Dollar is lifted mildly after stronger than expected core PCE inflation reading. But overall markets are relatively quite in quarter-end trading. Sterling is still keeping its place as the strongest one for the week, but rebound appears to be losing some momentum. Euro is following as second, and then Swiss Franc. Yen is among the worst performers with commodity currencies. The question is whether risk aversion could give Dollar and Yen a lift in the final hours.

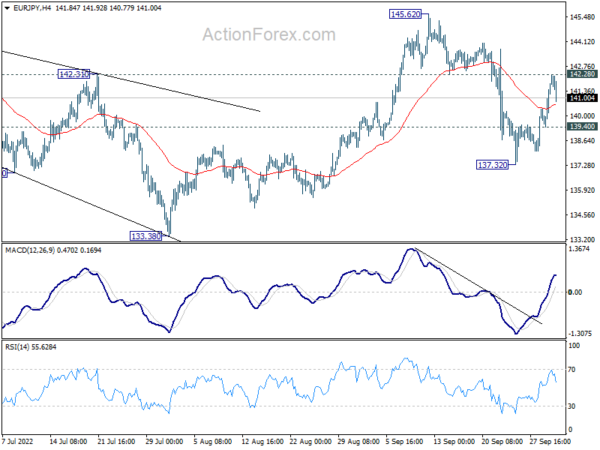

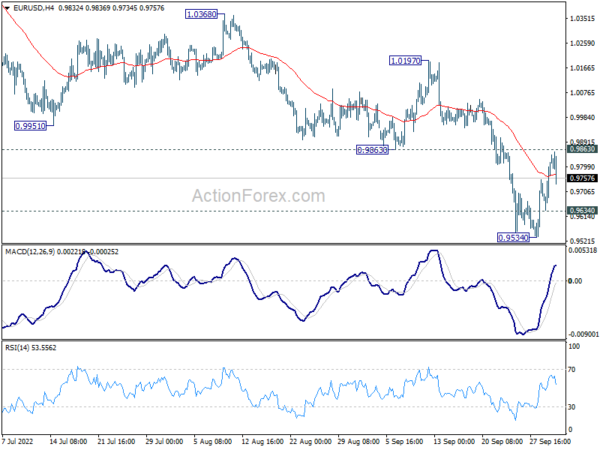

Technically, Euro’s rebound is also momentum as seen in both EUR/USD and EUR/JPY. There’s just isn’t enough follow through buying to push the pairs through 0.9863 and 142.28 resistance respectively. Rejection by these levels, followed by a reversal, will keep near term outlook bearish for another fall through this week’s lows, at a later stage.

In Europe, at the time of writing, FTSE is down -0.15%. DAX is up 0.27%. CAC is up 0.38%. Germany 10-year yield is down -0.089 at 2.089. Earlier in Asia, Nikkei dropped -1.83%. Hong Kong HSI rose 0.33%. China Shanghai SSE dropped -0.55%. Singapore Strait Times rose 0.49%. Japan 10-year JGB yield dropped -0.0074 to 0.252.

US PCE price slowed to 6.2% yoy, core PCE rose to 4.9% yoy

US personal income rose 0.3% mom or USD 71.6B in August, matched expectations. Personal spending rose 0.4% mom or USD 67.6B, above expectation of 0.2% mom.

PCE price index rose 0.3% mom, matched expectations. PCE core price index, ex-food and energy, rose 0.6% mom, above expectation of 0.5% mom. Prices for goods dropped -0.3% mom while prices for services rose 0.6% mom. Food prices rose 0.8% mom. Energy prices dropped -5.5% mom.

From the same month a year ago, PCE price index slowed from 6.4% yoy to 6.2% yoy, below expectation of 6.6% yoy. PCE core price index, ex-food and energy, accelerated from 4.7% yoy to 4.9% yoy, above expectation of 4.7% yoy. Goods prices rose 8.6% yoy while services prices rose 5.0% yoy. Food prices jumped 12.4% yoy and energy prices jumped 24.7% yoy.

Eurozone CPI rose to 10% yoy in Sep, energy up 40.8% yoy, food up 11.8% yoy

Eurozone CPI accelerated further from 9.1% yoy to 10.0% yoy in September, above expectation of 9.1% yoy. CPI core (ex-energy, food, alcohol & tobacco) also rose from 4.3% yoy to 4.8% yoy, above expectation of 4.7% yoy.

Looking at the main components , energy is expected to have the highest annual rate in September (40.8%, compared with 38.6% in August), followed by food, alcohol & tobacco (11.8%, compared with 10.6% in August), non-energy industrial goods (5.6%, compared with 5.1% in August) and services (4.3%, compared with 3.8% in August).

Also released, Eurozone unemployment rate was unchanged at 6.6% in August, matched expectations.

Swiss KOF edged up to 93.8, still augurs a cooling of economy

Swiss KOF Economic Barometer rose slightly from 93.5 to 93.8 in September, better than expectation of of 86.2. yet, the reading remains below its long-term average, “augurs a cooling of the Swiss economy for the end of 2022.”

The slight increase is “primarily attributable to bundles of indicators from the manufacturing and other services sectors”. On the other hand, “indicators from the finance and insurance sector and for foreign demand are sending negative signals.”

Also from Swiss, retail sales rose 3.0% yoy in August, above expectation of 2.8% yoy.

Japan industrial production rose 2.7% mom in Aug, to grow further in Sep and Oct

Japan industrial production rose 2.7% mom in August, much better than expectation of -0.2% decline. That’s also the third consecutive month of growth. The Ministry of Economy, Trade and Industry expects production to rise further by 2.9% mom in September and then 3.2% mom in October.

Retail sales rose 4.1% yoy in August, well above expectation of 2.8% yoy. Unemployment rate dropped from 2.6% to 2.5%, matched expectations. Housing starts rose 4.6% yoy in August, versus expectation of -4.1% yoy. Consumer confidence index dropped from 32.5 to 30.8, below expectation of 33.6.

China PMI manufacturing rose to 50.1, but Caixin PMI manufacturing dropped to 48.1

China’s official PMI Manufacturing rose from 49.4 to 50.1 in September, above expectation of 49.2. PMI Non-Manufacturing dropped from 52.6 to 50.6, below expectation of 52.0.

Senior NBS statistician Zhao Qinghe said, “In September, with a series of stimulus packages continuing to take effect, coupled with the impact of hot weather receding, the manufacturing boom has rebounded. The PMI returned to the expansionary range… [The non-manufacturing index] remained above the threshold, with the overall expansion of the non-manufacturing sector decelerating.”

On the other hand, Caixin PMI Manufacturing dropped from 49.5 to 48.1, below expectation of 49.9. Caixin said production fell for the first time in four months amid quicker dropped in sales. Firms cut back on purchasing activity and inventories. Selling prices fell at quickest rate since December 2015.

EUR/USD Mid-Day Outlook

Daily Pivots: (S1) 0.9694; (P) 0.9755; (R1) 0.9874; More…

Intraday bias in EUR/USD remains neutral at this point, and outlook stays bearish with 0.9863 support turned resistance intact. Break of 0.9634 will suggest that larger down trend is ready to resume. Intraday bias will be back on the downside for 0.9534 and below. However, sustained break of 0.9863 will confirm short term bottoming, and bring stronger rally back to 1.0197 resistance instead.

In the bigger picture, down trend from 1.6039 (2008 high) is still in progress. Next target is 100% projection of 1.3993 to 1.0339 from 1.2348 at 0.8694. In any case, break of 1.0197 resistance is needed to be the first sign of medium term bottoming. Otherwise, outlook will stay bearish even with strong rebound.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 22:45 | NZD | Building Permits M/M Aug | -1.60% | 5.00% | 4.90% | |

| 23:30 | JPY | Unemployment Rate Aug | 2.50% | 2.50% | 2.60% | |

| 23:50 | JPY | Industrial Production M/M Aug P | 2.70% | -0.20% | 0.80% | |

| 23:50 | JPY | Retail Trade Y/Y Aug | 4.10% | 2.80% | 2.40% | |

| 01:30 | AUD | Private Sector Credit M/M Aug | 0.80% | 0.80% | 0.70% | 0.80% |

| 01:30 | CNY | NBS Manufacturing PMI Sep | 50.1 | 49.2 | 49.4 | |

| 01:30 | CNY | Non-Manufacturing PMI Sep | 50.6 | 52 | 52.6 | |

| 01:45 | CNY | Caixin Manufacturing PMI Sep | 48.1 | 49.9 | 49.5 | |

| 05:00 | JPY | Housing Starts Y/Y Aug | 4.60% | -4.10% | -5.40% | |

| 05:00 | JPY | Consumer Confidence Index Sep | 30.8 | 33.6 | 32.5 | |

| 06:00 | GBP | GDP Q/Q Q2 F | 0.20% | -0.10% | -0.10% | |

| 06:00 | GBP | Current Account (GBP) Q2 | -33.8B | -43.9B | -51.7B | -43.9B |

| 06:30 | CHF | Real Retail Sales Y/Y Aug | 3.00% | 2.80% | 2.60% | |

| 06:45 | EUR | France Consumer Spending M/M Aug | 0.00% | 0.00% | -0.80% | |

| 07:00 | CHF | KOF Leading Indicator Sep | 93.8 | 86.2 | 86.5 | 93.5 |

| 07:55 | EUR | Germany Unemployment Change Sep | 14K | 20K | 28K | |

| 07:55 | EUR | Germany Unemployment Rate Sep | 5.50% | 5.50% | 5.50% | |

| 08:00 | EUR | Italy Unemployment Aug | 7.80% | 7.90% | 7.90% | |

| 08:30 | GBP | Mortgage Approvals Aug | 74K | 63K | 64K | |

| 08:30 | GBP | M4 Money Supply M/M Aug | -0.20% | 0.50% | 0.50% | |

| 09:00 | EUR | Eurozone Unemployment Rate Aug | 6.60% | 6.60% | 6.60% | |

| 09:00 | EUR | Eurozone CPI Y/Y Sep P | 10.00% | 9.10% | 9.10% | |

| 09:00 | EUR | Eurozone CPI Core Y/Y Sep P | 4.80% | 4.70% | 4.30% | |

| 12:30 | USD | Personal Income M/M Aug | 0.30% | 0.30% | 0.20% | 0.30% |

| 12:30 | USD | Personal Spending Aug | 0.40% | 0.20% | 0.10% | -0.20% |

| 12:30 | USD | PCE Price Index M/M Aug | 0.30% | 0.30% | -0.10% | |

| 12:30 | USD | PCE Price Index Y/Y Aug | 6.20% | 6.60% | 6.30% | 6.40% |

| 12:30 | USD | Core PCE Price Index M/M Aug | 0.60% | 0.50% | 0.10% | 0.00% |

| 12:30 | USD | Core PCE Price Index Y/Y Aug | 4.90% | 4.70% | 4.60% | 4.70% |

| 13:45 | USD | Chicago PMI Sep | 51.9 | 52.2 | ||

| 14:00 | USD | Michigan Consumer Sentiment Index Sep F | 59.5 | 59.5 |

breakout perfect entry #forex #crypto #trading #trending

breakout perfect entry #forex #crypto #trading #trending