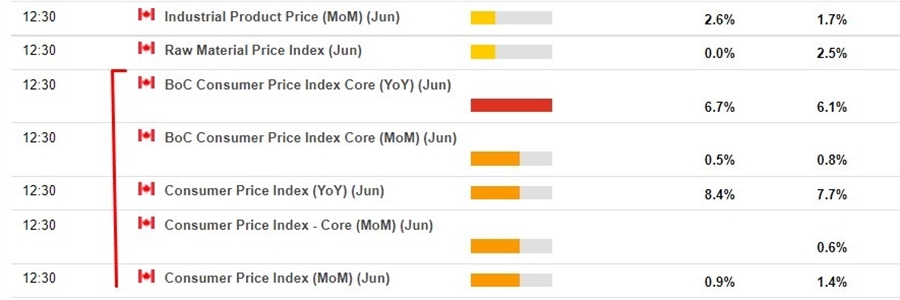

Changes in the CPI m/m are expected to be lower than those in June (both headline and core) according to consensus forecasts (see pic from the calendar below).

CIBC in Canada preview thoughts:

While recent pull backs in the prices of oil and some agricultural commodities should provide relief in the future, it will not be apparent in the June CPI data. There was a further increase in gasoline prices in the month relative to May, and with the long lag between changes in agricultural prices and food prices in stores, we are still living through the impact of past increases. But recent developments mean that we should start to see some relief in the months ahead.

Outside of food and energy, we expect CPI inflation to have grown slower on the month and to be roughly stable at an annual rate. Prices linked to the housing market, though still increasing, are not exerting as much upward pressure on CPI as they were just a few months ago.

- This snapshot from the ForexLive economic data calendar, access it here.

- The times in the left-most column are GMT.

- The numbers in the right-most column are the ‘prior’ (previous month) result. The number in the column next to that, where is a number, is the consensus median expected.