Dollar is trading mildly lower in Asian session today, but manages to maintain most of this week’s gain so far. The greenback will look into today’s FOMC rate decision, where a 75bps hike is well priced in. Today’s Fed meeting is not about today, but how Chair Jerome Powell would indicate the rate path ahead. Meanwhile, Yen is trading broadly higher as supported by comment from Japanese official that even gradual depreciation in exchange rate is now a concern. Overall, most major pairs and crosses are stuck inside last week’s range, with the exception of Kiwi.

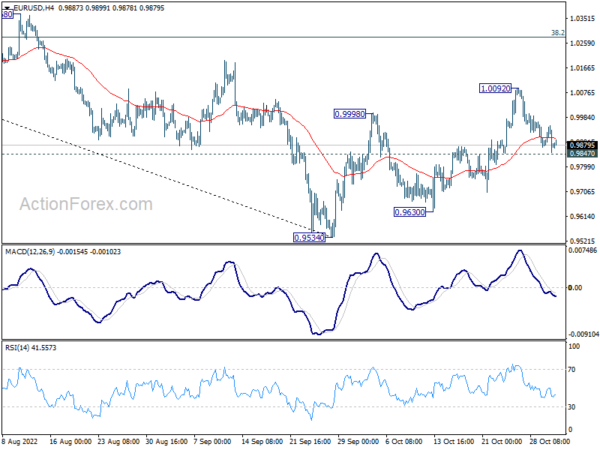

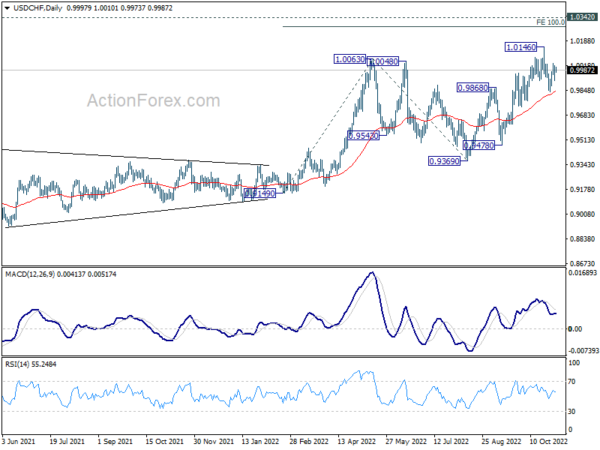

Technically, some focuses will be on 0.9847 minor support in EUR/USD and 1.0030 minor resistance in USD/CHF. Break of these levels will argue that Dollar’s near term pull back is finished, which set the stage for more upside in the greenback, at least until Friday’s non-farm payrolls.

In Asia, at the time of writing, Nikkei is down -0.11%. Hong Kong HSI is up 1.74%. China Shanghai SSE is up 0.88%. Singapore Strait Times is down -0.23%. Japan 10-year JGB yield is up 0.0026 at 0.255. Overnight, DOW dropped -0.24%> S&P 500 dropped -0.41%. NASDAQ dropped -0.89%. 10-year yield dropped -0.025 to 4.052, after dipping to 3.920.

BoC Macklem: We are getting closer, but we are not there yet

BoC Governor Tiff Macklem said in a speech that the central bank is trying to “balance the risks of under- and over-tightening.” “The tightening phase will draw to a close,” he added. “We are getting closer, but we are not there yet.”

BoC is still “far from that goal” of ensuring “low, stable and predictable” inflation. “With inflation so far above our target, we are particularly concerned about the upside risks,” he added.

Macklem also said, “We expect growth will stall in the next few quarters—in other words, growth will be close to zero. But once we get through this slowdown, growth will pick up, our economy will grow solidly, and the benefits of low and predictable inflation will be restored.”

Japan Suzuki concerned about gradual weakening of Yen

Japan Finance Minister Shunichi Suzuki told the parliament, “I am very concerned about the gradual weakening of the yen”, which could accelerate inflation by increasing import costs.

BoJ Governor Haruhiko Kuroda also said, recent Yen weakness raises uncertainty on the outlook, and is negative for the economy.

Regarding monetary policy, Kuroda said, “If the achievement of our 2% inflation target comes into sight, making yield curve control more flexible could become an option.” But for now, he added that the central bank must maintain ultra-low loose monetary policy to support the economy.

Australia AiG manufacturing fell to 49.6, longstanding supply-side problems continue

Australia AiG Performance of Manufacturing Index dropped -0.6 to 49.6 in October. Looking at some details, production dropped -0.1 to 47.6. Employment rose 7.1 to 46.9. New orders dropped -4.0 to 53.8. sales dropped -3.0 to 48.4. Input prices dropped -6.8 to 78.0. Selling prices dropped -2.7 to 67.5. Average wages dropped -5.1 to 71.0.

Innes Willox, Chief Executive of Ai Group said: “Australian manufacturing is in a holding pattern, with three straight months of flat results. Demand conditions in the market remain stable, but longstanding supply-side problems, such as labour and supply chain shortages, continue to drag on the industry.”

NZ unemployment rate unchanged at 3.3%, record hourly earning growth

New Zealand employment grew 1.3% in Q3, above expectation of 0.5%. Unemployment rate was unchanged at 3.3%, above expectation of 3.2%. Labor force participation rate rose 0.8% to 71.7%. Underutilization rate dropped -0.2 to 9.0%.

Average ordinary time hourly earnings rose 2.4% qoq, 7.4% yoy. The annual rise was the highest since the series began in 1989. All salary and wage rates (including overtime) index rose 3.7% yoy, second highest annual rate since record began in 1993.

Fed to hike 75bps, would Powell indicate slower tightening ahead?

Fed is widely expected to raise interest rate by 75bps again today, to 3.75-4.00%. The main question is whether Chair Jerome Powell would signal that tightening pace is going to slow afterwards.

Currently, there are some expectations that Fed would opt for a smaller hike of 50bps in December, then a 25bps hike in February, and probably another 25bps in March, and pause from there.

However, such hope was somewhat dashed as job data released yesterday showed that the job market could have tightened further. Job openings surged to 10.7m in September, rather than a fall to 9.8m. Ratio of openings to unemployed persons also climbed from 1.7 to 1.9. ISM manufacturing employment also improved.

Overall, there could be some negative market reactions if Powell doesn’t deliver any firm message of a pivot.

Here are some suggested readings on Fed:

Elsewhere

Germany trade balance and unemployment, Eurozone PMI manufacturing final will be released in European session. US will also publish ADP private employment today.

USD/CHF Daily Outlook

Daily Pivots: (S1) 0.9937; (P) 0.9980; (R1) 1.0044; More…

Intraday bias in USD/CHF stays neutral and outlook is unchanged. On the upside, break of 1.0030 minor resistance will suggest that pull back from 1.0146 has completed at 0.9840. Bias will be back on the upside for retesting 1.0146. Firm break there will resume larger up trend to 1.0283 projection level. However, break of 0.9840 support will now be a sign of reversal, and bring deeper decline back to 0.9779 support instead.

In the bigger picture, current development suggests that up trend from 0.8756 (2021 low) is still in progress. Next target is 100% projection of 0.9149 to 1.0063 from 0.9369 at 1.0283, and then 1.0342 (2016 high). For now, this will remain the favored case as long as 0.9779 support holds, even in case of deep pull back.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 21:30 | AUD | AiG Performance of Mfg Index Oct | 49.6 | 50.2 | ||

| 21:45 | NZD | Employment Change Q3 | 1.30% | 0.50% | 0.00% | |

| 21:45 | NZD | Unemployment Rate Q3 | 3.30% | 3.20% | 3.30% | |

| 21:45 | NZD | Labour Cost Index Q/Q Q3 | 1.10% | 1.00% | 1.30% | |

| 23:50 | JPY | Monetary Base Y/Y Oct | -6.90% | -2.00% | -3.30% | |

| 23:50 | JPY | BoJ Minutes | ||||

| 00:01 | GBP | BRC Shop Price Index Y/Y Sep | 6.60% | 5.50% | 5.70% | |

| 00:30 | AUD | Building Permits M/M Sep | -5.80% | -9.00% | 28.10% | 23.10% |

| 07:00 | EUR | Germany Trade Balance (EUR) Sep | 0.5B | 1.2B | ||

| 08:45 | EUR | Italy Manufacturing PMI Oct | 46.9 | 48.3 | ||

| 08:50 | EUR | France Manufacturing PMI Oct F | 47.4 | 47.4 | ||

| 08:55 | EUR | Germany Unemployment Change Oct | 15K | 14K | ||

| 08:55 | EUR | Germany Manufacturing PMI Oct F | 45.7 | 45.7 | ||

| 09:00 | EUR | Eurozone Manufacturing PMI Oct | 46.6 | 46.6 | ||

| 12:15 | USD | ADP Employment Change Oct | 198K | 208K | ||

| 14:30 | USD | Crude Oil Inventories | -0.2M | 2.6M | ||

| 18:00 | USD | Fed Interest Rate Decision | 4.00% | 3.25% | ||

| 18:30 | USD | FOMC Press Conference |