It’s looks like a rather typical risk-on day today, with Dollar and Yen trading broadly lower, while Aussie leads commodity currencies higher. Major European indexes are firmly up while US futures also point to higher open. US and European benchmark yields are trading down again. Gold is extending recent rebound, but oil prices are falling notably. Nevertheless, it should be reminded that there will be key events ahead, including ISM manufacturing and FOMC minutes today, and Eurozone CPI and US non-farm payrolls on Friday. So, the roller-coaster ride is just starting.

Technically, Dollar remains largely in range for now despite today’s selloff. Key levels to watch to prove the greenback’s weakness include 1.0733 resistance in EUR/USD, 0.6892 resistance in AUD/USD, 0.9199 low in USD/CHF and 1.3483 support in USD/CAD. Let’s see if these levels will finally be violated before the week ends.

In Europe, at the time of writing, FTSE is up 0.38%. DAX is up 1.62%. CAC is up 1.75%. Germany 10-year yield is down -0.1074. Earlier in Asia, Nikkei dropped -1.45%. Hong Kong HSI rose 3.22%. China Shanghai SSE rose 0.22%. Singapore Strait Times dropped -0.10%. Japan 10-year JGB yield rose 0.0486 to 0.464.

Eurozone PMI composite finalized at 49.3, downturn moderated further

Eurozone PMI Services was finalized at 49.8, in December, up from November’s 48.5. PMI Composite was finalized at 49.3, up from prior month’s 47.8. Looking at PMI Composite readings of some member states, Spain (49.9), Italy (49.6), France (49.1) and Germany (49.0) were all in contraction.

Joe Hayes, Senior Economist at S&P Global Market Intelligence said:

“The eurozone economy continued to deteriorate in December, but the strength of the downturn moderated for a second successive month, tentatively pointing to a contraction in the economy that may be milder than was initially anticipated….

“Cooling price pressures have helped temper the decline in economic activity levels….

“Nevertheless, there is little evidence across the survey results to suggest the eurozone economy may return to meaningful and stable growth any time soon.”

Swiss CPI down to 2.8% yoy, but core rose to 2.0% yoy

Swiss CPI dropped -0.2% mom in December, due to several factors including falling prices for fuels and heating oil, fruiting vegetables and medicines. On the other hand, rents for holiday flats and the hire of private means of transport increased.

Annually, CPI slowed from 3.0% yoy to 2.8% yoy in December, below expectation of 2.9% yoy. Core inflation (excluding fresh and seasonal products, energy and fuel), accelerated from 1.9% yoy to 2.0% yoy.

Domestic products inflation rose from 1.8% yoy to 1.9% yoy. Imported products inflation slowed notably from 6.3% yoy to 5.8% yoy.

BoJ Kuroda expects economy to grow firmly and stably this year

BoJ Governor Haruhiko Kuroda told the bankers’ association that Japan is facing uncertainties “such as inflation and pandemic. Yet, he expects the economy to “firmly and stably this year backed by accommodative monetary conditions.”

Kuroda reiterated that the central bank would keep monetary easing to achieve the 2% inflation target accompanied by wage growth.

Separately, Prime Minister Fumio Kishida said on a radio program that aired Tuesday, “raising interest rates has an impact on people’s day-to-day lives and small and midsize businesses It’s not the case that all that needs to be done is to raise rates. The government and the Bank of Japan each have a role to play.”

Japan PMI manufacturing finalized at 48.9, slipped further into contraction

Japan PMI Manufacturing was finalized at 48.9 in December, down from November’s 49.0. That’s the lowest level since October 2020. S&P Global noted there were strong reductions in output volumes and order books. Input buying was cut at strongest rate since September 2020. Supply pressures were the least widespread since February 2021.

Laura Den man, Economist at S&P Global Market Intelligence, said: “December PMI data saw the Japanese manufacturing sector slip further into contraction territory in the final month of 2022. The downturn was largely centred around the current demand environment which is weak both internationally and domestically….

“At the same time, forward looking indicators are increasingly painting a gloomier picture for Japan’s manufacturing sector in the future. Companies have cut back input buying sharply, and business sentiment waned to a seven-month low.”

EUR/USD Mid-Day Outlook

Daily Pivots: (S1) 1.0485; (P) 1.0584; (R1) 1.0648; More…

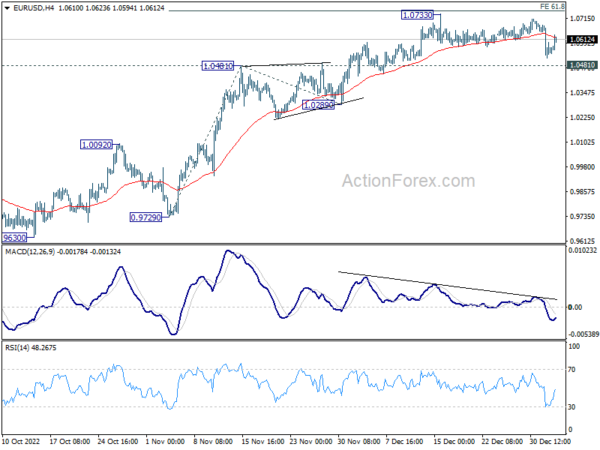

EUR/USD recovered ahead of 1.0481 resistance turned support but stays below 1.0733 resistance. Intraday bias remains neutral at this point. On the downside, break of 1.0481 will confirm short term topping, on bearish divergence condition in 4 hour MACD. Deeper fall would be seen back to 1.0289 support and below. On the upside, however, firm break of 61.8% projection of 0.9729 to 1.0481 from 1.0289 at 1.0754 will pave the way to 100% projection at 1.1041.

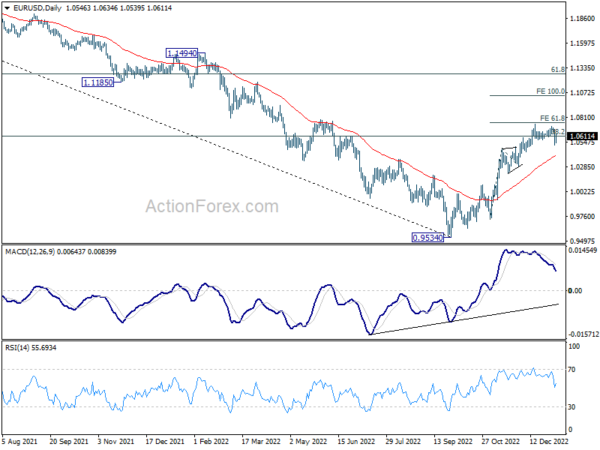

In the bigger picture, focus stays on 38.2% retracement of 1.2348 (2021 high) to 0.9534 at 1.0609. Rejection by 1.0609 will suggest that price actions from 0.9534 medium term bottom are developing into a corrective pattern. Thus, medium bearishness is retained for another fall through 0.9534 at a later stage. However, sustained break of 1.0609 will raise the chance of trend reversal and target 61.8% retracement at 1.1273.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 00:01 | GBP | BRC Shop Price Index Y/Y Nov | 7.30% | 7.40% | ||

| 00:30 | JPY | Manufacturing PMI Dec F | 48.9 | 48.8 | 48.8 | |

| 07:00 | EUR | Germany Import Price Index M/M Nov | -4.50% | -1.70% | -1.20% | |

| 07:30 | CHF | CPI M/M Dec | -0.20% | 0.00% | 0.00% | |

| 07:30 | CHF | CPI Y/Y Dec | 2.80% | 2.90% | 3.00% | |

| 08:45 | EUR | Italy Services PMI Dec | 49.9 | 47.6 | 49.5 | |

| 08:50 | EUR | France Services PMI Dec F | 49.5 | 48.1 | 48.1 | |

| 08:55 | EUR | Germany Services PMI Dec F | 49.2 | 49 | 49 | |

| 09:00 | EUR | Eurozone Services PMI Dec F | 49.8 | 49.1 | 49.1 | |

| 09:30 | GBP | Mortgage Approvals Nov | 46K | 54K | 59K | 58K |

| 09:30 | GBP | M4 Money Supply M/M Nov | -1.60% | 0.20% | 0.00% | 0.10% |

| 15:00 | USD | ISM Manufacturing PMI Dec | 48.6 | 49 | ||

| 15:00 | USD | ISM Manufacturing Prices Paid Dec | 42.3 | 43 | ||

| 15:00 | USD | ISM Manufacturing Employment Index Dec | 48.4 | |||

| 19:00 | USD | FOMC Minutes |