Snippet from a note from ING on crude oil. From Friday ICYMI.

In brief:

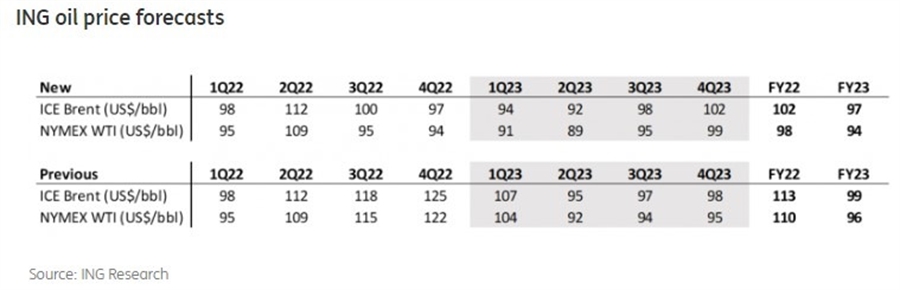

- Stubborn Russian oil output and weaker than expected demand growth mean the oil market is likely to remain in surplus for the remainder of this year and into early next year, which should limit the upside in oil prices.

- Although, given that inventories are at historically low levels, we still believe that prices will remain elevated, whilst limited OPEC spare capacity and uncertainty over how Russian flows will evolve once the EU ban comes into full force should also limit downside in the medium term.

This article was originally published by Forexlive.com. Read the original article here.