- McDonald’s (MCD) is due to release quarterly earnings on Tuesday before the open.

- MCD stock has outperformed in 2022 due to its defensive nature.

- S&P 500 is down 18% YTD, but McDonald’s stock is only down 5%.

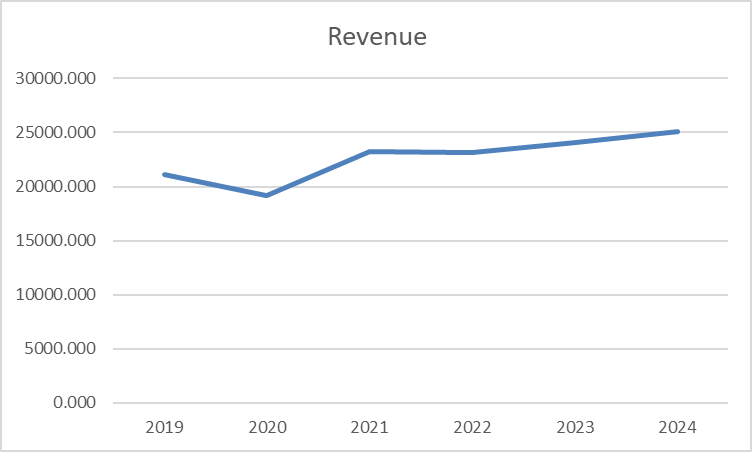

UPDATE: McDonald’s earnings came out better than expected on Tuesday morning, as the fast food restaurant chain printed 2.55 EPS, bigger than what Wall Street consensus was forecasting at 2.47. Revenue came out in the red, with $5.72 billion, which was below what the market was expecting at $5.81B, somewhat affected by the closing of restaurants in Russia and Ukraine over the ongoing war. McDonald’s CEO Chris Kempczinski said the economic environment is still “challenging” with inflation and the Ukraine war weighing on the company books. MCD stock is trading at $251.58 at the time of this update during pre-market, above Monday’s closing price of $250.38. The restaurant chain company has been a resilient stock year-to-date – having just lost 7% year-to-date versus the 17% loss by the S&P 500 – showing its defensive value against the current stock bear market.

McDonald’s (MCD) reports earnings before the open on Tuesday, and investors will be hungry to see if the recent outperformance can be maintained. Food stocks are generally defensive in nature during bear markets and recessions as food is a basic need. McDonald’s may operate as more of a restaurant chain and so does not fit into the defensive sphere, which usually includes food producers. However, due to its global reach and low-cost offering, McDonald’s has managed to perform well in past downturns.

McDonald’s earnings preview

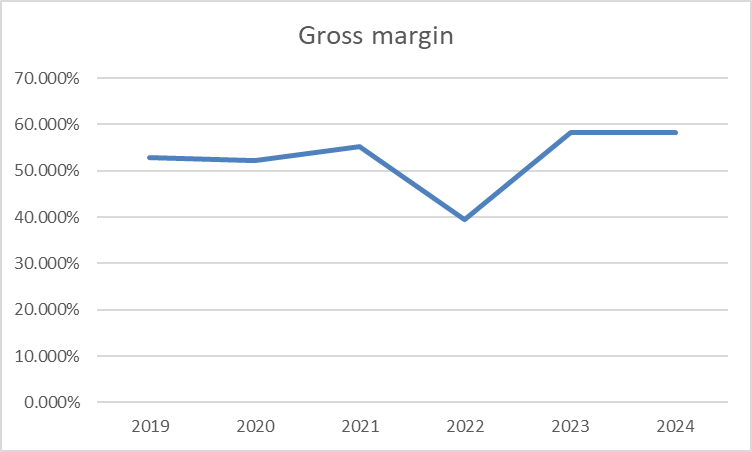

McDonald’s is expected to post earnings per share (EPS) of $2.47 and revenue of $5.82 billion. The company remains a low-cost operator within the restaurant space and runs a very financially controlled business. Revenue growth has been strong, and projections are for continued steady revenue growth despite the economic downturn. With margins taking a hit this year but due to return to high levels in 2023 and 2024, the company looks set for continued stability. This will be the key metric – maintaining those margins above 50%. This is high for the consumer sector and one of the reasons why the stock is so favored by investors. Dividend growth remains solid and the yield has been increasing, so look for some details on an increase here too.

Source: Refinitiv

McDonald’s (MCD) stock forecast

Margins are the key. How McDonald’s navigates the inflationary environment with rising labor costs as well as input costs is the key to its continued high-profit levels. In terms of technicals, the stock remains in a large sideways range in 2022. There is strong support in volume terms at $218, which is also the yearly low.

MCD stock, weekly

RULE-BASED Pocket Option Strategy That Actually Works | Live Trading

RULE-BASED Pocket Option Strategy That Actually Works | Live Trading This “NEW CONCEPT” Trading Strategy Prints Money!… (INSANE Results!)

This “NEW CONCEPT” Trading Strategy Prints Money!… (INSANE Results!)