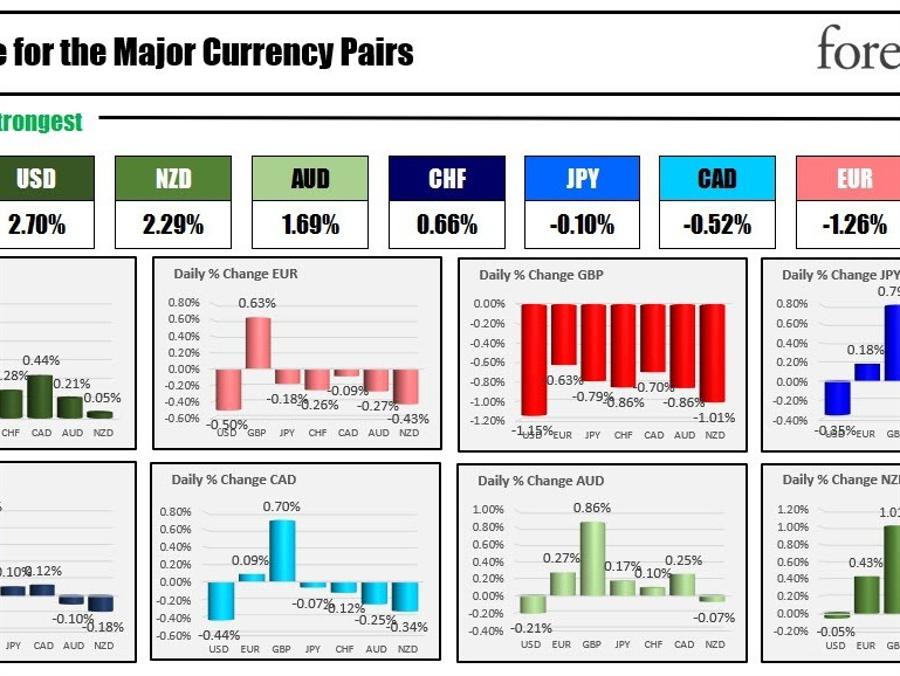

The strongest to the weakest of the major currencies

As the NA session begins after the big reversal day in the markets yesterday after the US CPI report, the USD is back to being the strongest and the GBP is weakest. It is being reported in the UK that the Chancellor of the Exchequer Kwarteng will be sacked, and more recently that there are a group of senior Tory MPs who will push PM Truss to resign (according to the BBC’s Watt)

Technically, the GBPUSD has moved back down to test its 200 hour MA at 1.11912 at the start of the NA session.

JP Morgan reported better than expected earnings this morning. Morgan Stanley beat EPS but was short of revenues. Wells Fargo beat on revenues but was light on EPS. Citicorp is reporting better top and bottom line numbers. The earning season is off and underway in what will be a critical quarterly earnings season for stocks as corporations deal with higher costs and the higher USD.

US retail sales and the Univ. of Michigan will be the follow up to the hotter CPI yesterday. Retail sales are expected to a gain of 0.2% for the headline and -0.1% for the core measure. Michigan preliminary is expected to move marginally higher to 58.7 vs 58.6 last month. The inflation expectations last month came in at 4.6%. Traders will be watching that part of the report.

In other markets:

- Spot gold is trading down $10.47 -0.63% at $1655.54

- Spot silver is down $0.19 -1.04% at $18.67

- WTI crude oil is trading down -$1.72 at $87.32

- Bitcoin is trading at $19,615

In the premarket for US stocks, the major indices are mixed/little changed after sharp rebound gains yesterday snapped the 6 day decline for the S&P and NASDAQ indices:

- Dow industrial average +20 points after yesterdays 827.87 point rise

- S&P index -3 points after yesterdays 92.85 point rise

- NASDAQ index -33 points after yesterdays 232.05 point rise

in the European equity markets the major indices are higher following up to the sharp rise in the US stocks and afternoon trading yesterday

- German DAX, +0.93%

- France’s CAC +1.33%

- UK’s FTSE 100 +0.8%

- Spain’s Ibex +0.95%

- Italy’s FTSE MIB +1.2%

In the US debt market, yields are moving lower. The 10 year is at 3.89% after trading as high as 4.085% intraday yesterday. The 2 year is at 4.42%. It traded as high as 4.535% yesterday.

US yields are lower

In the European debt market, the UK yields are reacting favorably (to the downside) on the reports of Kwarteng sacking and other talks of reversing the stimulus measures from the PM Truss administration:

10 year yields in Europe are lower