The price of WTI crude oil futures for June settlement are up $0.14 at $102.19.

The May contract which goes off the board today settled at $102.75 up $0.19 or 0.19%.

The price action was up and down choppy today. The weekly inventory data showed a much higher-than-expected drawdown of -8.02 million barrels. The expectations was for a 2.471 million barrel increase.

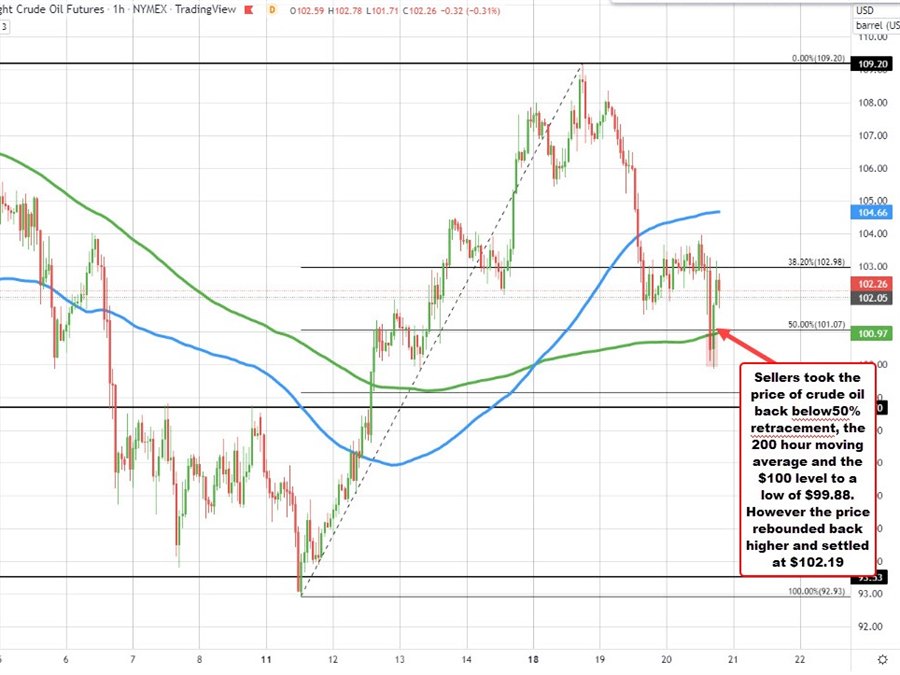

Despite the sharp drawdown, the price of of crude oil saw selling which took the price back below its 50% retracement of the move up from the April 12 low (at $101.07), and the 200 hour moving average currently at $100.97.

The price also cracked below the $100 level but stalled the fall at $99.88 before rebounding into the settlement.

The contract trades near the middle of the 100 hour moving average above at $104.66, and the rising 200 hour moving average below at $100.97 (which is near the 50% midpoint at $101.07). The good news for buyers is that the price decline could not sustain momentum below the 50% and 200 hour moving average.

Other positive news for crude oil includes

- Shanghai lockdowns are starting to be eased.

- Russian production declined by 7.5% in the first half of April from March,

- EU governments said last week the bloc’s executive was drafting proposals to ban Russian crude.

- In Libya, protests are forcing plant closures, leading to force majeure on delivery condeliveries, and in that impact production by 500,000 barrels per day .