Selloff in Yen and Swiss Franc is still the main theme today even though US and Germany benchmark yields are retreating slightly. Australia was only lifted very briefly by the larger than expected rate hike by RBA. Though, Aussie is maintaining gains against Kiwi, which is the worst performing one for the day. On the other hand, Dollar, Canadian, and Sterling are the stronger ones while Euro is mixed.

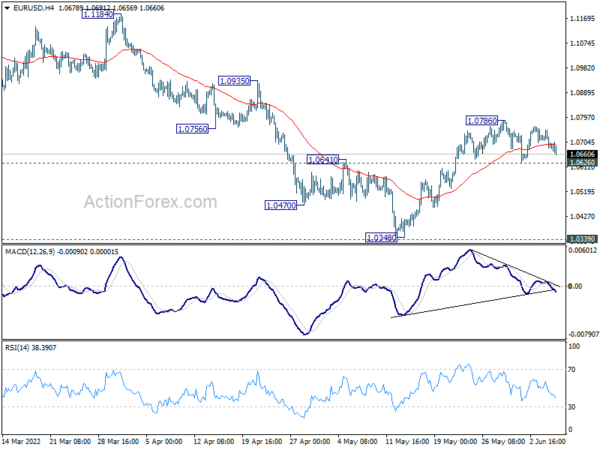

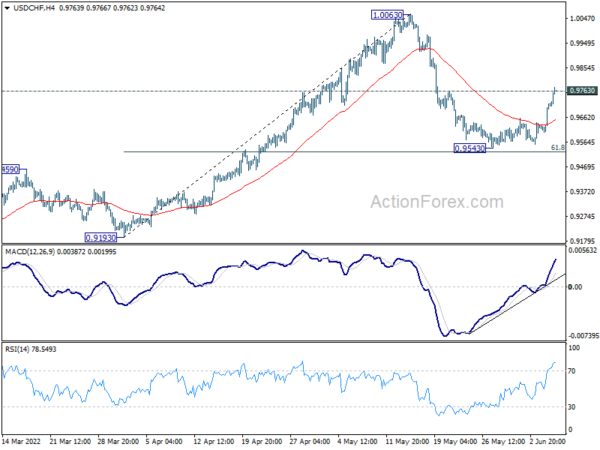

Technically, USD/CHF’s break of 0.9763 minor support argues that pull back from 1.0063 has completed. Stronger rebound would be seen back to retest this high. The question is whether the Franc’s weakness is its own, or it’s leading other European majors. Hence, eyes will be on 1.0626 minor support in EUR/USD and 1.2457 minor support in GBP/USD.

In Europe, at the time of writing, FTSE is down -0.24%. DAX is down -1.12%. CAC is down -1.07%. Germany 10-year yield is down -0.0081 at 1.315. Earlier in Asia, Nikkei rose 0.10%. Hong Kong HSI dropped -0.56%. China Shanghai SSE rose 0.17%. Singapore Strait Times rose 0.15%. Japan 10-year JGB yield rose 0.0043 to 0.250.

US exports of goods and services rose 3.5% mom in Apr, imports dropped -3.4% mom

US exports of goods and services rose 3.5% mom to USD 252.6B in April. Imports dropped -3.4% mom to USD 339.7B. Trade deficit narrowed from USD 107.7B to USD 87.1B, versus expectation of USD 89.3B.

In Q1, goods and services trade deficit with China increased USD 22.9B to USD 112.7B. The deficit with Canada increased USD 9.6B to USD 19.1B. The surplus with the United Kingdom increased USD 2.5B to USD 5.8B.

Eurozone Sentix investor confidence rose to -15.8, real economy is not suffering as quickly and as severely than expected

Eurozone Sentix Investor Confidence rose from -22.6 to -15.8 in June, above expectation of -20.0. Current Situation Index rose from -10.5 to -7.3. Expectations Index rose from -34.0 to -24.0.

Sentix said, “the real economy is not suffering as quickly and as severely from phenomena such as rising inflation and supply chain problems as one might have suspected.

“While consumers are already suffering much more from rising prices, many companies are still benefiting from inflation-related pull-forward effects. So far, many companies have also been able to pass on their sharply rising costs to their customers.

“But this is likely to be a finite phase. At a certain point, end consumers will have to cut back. Then, at the latest, the ability of companies to pass on their costs without restriction will also come to an end. In addition, there is a foresee-able change in monetary policy, which could also become more restrictive in the Eurozone from July.

“On the other hand, it should be positive that according to the sentix topic barometer the inflation peak should have been passed for the time being.”

From Germany, factory orders dropped -2.7% mom in April, worse than expectation of -0.5% mom. Swiss foreign currency reserves were unchanged at CHF 925B in May.

UK PMI services finalized at 53.4, worrying combination of slower growth and higher prices

UK PMI Services was finalized at 53.4 in May, down from April’s 58.9. That’s the weakest level since February 2021. PMI Composite was finalized at 53.1, down from April’s 58.2. S&P Global added that business activity expansions eased for the second month running. Input cost and prices charged inflation hit fresh record highs. Growth projections were lowest since October 2020.

Tim Moore, Economics Director at S&P Global Market Intelligence: “May data illustrate a worrying combination of slower growth and higher prices across the UK service sector. The latest round of input cost inflation was the steepest since this index began in July 1996, while the monthly loss of momentum for business activity expansion was a survey-record outside of lockdown periods.”

RBA hikes by 50bps to 0.85%, more normalization over the months ahead

RBA raises cash rate target by 50bps to 0.85% today, larger than expectation of 40bps. Interest rate on exchange settlement balances is also lifted by 50bps to 75bps. The central bank also maintains tightening bias, as “the Board expects to take further steps in the process of normalizing monetary conditions in Australia over the months ahead.”

In the accompanying statement, RBA said inflation in Australia has “increased significantly”, and is “expected to increase further”, before declining back towards the 2-3% target range next year. The economy is “resilient” while labour market is “strong”.

One source of uncertainty is “how household spending evolves”, given the “increasing pressure” from higher inflation, and interest rates. The central scenario is for strong household consumption growth this year, but RBA will pay close attention to various influences on consumption.

Australia AiG services dropped to 49.2, back in mild contraction

Australia AiG Performance and Services Index dropped sharply from 57.8 to 49.2 in May, indicating mild contraction. Sales dropped -13.0 pts to 50.7. Employment dropped -10.4 to 47.4. New orders dropped -3.3 to 49.7. Input prices dropped -9.1 o 68.7. Selling prices dropped -3.6 to 61.9. Average wages dropped -9.8 to 57.4.

Innes Willox, Chief Executive of Ai Group, said: “The Australian services sector contracted mildly in May after a period of healthy expansion in the earlier months of 2022. Performance was mixed across the sector with strong growth in logistics, retail trade and personal, recreational & other services offset by sharp declines in business & property services and health & education services.”

USD/CHF Mid-Day Outlook

Daily Pivots: (S1) 0.9637; (P) 0.9675; (R1) 0.9745; More…

US/CHF’s breach of 0.9763 minor resistance suggests that pull back from 1.0063 has completed at 0.9854 already, ahead of 61.8% retracement of 0.9193 to 1.0063 at 0.9525. Intraday bias is back on the upside for retesting 1.0063 resistance first. Firm break there will resume larger up trend. In case of another fall, strong support is still expected from 0.9525 to bring rebound.

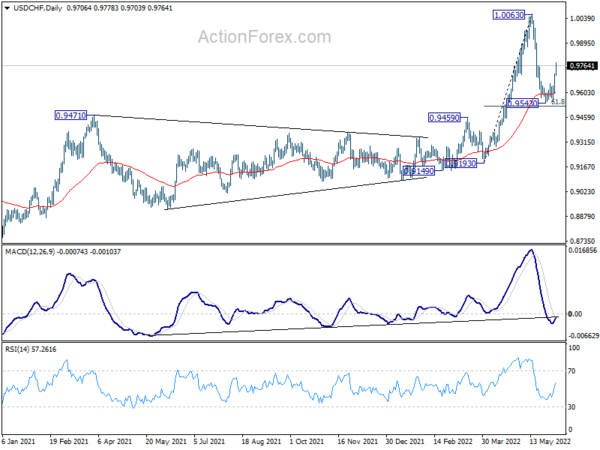

In the bigger picture, down trend from 1.0342 (2016 high) should have completed with three waves down to 0.8756 (2021 low) already. Rise from 0.8756 is likely a medium term up trend of its own. Next target is 1.0237/0342 resistance zone. This will remain the favored case as long as 0.9471 resistance turned support holds. However, sustained break of 0.9471 will extend long term range trading with another falling leg.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 22:30 | AUD | AiG Performance of Services Index May | 49.2 | 57.8 | ||

| 23:01 | GBP | BRC Like-For-Like Retail Sales Y/Y May | -1.50% | -1.70% | ||

| 23:30 | JPY | Labor Cash Earnings Y/Y Apr | 1.70% | 1.50% | 1.20% | |

| 23:30 | JPY | Overall Household Spending Y/Y Apr | -1.70% | -1.00% | -2.30% | |

| 04:30 | AUD | RBA Interest Rate Decision | 0.85% | 0.75% | 0.35% | |

| 05:00 | JPY | Leading Economic Index Apr P | 102.9 | 102.3 | 100.8 | |

| 06:00 | EUR | Germany Factory Orders M/M Apr | -2.70% | -0.50% | -4.70% | -4.20% |

| 07:00 | CHF | Foreign Currency Reserves (CHF) May | 925B | 926B | 925B | |

| 08:30 | EUR | Eurozone Sentix Investor Confidence Jun | -15.8 | -20 | -22.6 | |

| 08:30 | GBP | Services PMI May F | 53.4 | 51.8 | 51.8 | |

| 12:30 | USD | Trade Balance (USD) Apr | -87.1B | -89.3B | -109.8B | -107.7B |

| 12:30 | CAD | Trade Balance (CAD) Apr | 1.5B | 1.9B | 2.5B | 2.3B |

| 14:00 | CAD | Ivey PMI May | 64.3 | 66.3 |