Euro is now the strongest one for the week, following the post-ECB rally overnight. Swiss Franc is trailing the common currency as the next strongest, and then Canadian. Dollar tried to rebound overnight on risk-off sentiment. Some progress is made by the greenback but more is needed to prove a reversal. Australian and New Zealand Dollar are currently the worst performers, followed by Yen.

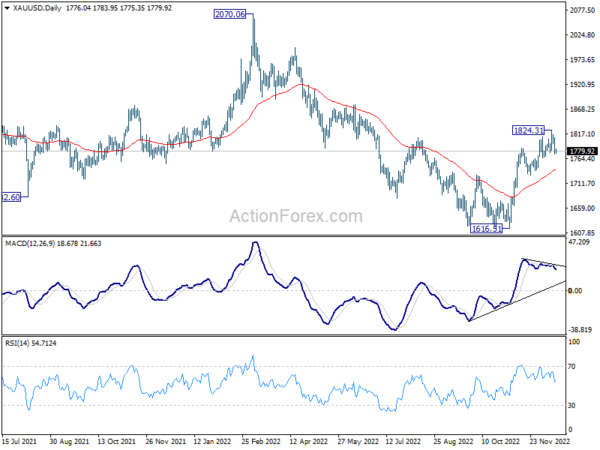

Technically, a short term top should be formed in Gold at 1824.31 on bearish divergence condition in daily MACD. Deeper pull back is now in favor back to 55 day EMA (now at 1741.01). Reaction from there would reveal whether rebound from 1616.51 has finished. Such development would also be a signal on whether Dollar is ready for a near term bullish reversal.

In Asia, Nikkei dropped -1.93%. Hong Kong HSI is up 0.53%. China Shanghai SSE is down -0.18%. Singapore Strait Times is down -0.74%. Japan 10-year yield is down -0.0036 at 0.254. Overnight, DOW dropped -2.25%. S&P 500 dropped -2.49%. NASDAQ dropped -3.23%. 10-yaer yield dropped -0.053 to 3.450.

Japan PMI manufacturing fell to 48.8, but services improved to 51.7

Japan PMI Manufacturing fell slightly from 49.0 to 48.8 in December, above expectation of 48.0. That’s the worst contractionary reading since October 2020. PMI Services, however, improved from 50.3 to 51.7. PMI Composite also rose back from 48.9 to 50.0.

Laura Denman, Economist at S&P Global Market Intelligence, said:

“The Japanese private sector economy saw a stabilisation in business activity in the final month of the year, with flash data indicating that the divergence between the manufacturing and services sectors has grown further. As has been the case since the launching of the National Travel Discount Programme in October, service providers have reportedly continued to profit from a boost in tourism volumes. Notably, firms have seemingly gained some pricing power as a result of improving demand within the sector and raised their selling prices at the sharpest rate since October 2019.

“Conversely, manufacturing firms continued to struggle in the face of subdued demand conditions and severe inflationary pressures with the latest flash PMI reading the lowest since October 2020. December data saw production and order books at Japanese manufacturers contract further, but at paces that were slower than in November. At the same time, though historically sharp, inflationary pressures cooled with the rate of input price inflation at the lowest level since September 2021.”

NZ BusinessNZ manufacturing dropped to 47.4, negative dynamic at play

New Zealand BusinessNZ Performance of Manufacturing Index dropped from 49.3 to 47.4 in November. That is the first time the PMI has shown consecutive months of contraction since the first nationwide lockdown in 2020.

Looking at some details, production fell slightly from 49.9 to 49.6. Employment fell from 48.7 to 46.7. New orders dropped further from 44.4 to 41.8. Finished stocks rose from 55.0 to 56.1. Deliveries dropped from 55.4 to 50.7.

BNZ Senior Economist, Craig Ebert stated “it’s been quite the sag in the PMI, compared to just three months ago when everything appeared positive. Of course, the PMI can dive down to the 40-zone when things get recessionary. And November’s result wasn’t that awful. That said, it also had componentry showing a negative dynamic at play”.

Australia PMI composite dropped to 47.3, first signs of desired soft landing

Australia PMI Manufacturing dropped from 51.3 to 50.4 in December, a 31-month low. PMI Services dropped from 47.6 to 46.9, an 11-month low. PMI Composite dropped from 48.0 to 47.3, also an 11-month low.

Warren Hogan, Chief Economic Advisor at Judo Bank said:

“The December results are one of the most up to date readings on the Australian economy and show that higher interest rates are starting to have the desired impact on activity. The Flash PMI readings for December are still well above levels that would normally be associated with recession. What we are seeing could be the first signs of a desired soft landing for the Australian economy in 2023…

“The slowing in this leading indicator of Australian economic activity will be welcomed by the RBA. Tighter monetary policy is having the desired effect, that is, a gradual slowing in domestic demand that should eventually filter through to lower inflation…

“This important leading indicator of Australian economic activity raises the prospect of an extended pause in the rate hiking cycle. As the rate hikes of 2022 continue to work through the economy over the first half of 2023, the RBA appears to have some scope to sit back and watch for a while.”

Looking ahead

UK will release retail sales and PMIs. Eurozone will release PMIs, trade balance and CPI final. Later in the day, Canada will release wholesales while US will release PMIs.

EUR/AUD Daily Outlook

Daily Pivots: (S1) 1.5642; (P) 1.5763; (R1) 1.5984; More…

Intraday bias in EUR/AUD remains on the upside for the moment. Current rally from 1.4281 should target 61.8% projection of 1.4281 to 1.5704 from 1.5271 at 1.6150. On the downside, below 1.5683 minor support will turn bias neutral and bring consolidations. But outlook will remain bullish as long as 1.5441 support holds, in case of retreat.

In the bigger picture, as long as 1.5271 support holds, rise from 1.4281 medium term bottom is expected to continue to 1.6434 key resistance next. However, firm break of 1.5271 will argue that such rebound has completed, and keep medium term outlook neutral at best. But in this case, more range trading should be seen above 1.4281 low first.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 21:30 | NZD | Business NZ PMI Nov | 47.4 | 49.3 | ||

| 22:00 | AUD | Manufacturing PMI Dec P | 50.4 | 51.3 | ||

| 22:00 | AUD | Services PMI Dec P | 46.9 | 47.6 | ||

| 00:01 | GBP | GfK Consumer Confidence Dec | -42 | -43 | -44 | |

| 00:30 | JPY | Manufacturing PMI Dec P | 48.8 | 48 | 49 | |

| 07:00 | GBP | Retail Sales M/M Nov | 0.30% | 0.60% | ||

| 07:00 | GBP | Retail Sales Y/Y Nov | -5.60% | -6.10% | ||

| 07:00 | GBP | Retail Sales ex-Fuel M/M Nov | 0.30% | 0.30% | ||

| 07:00 | GBP | Retail Sales ex-Fuel Y/Y Nov | -5.80% | -6.70% | ||

| 08:15 | EUR | France Manufacturing PMI Dec P | 48.1 | 48.3 | ||

| 08:15 | EUR | France Services PMI Dec P | 49.1 | 49.3 | ||

| 08:30 | EUR | Germany Manufacturing PMI Dec P | 46.7 | 46.2 | ||

| 08:30 | EUR | Germany Services PMI Dec P | 46.4 | 46.1 | ||

| 09:00 | EUR | Eurozone Manufacturing PMI Dec P | 46.8 | 47.1 | ||

| 09:00 | EUR | Eurozone Services PMI Dec P | 48.5 | 48.5 | ||

| 09:30 | GBP | Manufacturing PMI Dec P | 46.5 | 46.5 | ||

| 09:30 | GBP | Services PMI Dec P | 48.5 | 48.8 | ||

| 10:00 | EUR | Eurozone Trade Balance (EUR) Oct | -32.5B | -37.7B | ||

| 10:00 | EUR | CPI Y/Y Nov F | 10.00% | 10.00% | ||

| 10:00 | EUR | CPI Core Y/Y Nov F | 5.00% | 5.00% | ||

| 13:30 | CAD | Wholesale Sales M/M Oct | 1.40% | 0.10% | ||

| 14:45 | USD | Manufacturing PMI Dec P | 47.7 | 47.7 | ||

| 14:45 | USD | Services PMI Dec P | 46.5 | 46.2 |