The major US stock indices are rebounding higher after yesterday’s sharp declines. A snapshot of the major indices 12 minutes into the opening is showing:

- Dow industrial average up 383 points or 1.19% at 32629.33

- S&P index up 55.92 points or 1.4% at 4047.15

- NASDAQ index up 205.8 points or 1.77% at 11829.05

- Russell 2000 up 21.77 points or 1.24% at 1783.85

The market is getting a boost from the reversal back lower in yields, short covering, and thoughts that lower stocks will slow growth and also slow central bank policy going forward.

Fed chatter today is still focused on getting to the neutral rate. The question is does the decline in asset values give policymakers cause for pause after reaching those levels? That could slow the declines in anticipation of a lower terminal rate (than expected yesterday or last week), but there is still a lot of uncertainty which is likely to lead to caution in equity markets.

Also helping today’s market is respected investor David Tepper told CNBCs Cramer that he was covering his NASDAQ shorts and that the selling may be over.

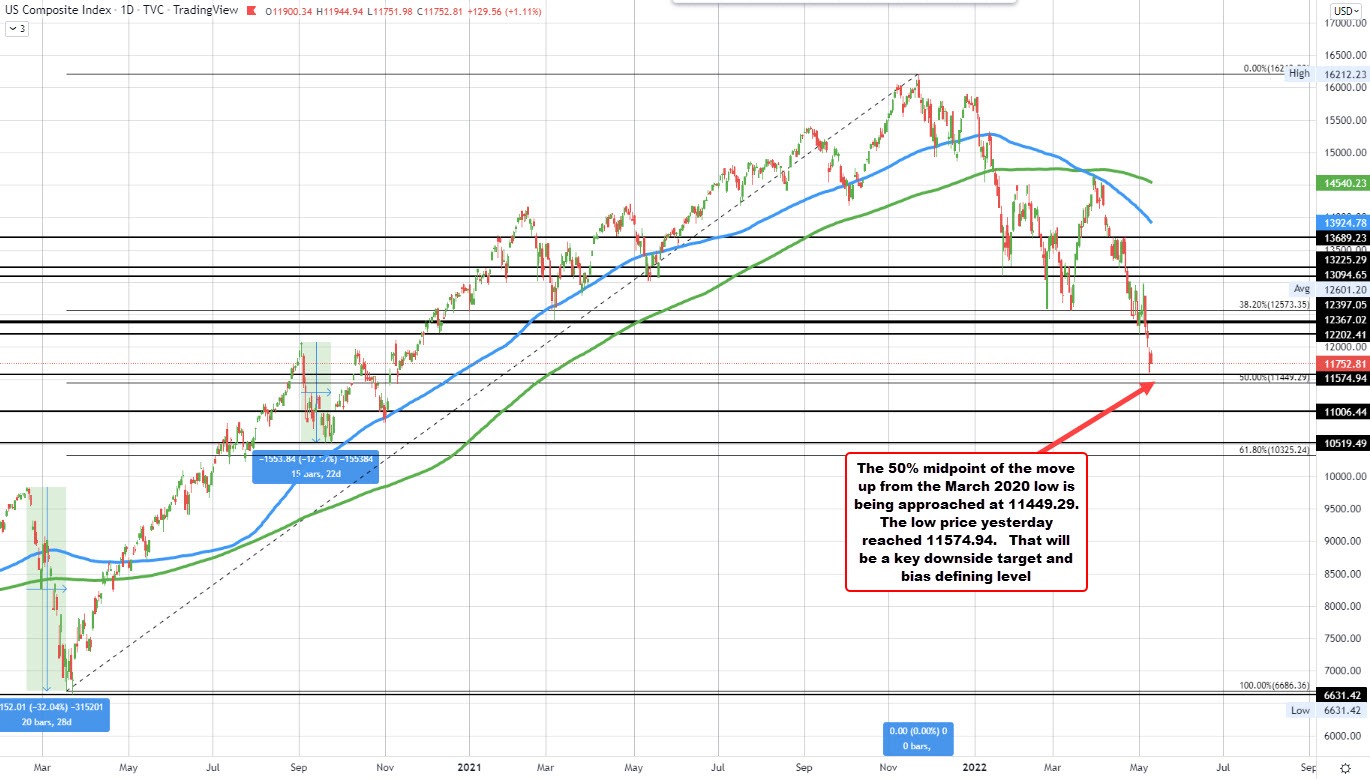

Technically, looking at the NASDAQ daily chart below, the 50% midpoint of the move up from the March 2020 low comes in at 11449.29. Yesterday the low price reached 11574.94 within shouting distance of that key target level. Traders – like Tepper – may be looking toward that midpoint level as a low risk buying/profit taking level to lean against. The buying can also turn to sellers on a break below. However, there should be some cause for pause against that target on the test.

PS. A move to the 50% would imply a near 29.5% decline from the high. That is near a nice round 30% decline which is pretty significant. Looking back to the sharp move down in the early days of the pandemic, the price fell -32.04% before bouncing back higher and starting its run to the upside that culminated in the all-time high print at 16212.23.