Dollar falls sharply together with treasury yield after US data showed consumer inflation cooled more than expected. Stock futures also jump as reaction. Australian and New Zealand Dollar appear to be leading the way up, followed by Yen and then European majors. The question now is on whether current wave of selloff would sustain pass tomorrow’s FOMC rate decision and economic projections.

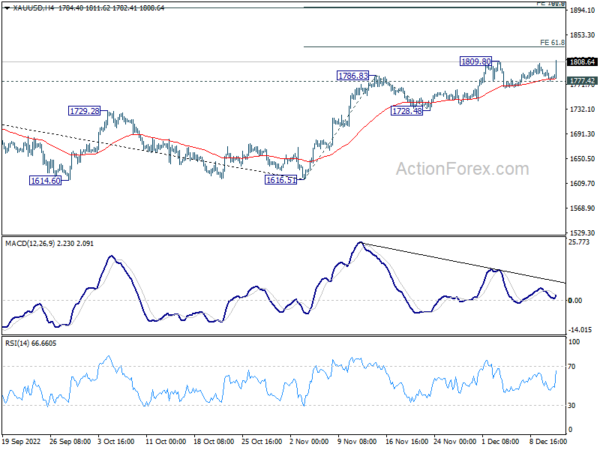

Technically, Gold is also regaining 1800 handle, and trying to resume the rally from 1616.51, on Dollar’s weakness. For now, near term outlook will stay bullish as long as 1777.42 support holds. Next target is 61.8% projection of 1616.51 to 1786.83 from 1728.48 at 1833.73. Firm break there could prompt more upside acceleration to 100% projection at 1898.80, which is close to 1900 handle.

In Europe, at the time of writing, FTSE is up 0.84%. DAX is up 1.90%. CAC is up 1.66%. Germany 10-year yield is down -0.0725 at 1.868. Earlier in Asia, Nikkei rose 0.40%. Hong Kong HSI rose 0.68%. China Shanghai SSE dropped -0.09%. Singapore Strait Times rose 0.98%. Japan 10-year JGB yield dropped -0.0014 to 0.255.

US CPI slowed to 7.1% yoy in Nov, core CPI down to 6.0% yoy

US CPI rose 0.1% mom in November, lower than expectation of 0.3% mom. Food index rose 0.5% mom while energy index decreased -1.6% mom. CPI core (all items less food and energy) rose 0.2% mom, below expectation of 0.3% mom.

Over the last 12 months, CPI slowed from 7.7% yoy to 7.1% yoy, below expectation of 7.3% yoy. CPI core slowed from 6.3% yoy to 6.0% yoy, below expectation of 6.1% yoy. Energy index rose 13.1% while food index rose 10.6% yoy.

Germany ZEW rose to -23.3, significant improvement in economic outlook

Germany ZEW Economic Sentiment rose from -36.7 to -23.3 in December, above expectation of -26.3. Current Situation Index rose from -64.5 to -61.4, below expectation of -57.0.

Eurozone ZEW Economic Sentiment rose from-38.7 to -23.6, above expectation of -25.3. Current Situation Index rose 7.7 pts to -57.4. Inflation expectation s for Eurozone fell very sharply by -27.1 pts to -79.3.

“The ZEW Indicator of Economic Sentiment rises again significantly in December. The vast majority of financial market experts expect the inflation rate to decline in the coming months. Together with the temporary stabilisation on the energy markets, this leads to a significant improvement in the economic outlook,” comments ZEW President Professor Achim Wambach on current expectations.

Swiss SECO downgrades 2022 and 2023 inflation forecasts

Swiss State Secretariat for Economic Affairs SECO revised down inflation forecasts for 2022 and 2023. For 2022, CPI is projected to be at 2.9% (comparing with September forecast of 3.0%). 2023 CPI is estimated to be 2.2%, (down from 2.3%.

2022 GDP growth forecast was left unchanged at 2.0%. 2023 GDP growth forecast was downgraded slightly from 1.1% to 1.0%. SECO said, “this would point to sluggish growth for the Swiss economy, but not a severe recession”.

SECO added, “Europe’s energy situation is projected to gradually normalize after a tense 2023/24 winter. At the same time, inflation rates will likely ease worldwide and the global economy should gradually gain momentum”. That would trigger a recovery in Switzerland, with 1.6% GDP growth in 2024, and inflation back below average at 1.5%.

UK payrolled employees rose 107k in Nov, unemployment rate rose to 3.7% in Oct

In November, UK payrolled employees rose 107k or 0.4% mom to 29.9m. That also means a rise of 777k or 2.7% yoy over the 12-month period. Early estimates indicate that median monthly pay rose 8.0% yoy. Claimant count rose 30.5k comparing to expectation of 3.5k.

In the three months to October, unemployment rate rose 0.1% to 3.7%, matched expectations. Employment rate rose 0.2% to 75.6%. Economic inactivity rate dropped -0.2% to 21.5%. Average earnings excluding bonus rose 6.1% 3moy, versus expectation of 5.9%. Average earnings including bonus rose 6.1% 3moy, below expectation of 6.2%.

Australia Westpac consumer sentiment bounced from near record low

Australia Westpac Consumer Sentiment Index bounced from near record low and rose 3% from 78.0 to 80.3 in December. But the level remains comparable to the lows see during the pandemic and the Global Financial Crisis.

Concerns over inflation remained dominant among respondents, followed by budget and taxation, economic conditions and interest rates.

Westpac expects RBA to continue to deliver on its “strong tightening bias” in February and hike by 25bps, and signal that there is still more work to be done.

Australia NAB business conditions hold up, but confidence turned negative

Australia NAB Business Confidence dropped from 0 to -4 in November, below zero for the first time since December 2021. Business Conditions dropped from 22 to 20, but remained elevated. Looking at some details, trading conditions dropped from 30 to 28. Profitability conditions dropped from 21 to 20. Employment conditions dropped from 14 to 13.

NAB Chief Economist Alan Oster. “There was a slight softening across a number of industries but the level of business conditions really still remains elevated across the board including in key consumer-facing sectors such as retail and recreation & personal services, and across the states.”

“Confidence is now negative, for the first time this year, despite the strength in conditions,” said Oster. “The gap between current business conditions and business confidence is now at a record level in the history of the survey – with the exception of March 2020 – pointing to heightened concerns about the resilience of the economy in the period ahead as inflation and higher rates begin to weigh on consumers.”

EUR/USD Mid-Day Outlook

Daily Pivots: (S1) 1.0503; (P) 1.0542; (R1) 1.0577; More…

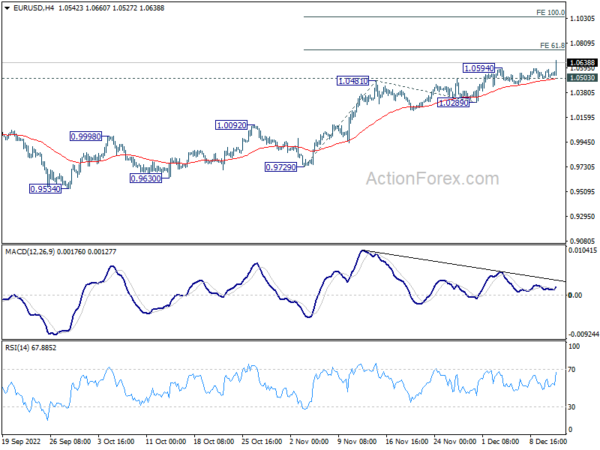

EUR/USD’s rally resumed by breaking through 1.0594/0609 resistance zone decisively. Intraday bias is back on the upside for 61.8% projection of 0.9729 to 1.0481 from 1.0289 at 1.0754. Firm break there could prompt upside acceleration to 100% projection at 1.1041. On the downside, break of 1.0503 support is needed to indicate short term topping. Or, outlook will stay bullish in case of retreat.

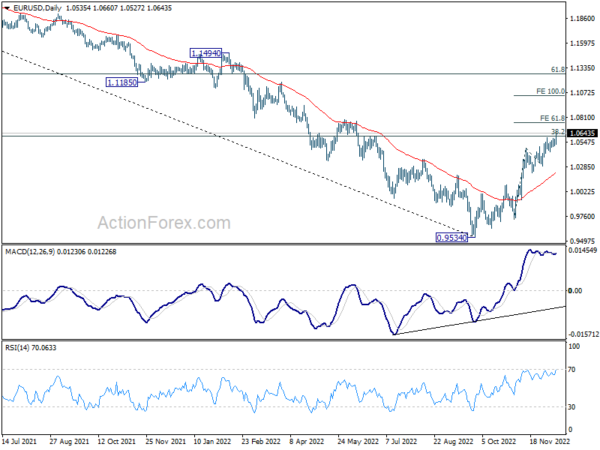

In the bigger picture, focus stays on 38.2% retracement of 1.2348 (2021 high) to 0.9534 at 1.0609. Rejection by 1.0609 will suggest that price actions from 0.9534 medium term bottom are developing into a corrective pattern. Thus, medium bearishness is retained for another fall through 0.9534 at a later stage. However, sustained break of 1.0609 will raise the chance of trend reversal and target 61.8% retracement at 1.1273.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 23:30 | AUD | Westpac Consumer Confidence Dec | 3.00% | -6.90% | ||

| 00:30 | AUD | NAB Business Confidence Nov | -4 | 0 | ||

| 00:30 | AUD | NAB Business Conditions Nov | 20 | 22 | ||

| 07:00 | GBP | Claimant Count Change Nov | 30.5K | 3.5K | 3.3K | -6.4K |

| 07:00 | GBP | ILO Unemployment Rate (3M) Oct | 3.70% | 3.70% | 3.60% | |

| 07:00 | GBP | Average Earnings Excluding Bonus 3M/Y Oct | 6.10% | 5.90% | 5.70% | 5.80% |

| 07:00 | GBP | Average Earnings Including Bonus 3M/Y Oct | 6.10% | 6.20% | 6.00% | |

| 07:00 | EUR | Germany CPI M/M Nov F | -0.50% | -0.50% | -0.50% | |

| 07:00 | EUR | Germany CPI Y/Y Nov F | 10.00% | 10.00% | 10.00% | |

| 08:00 | CHF | SECO Economic Forecasts | ||||

| 09:00 | EUR | Italy Industrial Output M/M Oct | -1.00% | -0.30% | -1.80% | -1.70% |

| 10:00 | EUR | Germany ZEW Economic Sentiment Dec | -23.3 | -26.3 | -36.7 | |

| 10:00 | EUR | Germany ZEW Current Situation Dec | -61.4 | -57 | -64.5 | |

| 10:00 | EUR | Eurozone ZEW Economic Sentiment Dec | -23.6 | -25.3 | -38.7 | |

| 11:00 | USD | NFIB Business Optimism Index Nov | 91.9 | 90.8 | 91.3 | |

| 13:30 | USD | CPI M/M Nov | 0.10% | 0.30% | 0.40% | |

| 13:30 | USD | CPI Y/Y Nov | 7.10% | 7.30% | 7.70% | |

| 13:30 | USD | CPI Core M/M Nov | 0.20% | 0.30% | 0.30% | |

| 13:30 | USD | CPI Core Y/Y Nov | 6.00% | 6.10% | 6.30% |