Yen trades generally lower in quite Asian session today, but markets are relatively steady elsewhere. Stock markets are mixed with Nikkei closing higher, following the rebound in the US last Friday. But China is weighed down by poor PMI data. Generally speaking, traders are cautious ahead of many key events ahead in the week, including rate decisions of Fed, BoE and RBA, as well as some heavy weight data like non-farm payrolls.

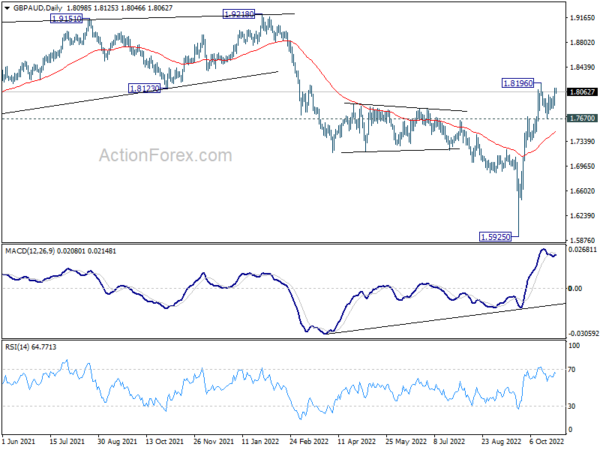

GBP/AUD is an interesting one to watch this week. The cross is now back above pre-Truss level while BoE is expected to outpace RBA’s tightening for the next few months. As long as 1.7670 support holds, an upside breakout should happen sooner rather than later. Rise from 1.5925 should then be on track to take on 1.9218 medium term resistance, probably later in the quarter.

In Asia, Nikkei closed up 1.64%. Hong Kong HSI is up 0.08%. China Shanghai SSE is down -0.72%. Singapore Strait Times is up 1.78%. Japan 10-year JGB yield is up 0.0009 at 0.243.

ECB Knot: We’re not in even half-time yet in inflation fight

ECB Governing Council member Klaas Knot said on Sunday, “we will take a significant interest step again in December,” adding that next hike would either be 50bps or 75bps.

He said, “we are not in even half-time yet” in the fight against inflation. “We are still returning interest rates towards their neutral level, for which we will also need the December meeting.”

“From 2023 we will play the second half, with smaller interest rate steps and by shrinking our balance sheet,” he said. “Then we will be in the zone where we will effectively cool down the economy, which is necessary to bring inflation down from 10% to 2% in the next 18 to 24 months.”

Japan industrial production dropped -1.6% mom, as auto-related production dived

Japan industrial production declined -1.6% mom in September, below expectation of -1.0% mom. That’s also the first contract in four months. The fall was driven by -12.4% mom decline in auto-related production, the steepest fall in eight months.

Manufacturers surveyed by the Ministry of Economy, Trade and Industry (METI) expected output to fall another -0.4% in October and then rise 0.8% in November.

Retail sales rose 4.5% yoy in September, above expectation of 4.1% yoy. Housing starts rose 1.0% yoy, below expectation of 2.3% yoy.

In October, consumer confidence dropped from 30.8 to 29.9, below expectation of 31.5.

Australia retail sales rose 0.6% mom in Sep

Australia retail sales rose 0.6% mom in September, matched expectations.

Ben Dorber, ABS head of retail statistics said, “This month’s rise was again driven by the combined strength in the food industries. Food retailing rose 1.0 per cent, while cafes, restaurants, and takeaway food services rose 1.3 per cent.

“Many retailers remained open for the National Day of Mourning, an additional one-off public holiday in September, and this boosted spending on food, alcohol and dining out.”

China PMI manufacturing and services fell to contraction

China PMI Manufacturing fell from 50.1 to 49.2 in October, below expectation of 50.0.

PMI Non-Manufacturing dropped from 50.6 to 48.7, below expectation of 50.2. Both readings were below 50-mark which separates growth from contraction on a monthly basis.

“In October, affected by the spread of the pandemic and other factors within the country, China’s PMI fell, with the manufacturing PMI, non-manufacturing PMI and comprehensive PMI standing at 49.2 per cent, 48.7 per cent and 49.0 per cent, respectively, and the foundation of China’s economic recovery needs to be further consolidated,” said senior NBS statistician Zhao Qinghe.

“In October, the composite PMI stood at 49.0 per cent, down 1.9 percentage points from the previous month, falling below the critical point, indicating a general slowdown in the production and operating activities of Chinese enterprises.”

RBA, Fed and BoE to hike; lots of data featured

Three central banks will meet this week. RBA is expected hike by 25bps to 2.85%. There are expectations that tightening will continue with two more 25bps hike in December and February before a pause. So, focuses will be on any indication from the Monetary Policy Statement.

Fed is expected to continue with another 75bps hike to 3.75-4.00%. There are also speculations that tightening pace will start to slow in December. Hence, markets will look for hints from Fed Chair Jerome Powell’s press conference to confirm this view.

BoE is also widely expected to hike 75bps to 3.00%. The new economic projections might not be too meaningful, as the outlook will be heavily affected by the new government’s new budget to be released in mid-November. Yet, the voting will still reveal some hints on the hawk/dove split in the MPC.

In addition to these central bank activities, economic data calendar is also ultra-busy. Non-far payroll report in the US, and ISM indexes should carry a large weight on Fed’s decision in December. Other data to watch include Eurozone GDP and CPI flash, Swiss CPI, Canada employment, New Zealand employment and China PMIs.

Here are some highlights for the week:

- Monday: Japan industrial production, retail sales, consumer confidence, housing starts; Australia MI inflation gauge, private sector credit, retail sales; China PMIs; Germany retail sales; Swiss retail sales; UK M4 money supply, mortgage approvals; Eurozone CPI flash, GDP; US Chicago PMI.

- Tuesday: New Zealand building permits; Japan PMI manufacturing final; RBA rate decision; China Caixin PMI manufacturing; Germany import prices; Swiss SECO consumer climate, PMI manufacturing; UK PMI manufacturing final; Canada PMI manufacturing; ISM manufacturing, construction spending.

- Wednesday: Australia AiG manufacturing, building approvals; New Zealand employment, labor cost index; Japan monetary base, BoJ minutes; Germany trade balance, unemployment; Eurozone PMI manufacturing final; US ADP employment, FOMC rate decision.

- Thursday: Australia trade balance; China Caixin PMI services; Swiss CPI;UK PMI Services final, BoE rate decision; Eurozone unemployment rate; Canada building permits, trade balance; US jobless claims, non-farm productivity, trade balance, ISM services, factory orders.

- Friday: Australia AiG services; Germany factory orders; France industrial production; Eurozone PMI services final, PPI; UK PMI construction; Canada employment, Ivey PMI; US non-farm payroll employment.

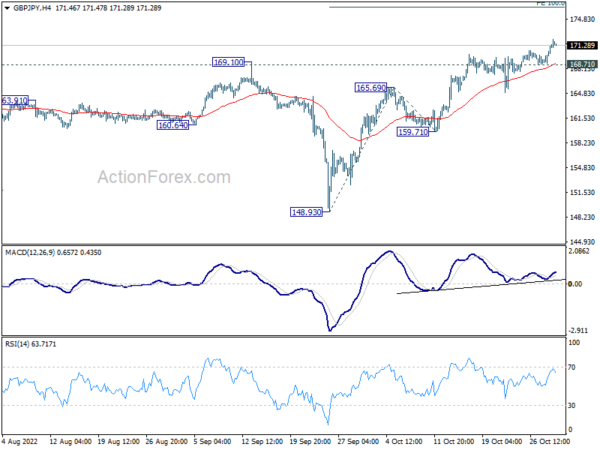

GBP/JPY Daily Outlook

Daily Pivots: (S1) 169.66; (P) 170.52; (R1) 172.16; More…

Intraday bias in GBP/JPY remains on the upside at this point. Current rally should target 100% projection of 148.93 to 165.69 from 159.71 at 176.47 next. On the downside, break of 168.71 minor support will turn intraday bias neutral and bring consolidations, before staging another rally.

In the bigger picture, up trend from 123.94 (2020 low), as part of the trend from 122.75 (2016 low) is still in progress. Further rise would be seen to 161.8% projection of 122.75 to 156.59 (2018 high) from 123.94 at 178.69. This will now remain the favored case as long as 148.93 support holds.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 23:50 | JPY | Industrial Production M/M Sep P | -1.60% | -1.00% | 3.40% | |

| 23:50 | JPY | Retail Trade Y/Y Sep | 4.50% | 4.10% | 4.10% | |

| 00:00 | AUD | TD Securities Inflation M/M Oct | 0.40% | 0.50% | ||

| 00:30 | AUD | Private Sector Credit M/M Sep | 0.70% | 0.80% | 0.80% | |

| 00:30 | AUD | Retail Sales M/M Sep | 0.60% | 0.60% | 0.60% | |

| 01:00 | CNY | Manufacturing PMI Oct | 49.2 | 50 | 50.1 | |

| 01:00 | CNY | Non-Manufacturing PMI Oct | 48.7 | 50.2 | 50.6 | |

| 05:00 | JPY | Consumer Confidence Oct | 29.9 | 31.5 | 30.8 | |

| 05:00 | JPY | Housing Starts Y/Y Sep | 1.00% | 2.30% | 4.60% | |

| 07:00 | EUR | Germany Retail Sales M/M Sep | -0.50% | -1.30% | ||

| 07:30 | CHF | Real Retail Sales Y/Y Sep | 3.30% | 3.00% | ||

| 09:00 | EUR | Italy GDP Q/Q Q3 P | -0.10% | 1.10% | ||

| 09:30 | GBP | M4 Money Supply M/M Sep | 0.10% | -0.20% | ||

| 09:30 | GBP | Mortgage Approvals Sep | 66K | 74K | ||

| 10:00 | EUR | Eurozone GDP Q/Q Q3 P | 0.10% | 0.80% | ||

| 10:00 | EUR | Eurozone CPI Y/Y Oct P | 9.90% | 10.00% | ||

| 10:00 | EUR | Eurozone CPI Core Y/Y Oct P | 4.80% | 4.80% | ||

| 13:45 | USD | Chicago PMI Oct | 47.1 | 45.7 |

#shorts #crypto #forex #trading #patterns

#shorts #crypto #forex #trading #patterns