The US stocks continued their move to the upside despite some concerning earnings from Amazon after the close yesterday. That was offset by Apple whose earnings and guidance was better than expectations. This week other big mega caps did not do all that well either with Microsoft, Google and Meta all underperforming, but that did not really matter today as all, with the expection of Amazon (which fell -6.8%) advanced (Apple +7.44%, Microsoft, +4.02%, Google, +3.97%, Meta, +1.29%). Even Intel which traditionally of late sells off the day after earnings, rose 10.66%.

For the week, the:

- Dow rose 5.72% and is on pace to have its best month with a 14.44% gain

- S&P rose 3.95%

- Nasdaq rose 2.25%

- Russell 2000 rose 6.01%.

The gains today came despite a rise in yields ahead of the all import Fed meeting next week. Looking at the yield curve, the:

- 2 year 4.414%, +9.3 basis points

- 5 year 4.1809%, +9.1 basis points

- 10 year 4.0120%, +7.1 basis points

- 30 year 4.135%, up 4.1 basis points

Although yields are higher on the day, they are lower for the week

- 2 year fell -6.5 basis points after trading as low as 4.266%. The high for the week was at 4.528% on Monday

- 5 year fell -16.2 basis points but traded as low as 4.043%. The high for the week was at 4.40%

- 10 year fell -20.9 basis points but traded as low as 3.90% on Thursday. The high for the week on Monday reached 4.289%

- 30 year fell -20.7 basis points but traded as low as 4.054%. The high for the week reached 4.423%

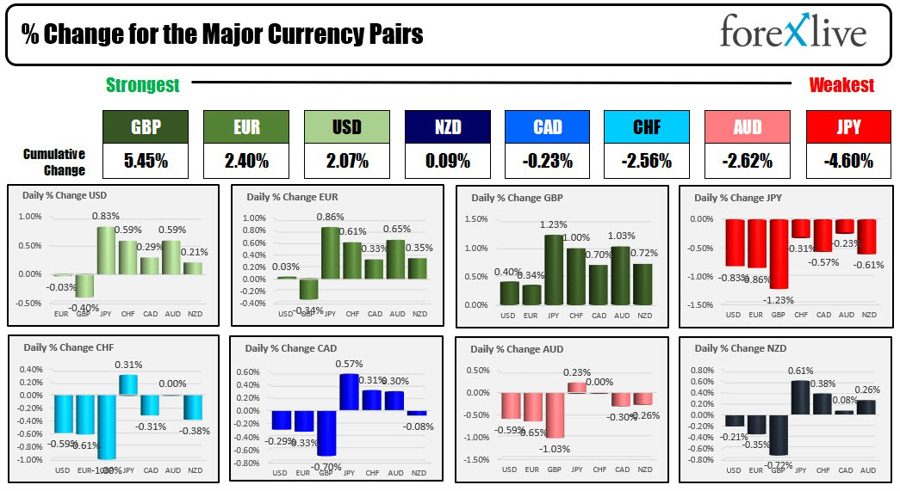

The strongest to weakest of the major currencies at week end

In the forex today, the GBP was the strongest of the major currencies. The GBPUSD is going out near its high for the day at 1.1612. There is a key downward sloping trendline on the daily chart cutting across at 1.1630 (and moving lower). Next week that line will be a barometer for bullish and bearish. There is also upside resistance at the 38.2% retracement of the 2022 trading range at 1.16479. The 100 day moving average is also in play 1.1733. Keep those levels mind going into the new trading week.

The weakest of the major currencies today was the JPY. It fell after the Bank of Japan kept rates unchanged and BOJs Kuroda said that he would add more stimulus if needed. For the USDJPY it is closing just above its 100 hour moving average at 147.32 (trading at 147.46). Stay above that moving average tilts the short term bias in the upward direction with the 200 hour moving average 148.422 going into the new trading week. Move below the 100 hour moving average and stay below would tilt the technical bias to the downside. With the fundamentals of a tightening Fed and a steady Bank of Japan, favors a higher USDJPY. However technicals can control market price action, and fundamentals do change, so the 100 hour moving average will be a key barometer in the new trading week that will help the traders decide the short term bias at the very least.

A snapshot of other markets as traders exit for the week shows:

- spot gold down $-17 or -1.03% at $1645.01

- spot silver down -$0.34 or -1.74% at $19.24

- WTI crude oil down -$0.80 at $88.28

- bitcoin up marginally at $20,663

- Doge coin was a bigger gainer with a gain of 0.8 cents or +10.99% to $0.08537. FOMO traders are hoping that Elon Musk will be more vocal and supportive of Doge now that he owns Twitter (who knows how he will use the app).