The price of WTI crude oil futures are settling at $89.35. That’s down -him $1.78 or -1.95%.

The low for the day reached $80.38. The high for the day traded up to $91.33.

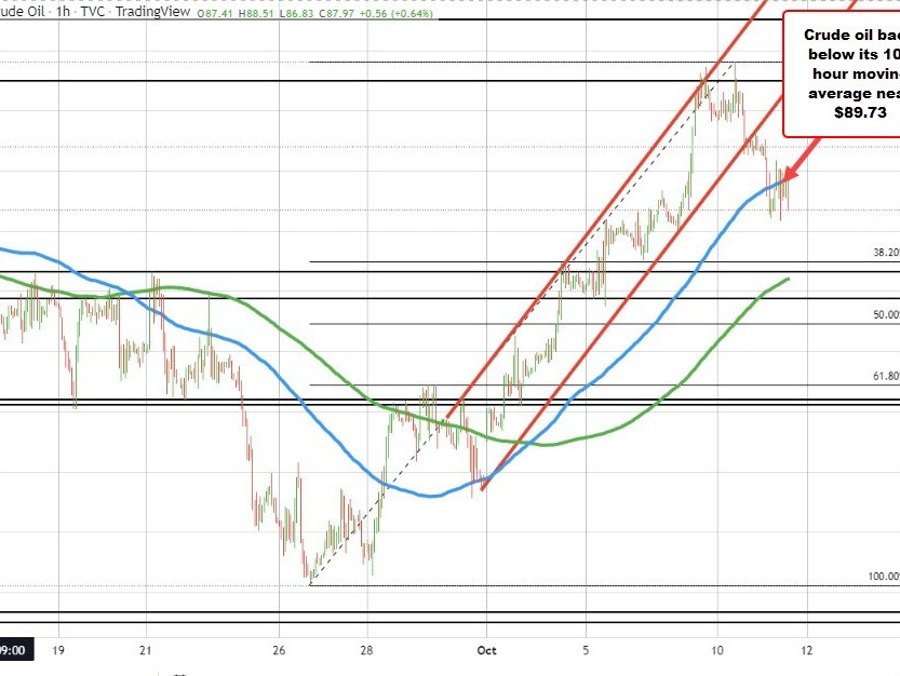

Looking at the hourly chart below, the price has traded above and below its 100 hour moving average in trading today, but over the last few hours has been able to use that moving average as a ceiling. Bearish.

WTI crude oil trades down on the

The price action today was driven by the expectations for lower demand – especially given economic headwinds.

Yes OPEC+ cut production by 2 million barrels per day last week. That 2M BPD was “really” like 1M BPD as numbers were off of the quota levels which are not being reached anyway. Regardless of 1 or 2 M, that was the fundamental story for the price going up to the peak at $93.62.

However, as the price goes higher due to lower supply, that has the dampening effect to demand which counteracts the supply constraints.

That seems to be part of the dynamics of the price action today. If consumers have less money in the pockets due to higher inflation including the price of oil, and wages are not keeping up with price increases, consumers will look to cut back on things like travel or maybe look to limit driving just driving around town.

Technically, the move back below the 100 hour moving average (blue line in the chart above at $89.74) is a step in a bearish direction. Getting below the 38.2% retracement of the move up from the September low at $86.98 and also below the 200 hour moving average at $86.43 (and moving higher), would give sellers more confidence that a high has been set at least for now..