Dollar is recovering some ground today but stays below yesterday’s high in general, consolidations continue. Overall trading in subdued with major pairs and crosses suck inside yesterday’s range. Kiwi and Aussie are on the softer side while the greenback and Yen are firmer. European majors are also weak but there is no follow through selling. Traders are apparently holding their bets before Jackson Hole.

Technically, while DOW’s pull back this week is steep and deep, it’s holding above 55 day EMA as well as 32387.12 support so far. There is no serious threat to the rally from 29653.29 yet. A bounce from current level could set the base for another rise, probably after Fed Chair Jerome Powell’s comments at Jackson hole. However, firm break of 32387.12 will argue that the near term move has reversed fro another take on 30k handle.

In Europe, at the time of writing, FTSE is down -0.41%. DAX is up 0.01%. CAC is up 0.12%. Germany 10-year yield is up 0.0585 at 1.378. Earlier in Asia, Nikkei dropped -0.49%. Hong Kong HSI fell -1.20%. China Shanghai SSE lost -1.86%. Singapore Strait Times declined -0.39%. Japan 10-year JGB yield rose 0.0022 to 0.224.

US durable goods orders flat in July, ex-transport orders rose 0.3% mom

US durable goods orders dropped -0.0% mom to USD 273.5B in July, well below expectation of 0.6% mom rise. Ex-transport orders rose 0.3% mom, above expectation of 0.2% mom. Ex-defense orders rose 1.2% mom. Transportation equipment drove the decrease and dropped -0.7% mom to USD 93.0B.

Shipments of manufactured durables goods rose 0.4% mom to USD 270B. Transportation equipment shipments rose 1.1% mom to USD 86.3B.

ECB Rehn: Digital native form of safe central bank money could enhance stability

ECB Governing Council member Olli Rehn said, “a digital euro would give people an additional choice about how to pay and would make it easier to do so in an increasingly digital economy.”

“A digital native form of safe central bank money could enhance stability by providing the neutral trusted settlement layer in the future financial system,” he added.

Rehn expected the investigation phase for digital Euro to conclude in October 2023.

USD/CHF Mid-Day Outlook

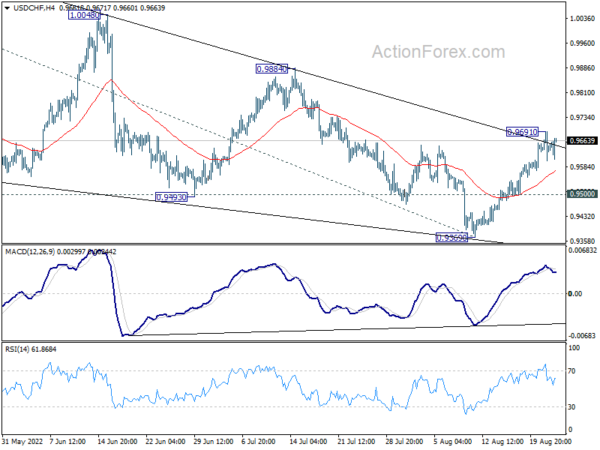

Daily Pivots: (S1) 0.9600; (P) 0.9646; (R1) 0.9689; More…

Intraday bias in USD/CHF stays neutral at this point. Triangle correction from 1.0063 could have completed at 0.9369 already. Above 0.9691 will t target 0.9884 resistance next. Break there will argue that larger up trend is ready for resumption through 1.0063. On the downside, below 0.9500 minor support will dampen this view and turn bias back to the downside for 0.9369 support instead.

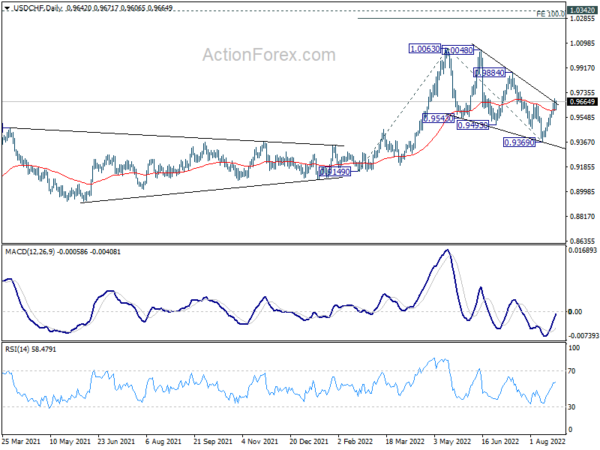

In the bigger picture, current development suggests that up trend from 0.8756 (2021 low) is still in progress. Sustained break of 1.0063 will target 100% projection of 0.9149 to 1.0063 from 0.9369 at 1.0283, and then 1.0342 (2016 high). For now, this will remain the favored case as long as 0.9369 support holds, even in case of deep pull back.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 12:30 | USD | Durable Goods Orders Jul | 0.00% | 0.60% | 2.00% | |

| 12:30 | USD | Durable Goods Orders ex Transportation Jul | 0.30% | 0.20% | 0.40% | |

| 14:00 | USD | Pending Home Sales M/M Jul | -2.50% | -8.60% | ||

| 14:30 | USD | Crude Oil Inventories | -2.4M | -7.1M |