GBP/USD Weekly Forecast: Will the recovery sustain above 21 DMA?

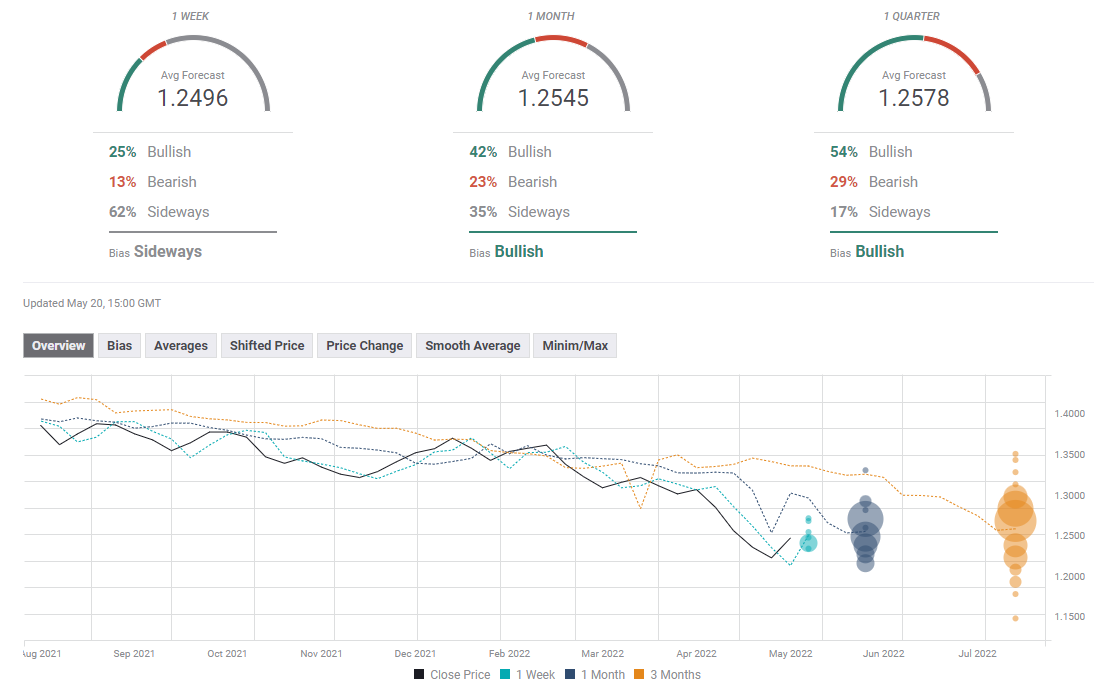

Bulls were finally rescued, as GBP/USD stalled its four-week downtrend and rebounded firmly from two-year lows of 1.2155 reached a week ago. A temporary bottom seemed in place, with the 400+ pips recovery, as the US dollar embarked on an overdue correction. The currency pair then flirted with the 1.2500 threshold ahead of BOE Governor Andrew Bailey’s appearance and critical US data. Read more…

GBP/USD holds onto weekly gains, near 1.2500

The GBP/USD is moving sideways on Friday, consolidating slightly below 1.2500. The pair remained steady even as stocks in Wall Street turned negative. Risk aversion is offering no boost to the dollar. The pound is rising versus the US dollar for the first time in five weeks as it recovers from the lowest level in almost two years and following a 900 pips slide. The main trend is still bearish for GBP/USD. The pair moved off YTD lows giving signs of an interim bottom. The recovery appears to have room to go, particularly is financial tensions across global markets ease. Read more…

Pound yawns on mixed Retail Sales

UK retail sales showed a strong gain in April, with a gain of 1.4% MoM. This followed a decline of 1.2% in March. However, on a yearly basis, sales volumes were 4.9% lower, as the broader picture looks grim. The monthly gain for March may have been a blip, as consumers were hit with higher household energy costs as well as an increase in taxes. Add into the mix inflation at 9.0% and possibly heading into double-digits, and it’s difficult to envision retail sales moving higher. Read more…