Here is what you need to know on Friday, July 22:

Equity markets just about held the positive narrative on Thursday with Tesla leading the Nasdaq higher as it surged 8% on the back of positive earnings. However, after the bell things turned ugly as Snap (SNAP) showed that advertising never holds up well in a recession, and this will have a big negative read-across for Alphabet (GOOG) and Meta Platforms (META). Next week is a big one in the earnings space. So far earnings are probably slightly ahead of investors’ worst fears, which has helped the current rally. Already this morning though, futures are lower on the back of SNAP as investors now brace for tech earnings season.

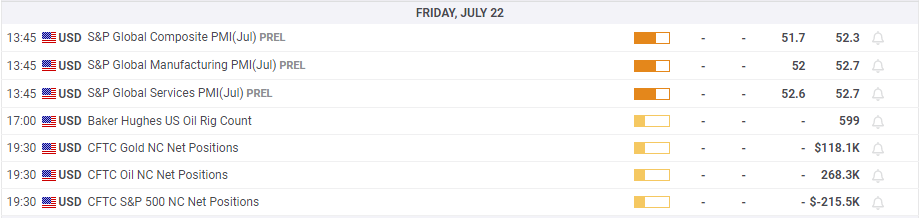

The macro environment remains challenging with jobless claims appearing to show the jobs market is indeed slowing and heading for a likely recession. That of course saw yields move lower across the curve, which has been pushing equities higher recently. Markets are pricing in a recession, but so far they are pricing in a mild one. The dollar index is higher at 107.04, and Bitcoin is also higher at $23,500. Gold is at $1,726, and oil is lower at $94.80.

European markets are higher: Eurostoxx +0.3%, FTSE flat, and Dax +0.3%.

US futures are mixed: S&P -0.3%, Dow flat, and Nasdaq -0.5%.

Wall Street top news (SPY) (QQQ)

GameStop (GME) down 74%! 4-for-1 share split is the cause, but some vendors have not updated their systems!

American Express (AXP) beats on top and bottom lines.

Verizon (VZ) misses EPS, revenue in line, and lowers guidance.

SNAP down 30% premarket.

Intuitive Surgical (ISRG) is down after earnings.

NextEra Energy (NEE) beats on top and bottom lines and raises dividends.

BJ Restaurant (BJRI) lower on profit miss.

Schlumberger (SLB) beats on top and bottom lines.

Novanta (NOVT) to enter S&P MidCap 400.

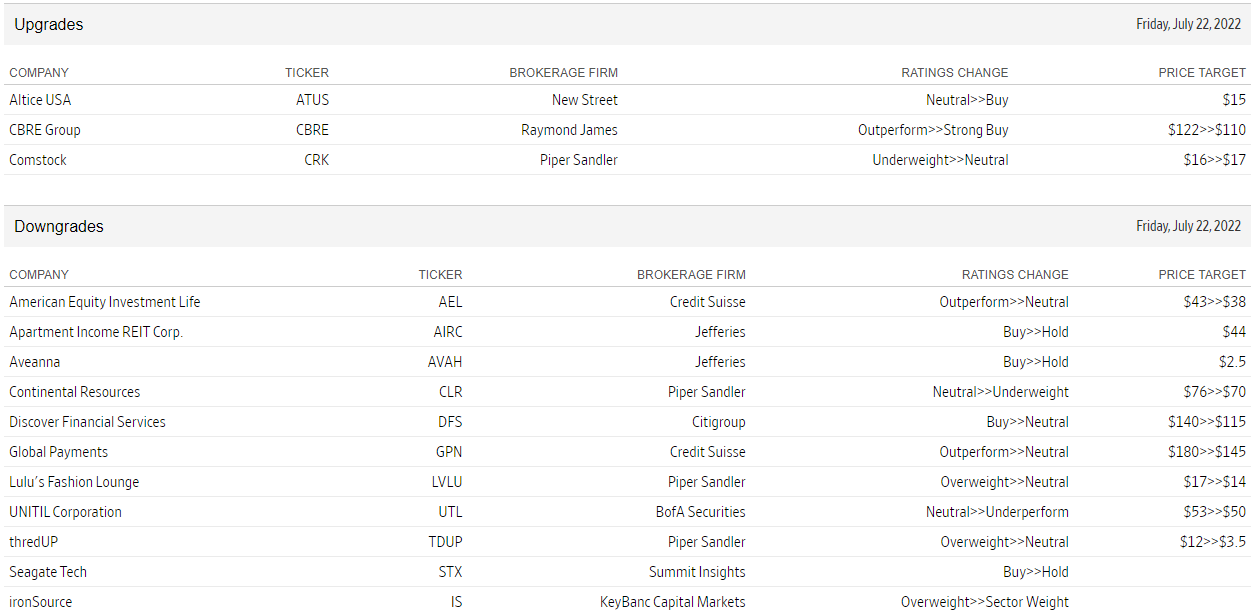

Upgrades and downgrades

Source: WSJ.com