As initial reactions to higher than expected headline and core CPI readings, Dollar is trying to resume its near term advance, which stocks futures are paring gains. The question is how sustainable the rally could be. Euro was rather indifferent to hawkish comments from ECB officials, who continued to talk up the chance of a July ECB hike.

So far, Dollar, Yen and Euro are still the strongest ones for the week. Commodity currencies are the worst performers. The trend will likely continue for a while after US inflation data. Still, Dollar traders will need to make up their mind on whether to bid the greenback up against Euro and Yen. Technically, the levels to watch remain 1.0470 support in EUR/USD and 131.34 resistance in USD/JPY.

In Europe, at the time of writing, FTSE is up 0.28%. DAX is up 0.34%. CAC is up 0.91%. Germany 10-year yield is up 0.077 at 1.083. Earlier in Asia, Nikkei rose 0.18%. Hong Kong HSI rose 0.97%. China Shanghai SSE rose 0.75%. Singapore Strait Times rose 0.75%. Japan 10-year JGB yield rose 0.0004 to 0.248.

US CPI slowed to 8.3% yoy, core CPI down to 6.2% yoy, but food index surged

US headline CPI rose 0.3% mom in April, above expectation of 0.2% mom. CPI core rose 0.6% mom, above expectation of 0.4% mom. Food index rose 0.9% mom. Energy index declined -2.8% mom.

Over the 12-month period, headline CPI slowed from 8.5% yoy to 8.3% yoy, but beat expectation of 8.1% yoy. CPI core slowed from 6.5% yoy to 6.2% yoy, also beat expectation of 6.0% yoy. Food index rose 9.4% yoy, highest since April 1981. Energy index rose 30.3% yoy.

ECB Lagarde: First hike could come only few weeks after early Q3

ECB President Christine Lagarde indicated in a speech that the asset purchases could end “early” in Q3, and interest rate hikes could start “only a few weeks” after that.

“We will end net purchases under the asset purchase programme. Judging by the incoming data, my expectation is that they should be concluded early in the third quarter,” she said.

“The first rate hike, informed by the ECB’s forward guidance on the interest rates, will take place some time after the end of net asset purchases,” she reiterated.

“We have not yet precisely defined the notion of ‘some time’, but I have been very clear that this could mean a period of only a few weeks. After the first rate hike, the normalisation process will be gradual,” she added.

ECB Muller: We may get to positive rate by end of the year

ECB Governing Council member Madis Müller said the central bank could already outline its interest rate expectations for the coming months at the June meeting. He added that the first step is to end asset purchases in early July, but “we could even discuss if we should end purchases a few weeks earlier.”

“The real issue is interest rate increases and we shouldn’t have much of a delay there either,” Müller added. “The recent data confirm that the monetary policy stance is not appropriate given where inflation is and given inflation expectations,”

“Even if we go by 25 basis point increments, we may get to a positive rate by the end of the year. For the time being, 25 basis points would be an appropriate increment.”

Separately, another Governing Council member Francois Villeroy de Galhau told France Inter radio today, “I think that from this summer onwards, the ECB will gradually raise its interest rates.” The Ukraine war provided a “negative shock” for the French economy. He added, “inflation is the principal concern of companies and citizens.”

Another Governing Council member Bostjan Vasle said, “what started as a one-off shock has now become a more broad-based phenomenon. When the circumstances change, the policy response must follow.”

Australia Westpac consumer sentiment dropped to 90.4 in May, lowest since Aug 2020

Australia Westpac-MI consumer sentiment index dropped from 95.8 to 90.4 in May. That’s the lowest level since August 2020. The reading was also -8.4% below the average seen in 2019. The -5.6% decline was the largest since the -6.9% fall in June 2016.

Looking at some details, family finances for the next 12 months dropped from 105.1 to 93.3. Economic conditions for the next 12 months dropped from 95.9 to 90.4. Unemployment expectations rose from 99.2 to 109.6.

Westpac said two “stunning developments are clearly unnerving consumers”. Firstly, headline inflation surged above 5% for the first time since 2007. Secondly, RBA raised interest rate for the first time since 2010.

Regarding RBA policies, Westpac said “having now begun its tightening cycle the Board is almost certain to follow up the move in May with a further move in June”. It added, “the need to avoid an over-shoot later in the cycle is why, despite this disturbing tumble in Consumer Sentiment, we believe the prudent approach in June would be to lift rates by 40bps rather than the 25 bps that is currently favoured by most analysts.

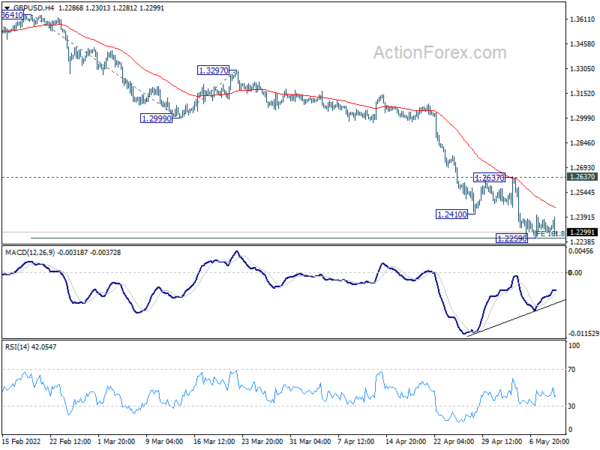

GBP/USD Mid-Day Outlook

Daily Pivots: (S1) 1.2280; (P) 1.2327; (R1) 1.2363; More…

GBP/USD is still bounded in right range above 1.2259 temporary low. Intraday bias remains neutral and some more consolidations could still be seen. In case of another recovery, upside should be limited by 1.2637 resistance to bring fall resumption. On the downside, firm break of 161.8% projection of 1.3641 to 1.2999 from 1.3297 at 1.2258 will extend recent down trend to 200% projection at 1.2013 next.

In the bigger picture, based on current momentum, fall from 1.4248 (2018 high) at least at the same degree as the rise form 1.1409 (2020 low). That is, fall from 1.4248 could be a leg inside the pattern from 1.1409, or resuming the longer term down trend. In either case, deeper decline is expected as long as 1.2999 support turned resistance holds. Next target is 1.1409 low.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 00:30 | AUD | Westpac Consumer Confidence May | -5.60% | -0.90% | ||

| 01:30 | CNY | CPI Y/Y Apr | 2.10% | 1.90% | 1.50% | |

| 01:30 | CNY | PPI Y/Y Apr | 8.00% | 7.80% | 8.30% | |

| 05:00 | JPY | Leading Economic Index Mar P | 101 | 100.4 | 100 | |

| 06:00 | EUR | Germany CPI M/M Apr F | 0.80% | 0.80% | 0.80% | |

| 06:00 | EUR | Germany CPI Y/Y Apr F | 7.40% | 7.40% | 7.40% | |

| 12:30 | USD | CPI M/M Apr | 0.30% | 0.20% | 1.20% | |

| 12:30 | USD | CPI Y/Y Apr | 8.30% | 8.10% | 8.50% | |

| 12:30 | USD | CPI Core M/M Apr | 0.60% | 0.40% | 0.30% | |

| 12:30 | USD | CPI Core Y/Y Apr | 6.20% | 6.00% | 6.50% | |

| 14:30 | USD | Crude Oil Inventories | -1.0M | 1.3M |