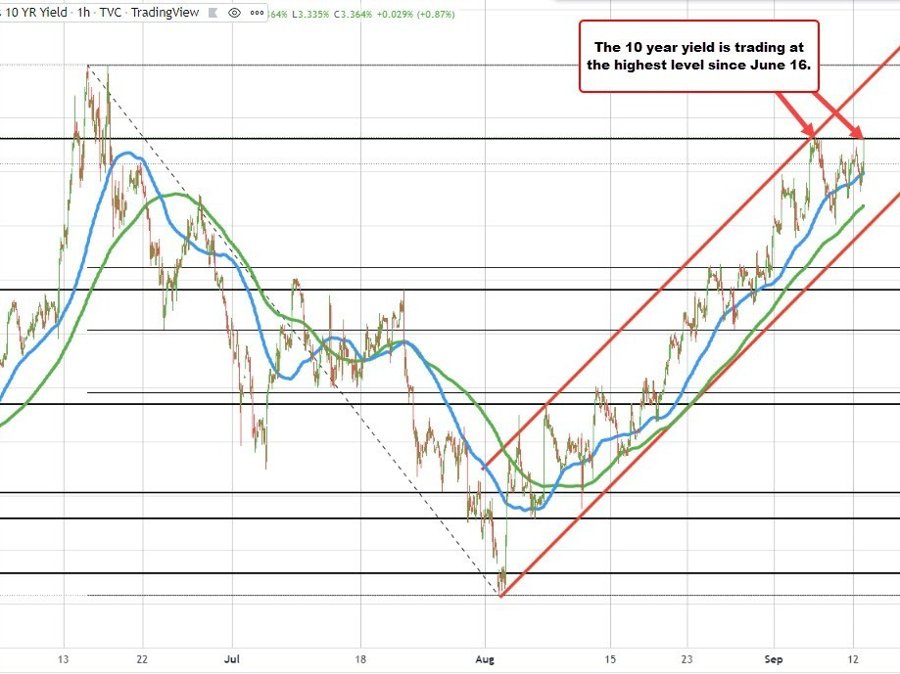

10 year yield traded to the highest level since June 16

The US auctions today were met with tepid demand. The 3- year auction had a tail of 1.4 bps above the WI level at the time of the auction. The foreign demand was lower than the average. The 10 year auction had a tail of 2.3 bps above the WI level. Once again, the demand was lower than the average.

That helped to push yields up. The current yield is trading at 3.362%. That took out the high yield from last week at 3.361%. The cycle high yield for the year came in on June 15 at 3.497%.

The move higher in yields has started to have a impact on the US dollar . We are seeing a little bit about tick up over the last few hour of trading.

- EURUSD has move back to 1.0112 and in the process, has moved back within the swing area between 1.00958 and 1.0121. The 200 bar moving average on the 4 hour chart is at 1.00989 and if broken, would disappoint the buyers today.

- USDJPY: The price of the USDJPY remains between its 200 hour moving average below (green line) and its 100 hour moving average above (blue line in the chart below). The price is off its New York session low which could not get below the Asian session swing low.

USDJPY moves off of its New York session low

GBPUSD: The GBPUSD has backed off from the topside channel trend line and trades down to 1.1676. The swing low from a London morning session and the NY session stalled at 1.16624. That would be the next downside target for the pair.