The forex markets are rather quiet in Asian session today, even though risk sentiment is positive. Most major pairs and crosses are staying inside Friday’s range, even though Yen is slightly stronger with Swiss Franc and Euro. Commodity currencies are generally soft, except Canadian, which is indeed trading notably higher against Aussie and Kiwi.

Technically, AUD/CAD looks set to resume medium term down trend from 0.9991 after multiple rejection by 55 day EMA. Deeper fall is expected as long as 0.9130 resistance holds. Main focus is indeed on 61.8% projection of 0.9991 to 0.8906 from 0.9514 at 0.8843. Sustained break there could prompt steeper selling and downside acceleration.

In Asia, at the time of writing, Nikkei is up 1.49%. Hong Kong HSI is up 2.18%. China Shanghai SSE is up 0.75%. Singapore Strait Times is up 0.49%. Japan 10-year JGB yield is up 0.0005 at 0.235.

BoJ opinions: Necessary to persistently continue with monetary easing

In the Summary of Opinions at the June 16-17 meeting, BoJ noted, “in order to achieve the price stability target, accompanied by wage increases, in a sustainable and stable manner, the Bank needs to conduct monetary easing while examining economic and financial developments, for which uncertainties have been extremely high.”

While price increases has “broadened”, “it cannot be said that the price stability target has been achieved amid a virtuous cycle.” Output gap remained “negative for more than two year”, Japan has not reached a situation to “accelerate a rise in wages”. It is “necessary to “persistently continue with monetary easing and thereby support the economy.”

There was no discussion on tweaking the 0.25% cap on 10-year JGB yield.

Hong Kong breaks April’s high on improving sentiment

Asian markets trade broadly higher today, following the strong rebound in US stocks on Friday. Hong Kong HSI is additionally lifted by news of easing pandemic restrictions in Shanghai. China’s industrial profit dropped -6.5% yoy in May, improved from April’s -8.5% yoy.

Technically, HSI breaks 22523.64 resistance (April’s high) to resume the rebound from 18235.48. Further rally is in favor as the index is moving away from 55 day EMA, with daily MACD back above signal line. Real test for the near term lies in 38.2% retracement of 31183.35 to 18235.48 at 23181.56. Sustained break there should confirm medium term bottoming and set the stage for stronger rebound to 61.8% retracement at 26237.26, even as a corrective move.

Some more CPI, consumer confidence and spending data

Focuses will stay on inflation and its impact on consumers globally. Data to watch include US consumer confidence, personal income and spending and PCE inflation,. Eurozone CPI flash, Germany Gfk consumer sentiment and retail sales, Japan and Australia retail sales could trigger some volatility. Also, Canada will release GDP and China will release PMIs. BoJ summary of opinions should maintain a dovish tone.

Here are some highlights for the week:

- Monday: BoJ summary of opinions. US durable goods orders, pending home sales.

- Tuesday: Germany Gfk consumer climate; US trade balance, house price index, consumer confidence.

- Wednesday: Japan retail sales, consumer confidence; Australia retail sales; Germany CPI flash; Swiss Credit Suisse economic expectations, Eurozone M3; US GDP final.

- Thursday: New Zealand ANZ business confidence; Japan industrial production, housing starts; China PMIs; Germany import prices, retail sales, unemployment; UK GDP final, current account; Swiss retail sales, KOF economic barometer; France consumer spending; Eurozone unemployment rate; Canada GDP; US jobless claims, personal income and spending, Chicago PMI.

- Friday: Australia AiG manufacturing index; New Zealand building permit; Japan Tokyo CPI, unemployment rate, Tankan survey, PMI manufacturing final; China Caixin PMI manufacturing; Swiss PMI manufacturing; Eurozone PMI manufacturing final, CPI flash; UK PMI manufacturing final; US ISM manufacturing, construction spending.

USD/CAD Daily Outlook

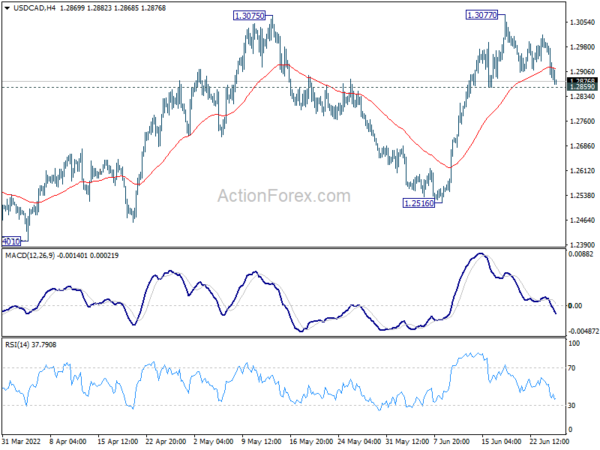

Daily Pivots: (S1) 1.2855; (P) 1.2931; (R1) 1.2973; More…

Intraday bias in USD/CAD remains neutral at this point, further rally is mildly in favor with 1.2859 support intact. On the upside, break of 1.3077 and sustained trading above 1.3022 fibonacci level will carry larger bullish implications. Next target is 100% projection of 1.2005 to 1.2947 from 1.2401 at 1.3343. However, break of 1.2859 minor support will turn bias back to the downside for 1.2516 support instead.

In the bigger picture, focus stays on 38.2% retracement of 1.4667 (2020 high) to 1.2005 (2021 low) at 1.3022. Sustained break there should confirm that the down trend from 1.4667 has completed after defending 1.2061 long term cluster support. Further rise would then be seen towards 61.8% retracement at 1.3650. However, rejection by 1.3022 will maintain medium term bearishness.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 23:50 | JPY | BoJ Summary of Opinions | ||||

| 12:30 | USD | Durable Goods Orders May | 0.10% | 0.50% | ||

| 12:30 | USD | Durable Goods Orders ex Transportation May | 0.40% | 0.40% | ||

| 14:00 | USD | Pending Home Sales M/M May | -3.50% | -3.90% |