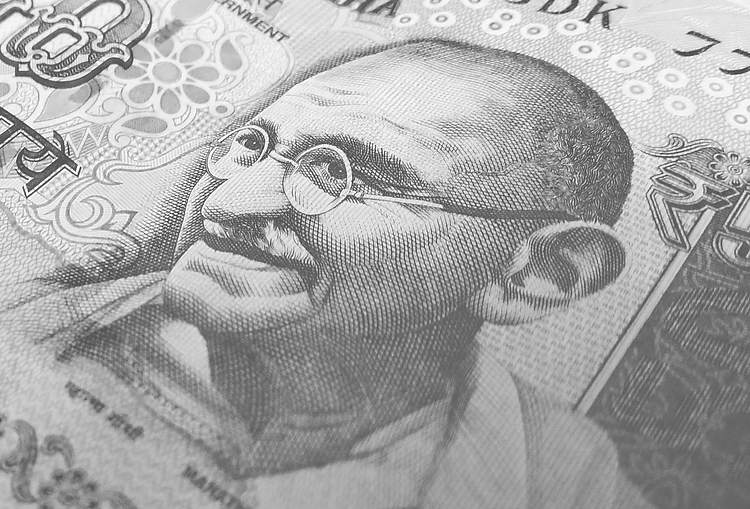

The USD/INR is about to end the week modestly lower, pulling back from record levels. The chart shows the primary trend is bullish and strong. According to analysts at Wells Fargo, the rupee will continue to decline versus the US dollar, at a gradual pace.

Key Quotes:

“The Indian rupee recently hit an all-time record low against the dollar, and going forward, we expect the currency to continue making new lows against the greenback. We believe the rupee will continue to weaken as the Reserve Bank of India (RBI) is likely behind the curve in tightening monetary policy.”

“While we forecast the RBI to lift interest rates again in June, we doubt RBI policymakers will be able to keep pace with the Federal Reserve.”

“As the Fed raises interest rates and shrinks its balance sheet, the U.S. dollar should rally against most emerging market currencies, including the rupee.”

“While we expect the rupee to consistently hit new lows, we believe the pace of depreciation will be gradual in nature. The RBI maintains a hefty stockpile of foreign exchange reserves and uses these asset buffers to limit rupee volatility. Recently, RBI FX intervention contained currency volatility, and going forward, we expect intervention efforts to continue to keep rupee depreciation orderly.”