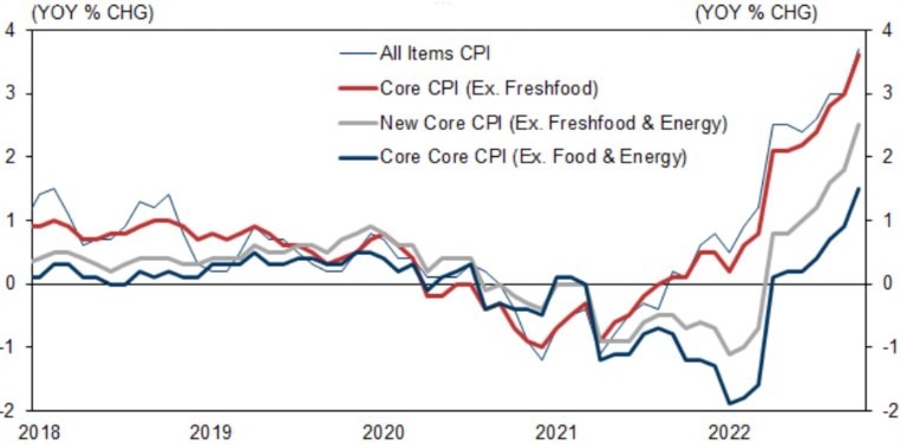

USD/JPY has dribbled lower on the day. In the Tokyo morning we had the October inflation data released. It is continuing to gain. Bank of Japan Governor Kuroda appeared in the Diet afterwards and repeated yet again that he sees the current high (for Japan) levels of inflation as only transitory and expects the cost-push factors prevalent right now to dissipate during Japan’s next fiscal year. Japan’s next fiscal year begins on April 1.

The USD has lost ground on the session, most noticeably amongst the majors against yen. As I post USD/JPY is down 75 or so points from its earlier high to circa 139.75.

EUR, GBP, AUD are all higher against the USD.

North Korea fired a ballistic missile today. It landed to the west of Japan.

Japan inflation, graph via Goldman Sachs: