The forex markets are generally in consolidation mode today. Risk sentiment is slightly on the off side, but there is no serious selloff in stocks. Treasury yields in US, Germany and UK are trading mildly higher, giving Yen a little pressure. But commodity currencies are the weaker ones. On the other hand, Dollar is firmer together with Euro and Sterling.

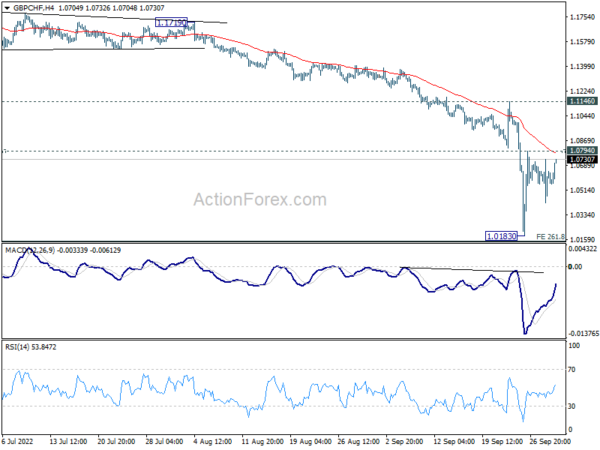

Technically, Sterling is trying to extend recovery again today, but upside is so far very limited. Some attention will be on 1.0794 minor resistance in GBP/CHF. Break there would extend the rebound from 1.0183 towards 1.1146 key near term resistance. If happens, that could be an early signal for stronger rise in the Pound against Euro and Yen, and possibly Dollar too.

In Europe, at the time of writing, FTSE is down -1.27%. DAX is down -1/.53%. CAC is down -1.37%. Germany 10-year yield is up 0.0109 at 2.230. UK 10-year gilt yield is up 0.117 at 4.130. Earlier in Asia, Nikkei rose 0.95%. Hong Kong HSI dropped -0.49%. China Shanghai SSE dropped -0.13%. Singapore Strait Times dropped -0.04%. Japan 10-year Jiggled rose 0.0079 to 0.249.

US initial jobless claims dropped to 193k

US initial jobless claims dropped -16k to 193k in the week ending September 24, smaller than expectation of 213k. Four-week moving average of initial claims dropped -9k to 207.

Continuing claims dropped -29k to 1347k in the week ending September 17. Four-week moving average of continuing claims dropped -22.5k to 1381k.

Also released, Q2 GDP contraction was finalized at -0.5% annualized., GDP price index finalized at 9.0%

Canada GDP grew 0.1% mom in Jul, flat in Aug

Canada GDP grew 0.1% mom in August, better than expectation of -0.1% mom contraction. Goods-producing industries grew 0.5% mom while Services-producing industrial contracted -0.1% mom. 11 of 20 industrial sectors increased.

Advance information indicates that real GDP was essentially unchanged in August. Increases in retail and wholesale trade, as well as in agriculture, forestry, fishing, and hunting were offset by decreases in manufacturing and oil and gas extraction.

BoE Ramsden: Gilt operation strictly time limited

BoE Governor Deputy Governor Dave Ramdsen reiterated in a speech that the target gilt purchases announced this week, after severe repricing of assets, are “strictly time limited until 14 October”.

“They are intended to tackle a specific problem in the long-dated government bond market,” he added. “The purchases will be unwound in a smooth and orderly fashion once risks to market functioning are judged to have subsided.

Eurozone economic sentiment dropped to 93.7, EU down to 106.4

Eurozone Economic Sentiment Indicator dropped from 97.3 to 93.7 in September. Employment Expectation Indicator dropped from 107.9 to 106.7. Economic Uncertainty Indicator rose from 25.4 to 29.3.

Eurozone Industrial confidence dropped from 1.0 to -0.4. Services confidence dropped from 8.1 to 4.9. Consumer confidence dropped from -25.0 to -28.8. Retail trade confidence dropped from -6.5 to -8.4. Construction confidence dropped from 3.4 to 1.6.

EU ESI dropped from 96.1 to 92.6. Amongst the largest EU economies, the ESI fell markedly in Germany (-4.8), the Netherlands (-3.7), Italy (-3.7), France (-3.2), Poland (-2.4) and, to a lesser extent, Spain (-1.0).

ECB Simkus: My choice is 75bps for next hike

ECB Governing Council member Gediminas Simkus said he choice for the next rate hike is 75, adding that “a couple of options may be on the table but 50 is the minimum.” He indicated that ECB should target “as soon as possible” on reducing its balance sheet.

At the same event another Governing Council member Madis Muller said “inflation calls for significant rate hikes,” but it’s “too early to say how much in basis points.”

Also Governing Count member Mario Council said, “Right now frontloading other debates may in my opinion have a destabilizing effect that we really need to avoid. We have a path towards normalization of monetary policy and that’s the focus right now.”

Australia monthly CPI slowed to 6.8% yoy in Aug on fuel costs

In its first monthly release, Australia CPI rose 6.8% yoy in June, accelerated to 7.0% yoy in July, and slowed to 6.8% yoy in August

Monthly CPI excluding fruit, vegetables and fuel rose 5.5% yoy in June, accelerated to 6.1% yoy in July, then 6.2% yoy in August.

David Gruen, Australian Statistician, said: ” The slight fall in the annual inflation rate from July to August was mainly due to a decrease in prices for Automotive fuel. This saw the annual movement for Automotive fuel fall from 43.3 per cent in June to 15.0 per cent in August.”

New Zealand ANZ business confidence rose to -36.7, a temporary reprieve

New Zealand ANZ Business Confidence rose from -47.8 to -36.7 in September. Own Activity Outlook rose from -4.0 to -1.8. investment intentions rose from -2.0 to 1.8. Employment intentions rose from 3.4 to 5.9. Pricing intentions rose from 68.0 to 70.1. Cost expectations dropped from 90.9 to 89.8. inflation expectations eased from 6.13 % to 5.98%.

ANZ said: “It’s fair to say that demand has not yet rolled over as feared as the Reserve Bank has raised interest rates. But insofar as the RBNZ can just keep on going until they see the cooling in demand they need to tame inflation, that’s likely to be a temporary reprieve, if not an outright double-edged sword for firms that have considerable debt.”

“Inflation pressures are easing, but painfully slowly. It’s not enough for the RBNZ to see inflation pressures top out and ever so gradually fall. They will be concerned about the chance that wage and price-setting behaviour will change in structural ways that make bringing inflation down more difficult. We expect that the RBNZ will need to deliver a policy rate closer to 5% than 4% to get on top of inflation pressures.”

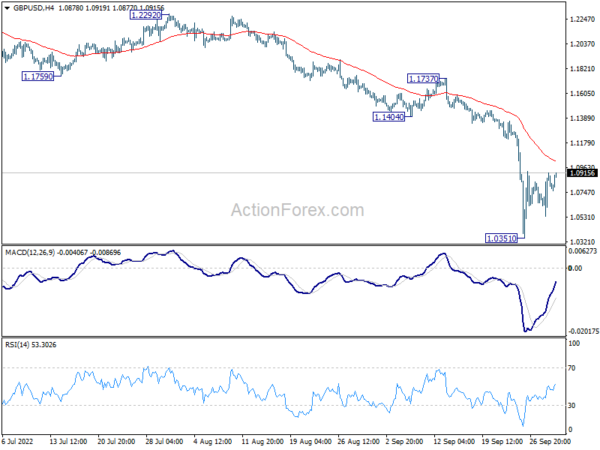

GBP/USD Mid-Day Outlook

Daily Pivots: (S1) 1.0648; (P) 1.0782; (R1) 1.1023; More…

Intraday bias in GBP/USD stays neutral for the moment, as recovery from 1.0351 is extending. While stronger recovery cannot be ruled out, upside should be limited by 4 hour 55 EMA (now at 1.1017). On the downside, break of 1.0351 will resume larger down trend towards parity next. Nevertheless, sustained trading above 4 hour 55 EMA will bring stronger rebound towards 1.1404 support turned resistance.

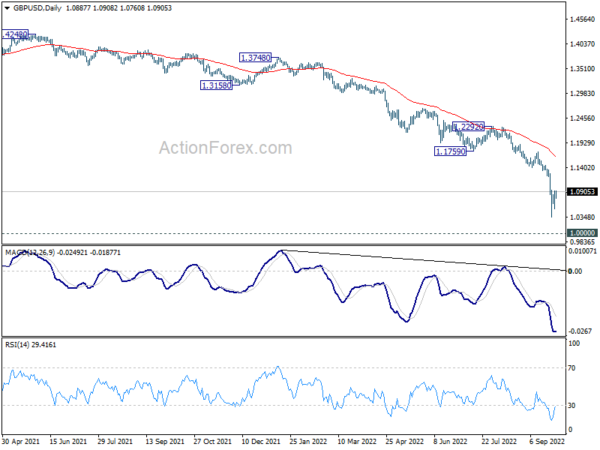

In the bigger picture, fall from 1.4248 (2018 high) is resuming long term down trend from 2.1161 (2007 high). Next target is 100% projection of 2.1161 to 1.3503 from 1.7190 at 0.9532. There is no scope of a medium term rebound as long as 1.1759 support turned resistance holds.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 09:00 | EUR | Eurozone Economic Sentiment Indicator Sep | 93.7 | 95 | 97.6 | 97.3 |

| 09:00 | EUR | Eurozone Industrial Confidence Sep | -0.4 | -1 | 1.2 | 1 |

| 09:00 | EUR | Eurozone Services Sentiment Sep | 4.9 | 7 | 8.7 | 8.1 |

| 09:00 | EUR | Eurozone Consumer Confidence Sep F | -28.8 | -28.8 | -28.8 | |

| 12:00 | EUR | Germany CPI M/M Sep P | 1.90% | 1.60% | 0.30% | |

| 12:00 | EUR | Germany CPI Y/Y Sep P | 10.00% | 9.50% | 7.90% | |

| 12:30 | CAD | GDP M/M Jul | 0.10% | -0.10% | 0.10% | |

| 12:30 | USD | Initial Jobless Claims (Sep 23) | 193K | 213K | 213K | 209K |

| 12:30 | USD | GDP Annualized Q2 F | -0.60% | -0.60% | -0.60% | |

| 12:30 | USD | GDP Price Index Q2 F | 9.00% | 8.90% | 8.90% | |

| 14:30 | USD | Natural Gas Storage | 93B | 103B |

This “NEW CONCEPT” Trading Strategy Prints Money!… (INSANE Results!)

This “NEW CONCEPT” Trading Strategy Prints Money!… (INSANE Results!) RULE-BASED Pocket Option Strategy That Actually Works | Live Trading

RULE-BASED Pocket Option Strategy That Actually Works | Live Trading