Let’s see how it goes with NFP.

In Asia, at the time of writing, Nikkei is up 0.54%. Hong Kong HSI is down -0.27%. China Shanghai SSE is up 0.12%. Singapore Strait Times is down -0.61%. Japan 10-year JGB yield is up 0.0804 at 0.501, pressing BoJ’s cap. Overnight, DOW dropped -1.02%. S&P 500 dropped -1.16%. NASDAQ dropped -1.47%. 10-year yield rose 0.011 to 3.720.

ECB Villeroy: Desirable to reach terminal rate by summer, and stay there

ECB Governing Council member Francois Villeroy de Galhau said yesterday, “it would be desirable to reach the right ‘terminal rate’ by next summer, but it is too early to say at what level.”

“We’ll then be ready to remain at this terminal rate as long as necessary,” Villeroy said. “The sprint of rate increases in 2022 becomes more of a long-distance race, and the duration will count at least as much as the level.”

“We need to be pragmatic and guided by observed data, including underlying inflation, without fetishism for increases that are too mechanical,” he added.

“Our forecast, and our commitment, is to bring inflation toward 2% between now and the end of 2024 to the end of 2025,” Villeroy said.

Fed Bullard: Policy rate getting closer to sufficiently restrictive zone

St. Louis Fed President James Bullard said yesterday that FOMC aggressive actions in 2022 and planned rate hike in 2023 has “returned inflation expectations to a level consistent with the Fed’s 2% inflation target.”

“During 2023, actual inflation will likely follow inflation expectations to a lower level as the real economy normalizes,” he said.

“The policy rate is not yet in a zone that may be considered sufficiently restrictive, but it is getting closer,” he added.

Regarding the economy, Bullard noted, “The probability of a soft landing has increased compared to where it was in the fall of 2022, where it was looking more questionable… And the reason I think that the prospects for a soft landing have increased is that the labor market has not weakened the way many had predicted” and growth levels rebounded from weakness”.

US NFP to guide stocks and Dollar

Focuses will once again turn to US non-farm payrolls data today. Markets are expecting 200k job growth in December. Unemployment rate is expected to be unchanged at 3.7%. Average hourly earnings are expected to continue to grow solidly by 0.4% mom.

Looking at some related data, ADP private employment posted strong upside surprise of 235k growth. ISM manufacturing employment rose from 48.4 to 51.4, back in expansion. Four-week moving average of initial jobless claims was down slightly to 214k. Consumer confidence improved notably from 101.4 to 108.3.

Overall, the US job markets should continue to show much resilience despite high inflation and continuous tightening. The point of attention is more likely on wages growth and the implications on inflation ahead, and thus Fed’s policy path.

US stocks have been trading in tight range in the past two weeks, rightly so. S&P 500 is capped below flat 55 day EMA, which keeps near term bearish bias. Break of near term support at 3764.49 will resume the decline from 4100.96. More importantly, such development will affirm the case that whole correction from 4818.62 is still in progress for at least another low below 3491.58. Nevertheless, a strong close above 55 day EMA and 3918.39 resistance will instead indicate that rebound from 3491.58 is ready to resume through 4100.96. SPX’s reaction to today’s NFP data will be a clear indication of underlying risk sentiment, which should then guide the path of Dollar.

Looking ahead

Eurozone CPI flash will be the main focus in European session. Eurozone economic sentiment and retail sales, Germany retail sales and factory orders, France consumer spending, Swiss retail sales and foreign currency reserves, UK PMI construction will also be released.

Later in the day, US non-farm payrolls, ISM services and factory orders will be released. Canada employment will also be featured.

GBP/USD Daily Outlook

Daily Pivots: (S1) 1.1832; (P) 1.1955; (R1) 1.2036; More…

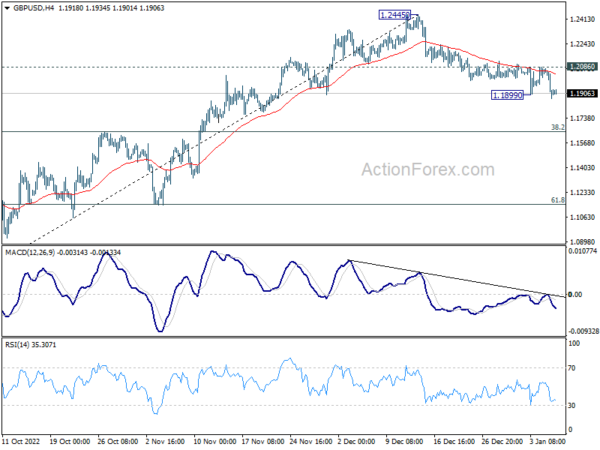

Intraday bias in GBP/USD is back on the downside with break of 1.1899 temporary low. Sustained trading below 55 day EMA (now at 1.19383) will extend the fall from 1.2445 to 38.2% retracement of 1.0351 to 1.2445 at 1.1645 next. However, strong rebound from 55 day EMA, followed by break of 1.2086 resistance, will argue that the pull back from 1.2445 has completed, and turn bias back to the upside for retesting this high.

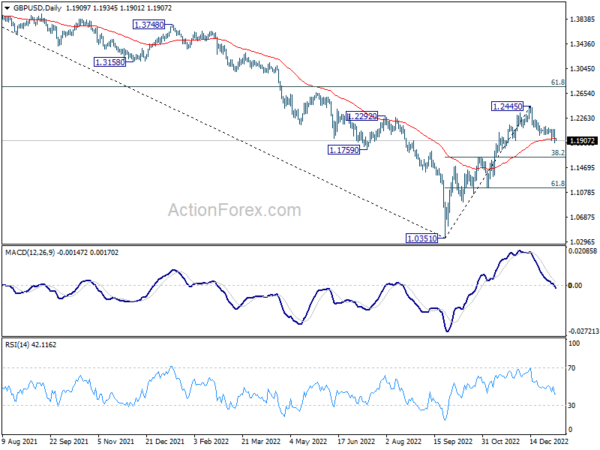

In the bigger picture, rise from 1.0351 medium term bottom is at least correcting whole down trend from 1.4248 (2021 high). Further rise is expected as long as 1.1644 resistance turned support holds. Next target is 61.8% retracement of 1.4248 to 1.0351 at 1.2759. Sustained break there will pave the way back to 1.4248. This will remain the favored case as long as 55 day EMA (now at 1.1916) holds.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 23:30 | JPY | Labor Cash Earnings Y/Y Nov | 0.50% | 1.50% | 1.80% | 1.40% |

| 07:00 | EUR | Germany Retail Sales M/M Nov | 1.50% | -2.80% | ||

| 07:00 | EUR | Germany Factory Orders M/M Nov | -0.50% | 0.80% | ||

| 07:30 | CHF | Real Retail Sales Y/Y Nov | 3.00% | -2.50% | ||

| 07:45 | EUR | France Consumer Spending M/M Nov | -1.00% | -2.80% | ||

| 08:00 | CHF | Foreign Currency Reserves (CHF) Dec | 790B | |||

| 09:30 | GBP | Construction PMI Dec | 50.6 | 50.4 | ||

| 10:00 | EUR | Eurozone CPI Y/Y Dec P | 10.00% | 10.10% | ||

| 10:00 | EUR | Eurozone CPI Core Y/Y Dec P | 5.00% | 5.00% | ||

| 10:00 | EUR | Eurozone Economic Sentiment Indicator Dec | 93 | 93.7 | ||

| 10:00 | EUR | Eurozone Industrial Confidence Dec | -1.6 | -2 | ||

| 10:00 | EUR | Eurozone Services Sentiment Dec | 2.1 | 2.3 | ||

| 10:00 | EUR | Eurozone Consumer Confidence Dec F | -22.2 | -22.2 | ||

| 10:00 | EUR | Eurozone Retail Sales M/M Dec | 0.10% | -1.80% | ||

| 13:30 | USD | Nonfarm Payrolls Dec | 200K | 263K | ||

| 13:30 | USD | Unemployment Rate Dec | 3.70% | 3.70% | ||

| 13:30 | USD | Average Hourly Earnings M/M Dec | 0.40% | 0.60% | ||

| 13:30 | CAD | Net Change in Employment Dec | 5.5K | 10.1K | ||

| 13:30 | CAD | Unemployment Rate Dec | 5.20% | 5.10% | ||

| 15:00 | USD | ISM Services PMI Dec | 55.5 | 56.5 | ||

| 15:00 | USD | Factory Orders M/M Nov | -0.90% | 1.00% |