The markets are generally rather quiet today, with major pairs and crosses trading inside yesterday’s range, as well as last week’s range. For now, Dollar is the strongest ones, followed by Sterling and then Euro. Australian and New Zealand Dollars are the weakest. Yen and Swiss Franc are mixed together with Canadian.

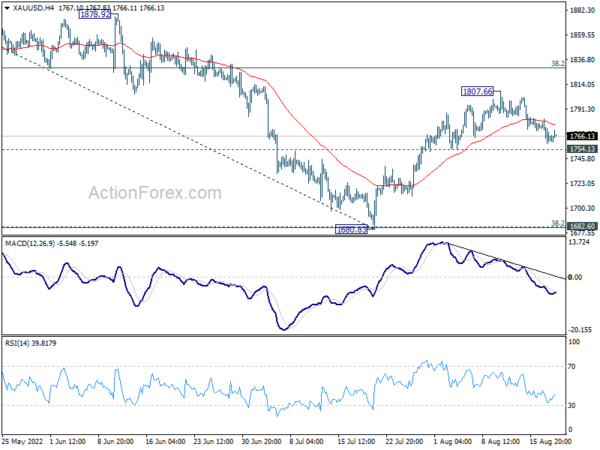

Technically, Dollar’s rally this week is not making much progress so far. Even Gold’s pull back is relatively shallow. As long as 1754.13 support holds, rise from 1680.83 is still in favor to resume through 1807.66. Nevertheless, firm break of 1754.13 will probably bring reversal for retesting 1680.83 low. That might be accompanied by stronger rise in the greenback.

In Europe, at the time of writing, FTSE is up 0.16%. DAX is up 0.53%. CAC is up 0.24%. Germany 10-yaer yield is up 0.022 at 1.110. Earlier in Asia, Nikkei dropped -0.96%. Hong Kong HSI dropped -0.80%. China Shanghai SSE dropped -0.46%. Singapore Strait Times rose 0.33%. Japan 10-year JGB yield rose 0.0139 to 0.200.

US initial jobless claims dropped to 250k, below expectations

US initial jobless claims dropped -2k to 250k in the week ending August 13, below expectation of 261k. Four-week moving average of initial claims dropped -2750 to 247k.

Continuing claims rose 7k to 1437k in the week ending August 6. Four-week moving average of continuing claims rose 13k to 1413.

Also released Philly Fed manufacturing survey improved from -12.3 to 6.2 in August. Canada IPPI dropped -2.1% mom in July. RMPI dropped -7.4% mom.

ECB Schnabel: Our concerns was not alleviated after Jul 50bps hike

ECB Executive Board member Isabel Schnabel said in an interview that there was a “strong indication that growth is going to slow”. She would not rule out a technical recession in Eurozone, “especially if energy supplies from Russia are disrupted further”. Downside risks also increased due to “additional supply-side shocks, caused by droughts or the low water levels in major rivers.”

Regarding inflation she said the increasing inflation rates are a “broad-based development”. “Inflationary pressures are likely to be with us for some time; they won’t vanish quickly,” she added. “I would not exclude that, in the short run, inflation is going to increase further…. it’s very difficult to predict when inflation is going to peak.”

Regarding September meeting, Schnabel said that “the concerns we had in July have not been alleviated”. Back in July, ECB raised interest rate by 50bps. “At the moment I do not think this outlook has changed fundamentally,” she added.

Eurozone CPI finalized at 8.9% yoy in Jul, core CPI at 5.4% yoy

Eurozone CPI was finalized at 8.9% yoy in July, comparing with June’s 8.6% yoy. CPI ex-energy, food, alcohol, and tobacco was finalized at 5.4% yoy (up from June’s 4.9% yoy). The highest contribution to the annual Eurozone inflation rate came from energy (+4.02%), followed by food, alcohol & tobacco (+2.08%), services (+1.60%) and non-energy industrial goods (+1.16%).

EU CPI was finalized at 9.8% yoy, up from June’s 9.6% yoy. The lowest annual rates were registered in France, Malta (both 6.8%) and Finland (8.0%). The highest annual rates were recorded in Estonia (23.2%), Latvia (21.3%) and Lithuania (20.9%). Compared with June, annual inflation fell in six Member States, remained stable in three and rose in eighteen.

Australia lost -40.9k jobs, but unemployment rate dropped to 3.4%

Australia employment contracted -40.9k in July, much worse than expectation of 25.0k growth. Full time jobs decreased by 86.9k while part time jobs rose 46k.

Unemployment rate dropped from 3.5% to 3.4%. Participation rate dropped notably from 66.8% to 55.4%. Monthly hours worked in all jobs dropped -16m hours, or -0.8% mom.

“The fall in unemployment in July reflects an increasingly tight labour market, including high job vacancies and ongoing labour shortages, resulting in the lowest unemployment rate since August 1974,” Bjorn Jarvis, head of labour statistics at the ABS, said.

RBNZ Orr: Monetary policy was too loose for a period

RBNZ Governor Adrian Orr told a parliamentary committee, “our core inflation is too high and that suggests at some point monetary policy was too loose for a period.”

“I have already apologized for the current level of inflation. I have already said that the Reserve Bank was party to that,” he added.

However, “the worst mistake we could be having would be fighting deflation, unnecessary unemployment and economic collapse,” he said. “We have ended up with the better problem — but it is a problem — which is inflation, core inflation of 4-6% that we need to put back in the bottle.”

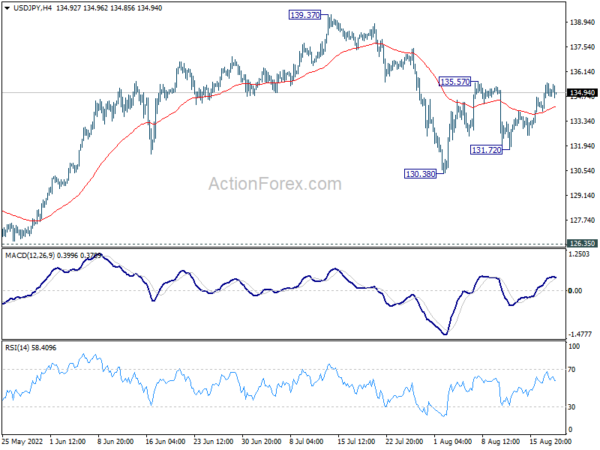

USD/JPY Mid-Day Outlook

Daily Pivots: (S1) 134.15; (P) 134.83; (R1) 135.74; More…

Intraday bias in USD/JPY stays neutral at this point. Overall, corrective pattern from 139.37 will extend further. On the upside, above 135.57 will resume the rebound to retest 139.37 high. But a decisive break there is not expected this time. On the downside, below 131.72 will resume the fall from 139.37 through 130.38 support.

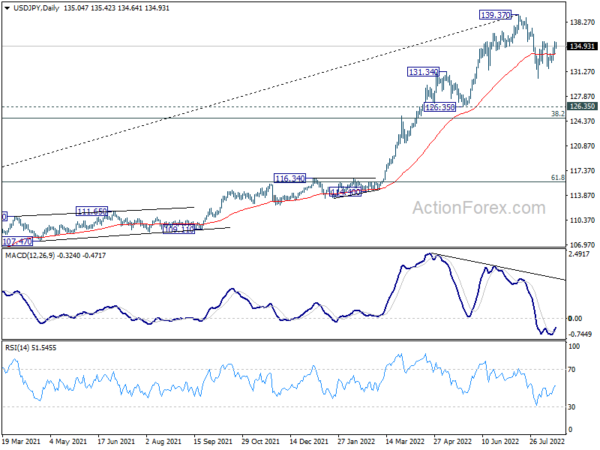

In the bigger picture, fall from 139.37 medium term top is seen as correcting whole up trend from 101.18 (2020 low). While deeper decline cannot be ruled out, outlook will stays bullish as long as 55 week EMA (now at 122.70) holds. Long term up trend is expected to resume through 139.37 at a later stage, after the correction finishes.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 01:30 | AUD | Employment Change Jul | -40.9K | 25.0K | 88.4K | |

| 01:30 | AUD | Unemployment Rate Jul | 3.40% | 3.50% | 3.50% | |

| 06:00 | CHF | Trade Balance (CHF) Jul | 3.58B | 3.55B | 3.80B | 3.68B |

| 09:00 | EUR | Eurozone CPI Y/Y Jul F | 8.90% | 8.90% | 8.90% | |

| 09:00 | EUR | Eurozone CPI Core Y/Y Jul F | 4.00% | 4.00% | 4.00% | |

| 12:30 | CAD | Industrial Product Price M/M Jul | -2.10% | -0.80% | -1.10% | |

| 12:30 | CAD | Raw Material Price Index Jul | -7.40% | -3.90% | -0.10% | |

| 12:30 | USD | Initial Jobless Claims (Aug 12) | 250K | 261K | 262K | 252K |

| 12:30 | USD | Philadelphia Fed Manufacturing Survey Aug | 6.2 | -6.2 | -12.3 | |

| 14:00 | USD | Existing Home Sales Jul | 4.85M | 5.12M | ||

| 14:30 | USD | Natural Gas Storage | 38B | 44B |