Canadian Dollar is taking a pole position in quiet markets today. Overall picture is mixed, as other commodity currencies of Aussie and Kiwi are both losing some momentum. Dollar is turning slightly stronger, except versus Loonie. Sterling faced some selloff in early part of European session, but Euro is following later. The more persistent move is in the decline of Yen.

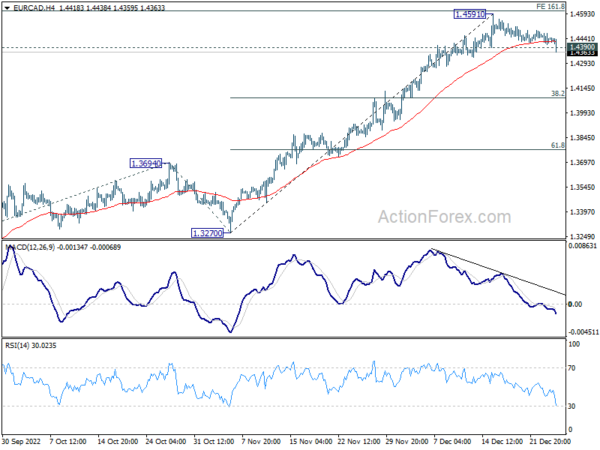

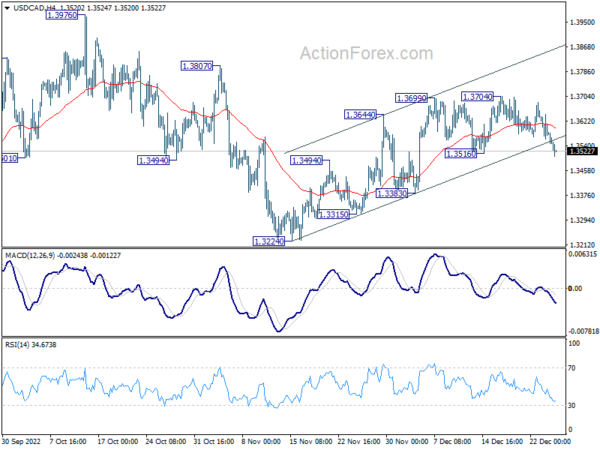

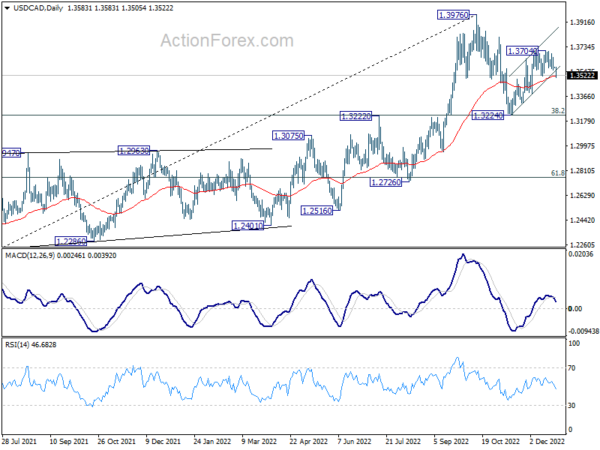

Technically, EUR/CAD’s break of 1.4390 minor support confirms short term topping at 1.4591, on bearish divergence condition in 4 hour MACD. Deeper decline should be seen to 38.2% retracement of 1.3270 to 1.4591 at 1.4086. USD/CAD’s break of 1.3516 support also opens up deeper decline back towards 1.3224 support. Let’s see how far the Loonie goes.

US goods trade deficit narrowed to USD -83.8B

US goods exports dropped -3.1% mom to USD 168.9B in November. Goods imports dropped -7.6% mom to USD 252.2B. Trade deficit narrowed from USD -98.8B to USD -83.3B, much smaller than expectation of USD -96.9B.

Whole sale inventories rose 1.0% mom to USD 933.6B. Retail inventories rose 0.1% mom to USD 738.7B.

ECB de Guindos: There will be further rate hikes until inflation on a path back to target

ECB Vice-President Luis de Guindos said in an interview, regarding how high are interest rates going to go, “that is something we will decide meeting by meeting and on the basis of incoming data, given the current high uncertainty.

“As we announced this month, there will be further, necessary, rate hikes until inflation is on a path back to close to our 2% target,” he added.

Regarding the economy, de Guindos said Europe is currently in a “very difficult economic situation”, with “high inflation rates… coinciding with an economic slowdown and low growth. With a recession on the horizon, the current high uncertainty makes it all the more difficult for businesses and entrepreneurs to distribute their capital. So, against this backdrop, it is very important to be prudent.”

Japan retail sales rose 2.6% yoy in Nov, unemployment rate down to 2.5%

Japan retail sales rose 2.6% yoy in November, below expectation of 3.8% yoy. The growth rate slowed from 4.4% in October and 4.8% in September. Nonetheless, that’s still the ninth straight month of expansion.

Released separately, unemployment rate fell from 2.6% to 2.5% in November, better than expectation of 2.6%. The jobs-to-applicants ratio was unchanged from October’s 1.35. This gauge of job availability stayed at the highest level since march 2020.

USD/CAD Mid-Day Outlook

Daily Pivots: (S1) 1.3560; (P) 1.3599; (R1) 1.3622; More….

USD/CAD’s break of 1.3516 support argues that corrective recovery from 1.3224 might have finished at 1.3704 already. Intraday bias is now back on the downside for 1.3383 support first. Break there will target 1.3222/3 key support zone again. On the upside, break of 1.3704 will resume the rebound towards 1.3976 high instead.

In the bigger picture, as long as 1.3222 cluster support (38.2% retracement of 1.2005 to 1.3976 at 1.3223) holds, larger up trend from 1.2005 (2021 low) is still expected to resume through 1.3976 high at a later stage. However, firm break of 1.3222/3 will indicate that the trend might have reversed. Deeper fall would be seen to next cluster support at 1.2726 (61.8% retracement at 1.2758).

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 23:30 | JPY | Unemployment Rate Nov | 2.50% | 2.60% | 2.60% | |

| 23:50 | JPY | Retail Trade Y/Y Nov | 2.60% | 3.80% | 4.40% | |

| 05:00 | JPY | Housing Starts Y/Y Nov | -1.40% | 1.30% | -1.80% | |

| 13:30 | USD | Goods Trade Balance (USD) Nov P | -83.3B | -96.9B | -99.0B | -98.8B |

| 13:30 | USD | Wholesale Inventories Nov P | 1.00% | 0.40% | 0.50% | |

| 14:00 | USD | S&P/CS Composite-20 HPI Y/Y Oct | 8.60% | 8.00% | 10.40% | |

| 14:00 | USD | Housing Price Index M/M Oct | 0.00% | -0.60% | 0.10% |