The markets continued what was started yesterday with stocks higher, yields lower, the dollar lower in early trading today. The retail sales data came in sufficiently mixed and suggested a slowing of demand especially in light that the retail sales are not adjusted for inflation meaning the 0.0% reading for the headline and the core of 0.1% was when adjusted for inflation, was likely negative.

However, when the 10 AM ET Michigan consumer confidence was released, the wind was taken out of the counter trend traders as not only was the confidence higher, the inflation was also higher. Stocks moved lower, yields moved back higher and the dollar headed back up.

The 10 year yield is trading up 7.4 basis points on the day at 4.02% after trading as low as 3.85% intraday. The yield is up 14 basis points for the week. The 2 year yield is trading at 4.5% after trading as lows at 4.399% earlier today. For the week the 2 year is up about 19 basis points.

In the US stock market today, the Nasdaq entered the day near unchanged for the week after the sharp recovery on Thursday. The day ended with the index down 3.08%.

For the S&P index, it moved back above its 200 week MA yesterday on the rebound back higher yesterday. That key longer term barometer was centered just below the nice round number of 3600 this week. The price of the broad S&P index closed today at 3583.81, below the MA level for the 2nd week in the last 3. Will this close below, open the door next week for more selling this time? The Dow 30 fell -403.84 points today or 1.34%, but for the week, the index was still higher by 1.15% (thanks to yesterday’s 800+ point surge).

Fed speak was not all that supportive today. Fed’s George said the only piece of clear data is that we have high inflation. Feds Bullard said the inflation data supports more frontloading of rate hikes. Fed’s Cook said we need ongoing rate hikes. Fed’s Daly did say that the CPI was not surprising as inflation is a lagging indicator (good things to come maybe), but she did add CPI shows inflation is not cooperating. George meanwhile did also warn about the risks of supersizing the rate hikes. The Fed members have one more week of chatter before they are shut down next Friday ahead of the November 3rd FOMC rate decision.

It seems that despite the market starting to price in a small chance of 100 bps, it will be 75 basis points in November. The Fed adjusted their trajectory of rates to the 4.25% to 4.5% at the end of 2022 at the last meeting. That was characterized as “outhawking the hawks”. As a result, I gotta think they are focused on that playbood. Where the wiggle room may come in is the potential for an extra 25 basis points in early 2023. The markets this week started to price that in after the CPI, with4.75% to 5% as being a nice round terminal rate target (who would have ever thought a year ago? – well I know some people).

The other news worthy item today was the sacking of the the UK Chancellor of the Exchequer Kwarteng as PM Truss clings to hope that the move quick replacement will save her from an equally disgraced exit before the ink dries on her new PM stationary. Time will tell but the UK debt market did not give their blessing as yields moved back to the upside and closed up 47 basis points from the intraday low. Ouch. The GBPUSD retraced 50% of the gains from Wednesday lowss today and is back between the 200 hour MA at 1.1184 and the 100 hour MA at 1.1128.

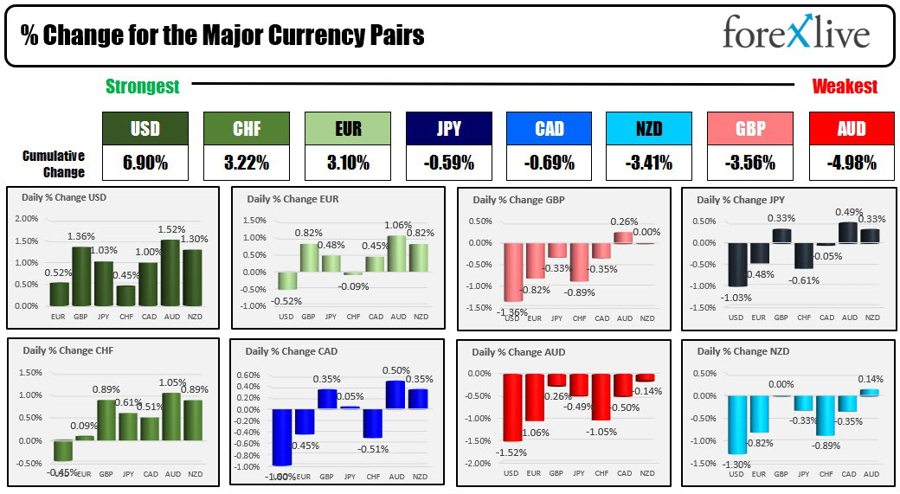

Looking at strongest to the weakest, the USD is ending the day as the strongest of the major currencies. The AUD is the weakest followed by the GBP.

The USDJPY continued its trend move to the upside by moving to the highest level since August 1990. Near the end of the US session, the Japan Finance Minister rubbed his eyes after waking and said that “we’ve seen unprecedented one sided yen moves”. I would be careful.

For the week the USD was up vs all the major currencies with the exception of the GBP:

- USDJPY is up 2.3%

- EURUSD is down -0.22%

- GBPUSD is up 0.60%

- USDCHF is up 1.08

- USDCAD is up 1.1%

- AUDUSD is down -2.58%

- NZDUSD is down -0.85%

The strongest to the weakest of the major currencies.

Thank you for your support this week. Have a good and safe weekend.