The forex markets are very quiet in Asian session today, and could remain so for the day with an ultra light economic calendar. Australian Dollar and Swiss Franc are currently the stronger ones for the week, followed by Canadian and Kiwi. On the other hand, Dollar and Yen are both on the softer side, together with Sterling and Euro. Traders are probably still awaiting the bigger bets until US CPI release on Wednesday.

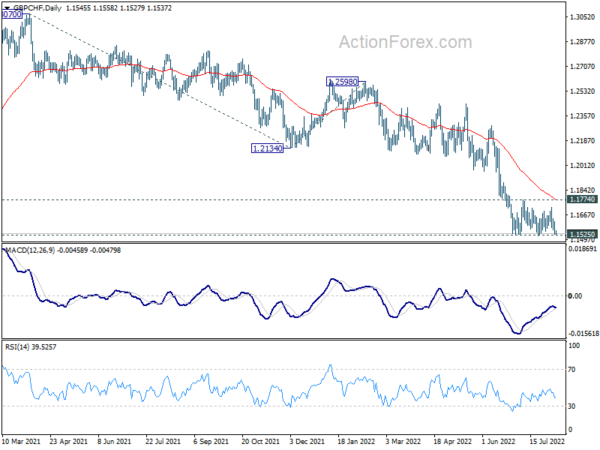

Technically, Swiss Franc is worth a watch today. GBP/CHF is now pressing 1.1525 low. Firm break there will resume larger down trend from 1.3070. And in any case, outlook will stay bearish as long as 1.1774 resistance, even in case of another recovery. At the same time, EUR/CHF is heading back to 0.9697 low, and break will resume long term down trend too.

In Asia, at the time of writing, Nikkei is down -0.92%. Hong Kong HSI is up 0.40%. China Shanghai SSE is up 0.25%. Singapore Strait Times is down -0.36%. Japan 10-year JGB yield is down -0.008 at 0.170. Overnight, DOW rose 0.09%. S&P 500 dropped -0.12%. NASDAQ dropped -0.10%. 10-year yield dropped -0.075 to 2.765.

Australia Westpac consumer sentiment dropped to 81.2 in Aug

Australia Westpac Consumer Sentiment Index fell -3% to 81.2 in August. The reading was on par with the lows of the Covid and Global Financial Crisis. Also, there was a cumulative decrease of -22.9% from recent peak made in November 2021.

Economic conditions for the 12 months dropped from 80.3 to 73.9. Economic conditions for the next five years dropped from 91.6 to 90.7. Unemployment expectations index dropped from 109.8 to 103.4. House price expectations index dropped from 104.9 to 97.1.

Regarding RBA’s next meeting on September 6, Westpac expects the central bank to hike by another 50bps to 2.35%, leaving the cash rate in “neutral range”. It expects RBA to then scale back the increase to 25bps per meeting until February 2023.

Australia NAB business confidence rose to 7, conditions rose to 20

Australia NAB Business Confidence rose from 2 to 7 in July. Business Conditions rose from 14 to 20. Trading conditions rose from 19 to 27. Profitability conditions rose from 13 to 17. Employment conditions rose from 11 to 17.

“Businesses are continuing to report that conditions are really strong,” said NAB Group Chief Economist Alan Oster. “While some of the real time data we look at is showing signs of softening, there are no signs of that in the survey with demand at a really high level. Importantly, the strength is showing up across the board in terms of industries and across the country.”

“Confidence bounced back in July, which was something of a surprise,” said Oster. “Inflation and rising interest rates are clouding the outlook, and there are growing concerns about the global economy, but businesses seem to have a fairly positive outlook at the moment. Forward orders are also fairly strong at +10 index points which also supports the outlook.”

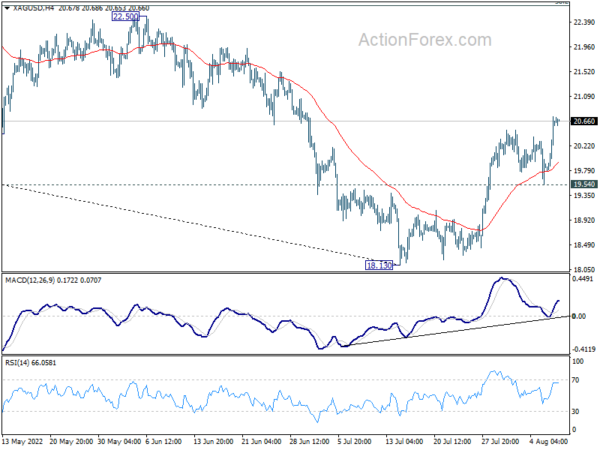

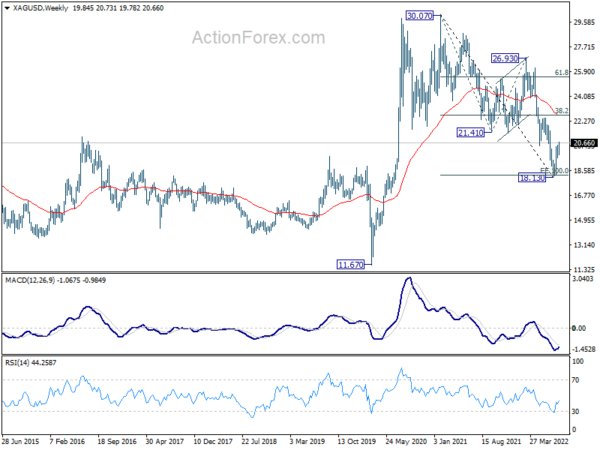

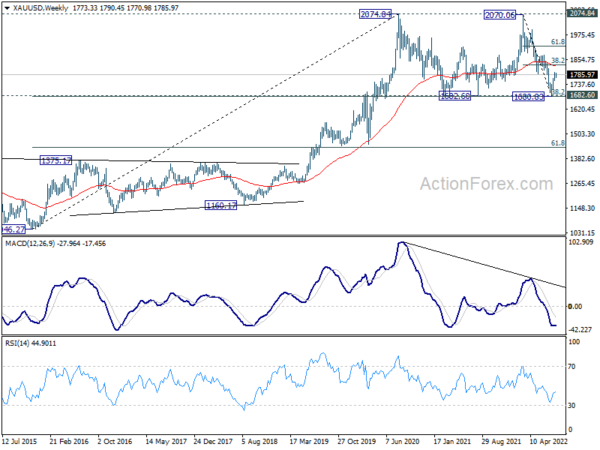

Silver extends rally above 20, Gold still struggling in range

Silver’s rally from 18.13 resumes this week and breaks above 20 handle. In the bigger picture, 18.13 is tentatively seen as a medium term bottom, made after hitting 100% projection of 30.07 to 21.41 from 26.93 at 18.27.

For now further rally is expected as long as 19.54 holds. The key resistance zone lies around 22.50, which is close to 55 week EMA (now at 22.61), and 38.2% retracement of 30.07 to 18.13 at 22.69. Reaction from there will reveal whether rise from 18.13 is a corrective rebound, or the start of an up trend (the preferred case).

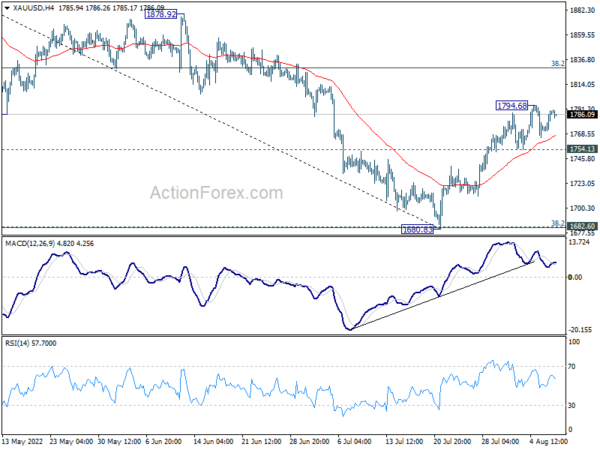

Gold is struggling in range for now, but further rally is expected as long as 1754.14 support holds. Break of 1794.68 will resume the rise from 1680.83 low. Key resistance level lies in 38.2% retracement of 2070.06 to 1680.83, which is close to 55 week EMA (now at 1826.89). Sustained break there will solidify the case that whole corrective pattern from 2074.84 has completed with three waves to 1680.83.

Looking ahead

The economic calendar is light today. US will release NFIB business optimism. US will release non-farm productivity and unit labor costs.

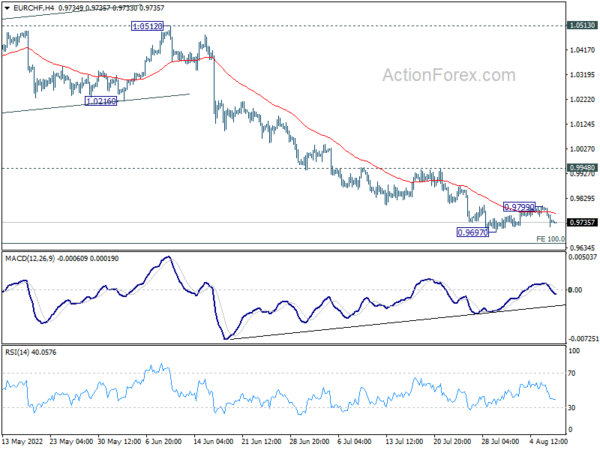

EUR/CHF Daily Outlook

Daily Pivots: (S1) 0.9705; (P) 0.9756; (R1) 0.9792; More….

EUR/CHF is staying in consolidation from 0.9697 and intraday bias remains neutral. Firm break of 0.9697 will resume larger down trend to 0.9650 long term projection level. Strong support could be seen there to bring rebound. On the upside, break of 0.9799 minor resistance will turn bias to the upside for stronger rise to 0.9948 resistance. However, firm break of 0.9650 will target 100% projection of 1.1149 to 0.9970 from 1.0513 at 0.9334.

In the bigger picture, long term down trend from 1.2004 (2018 high) is expected to target 100% projection of 1.2004 to 1.0505 to 1.1149 at 0.9650. Firm break there will target 138.2% projection at 0.9033. On the upside, break of 1.0513 resistance is needed to indicate medium term bottoming. Otherwise, outlook will stay bearish in case of strong rebound.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 23:50 | JPY | Money Supply M2+CD Y/Y Jul | 3.40% | 3.30% | 3.30% | |

| 01:30 | AUD | NAB Business Confidence Jul | 7 | 1 | ||

| 01:30 | AUD | NAB Business Conditions Jul | 20 | 13 | ||

| 06:00 | JPY | Machine Tool Orders Y/Y Jul P | 17.10% | |||

| 10:00 | USD | NFIB Business Optimism Index Jul | 89.5 | 89.5 | ||

| 12:30 | USD | Nonfarm Productivity Q2 P | -4.50% | -7.30% | ||

| 12:30 | USD | Unit Labor Costs Q2 P | 9.50% | 12.60% |