A snippet from a recent note from BoA:

- Different set of priorities China’s growth profile has been dwindling down for close to a year on account of the relentless onslaught of credit and regulatory tightening across sectors.

- Ever since we lowered our view to neutral in Nov-2020, we have advised against adding exposure to China stocks based on our belief that its pursuit of common prosperity and nation rejuvenation goals could come in the way of profit maximization and equity markets.

Before taking a quick peek at the positives it should be noted that the ‘zero’ COVID-19 policy in China that has seen Shngahi locked down for nearly a month (although its being eased a little now) is also not a positive for China’s economy (nor global supply chains, but that’s another story).

OK, so on the other hand we are seeing small monetary policy support from the People’s Bank of China (very small, but I suspect there may be more to come):

And, there is ongoing fiscal support also. For equities, valuations are subdued.

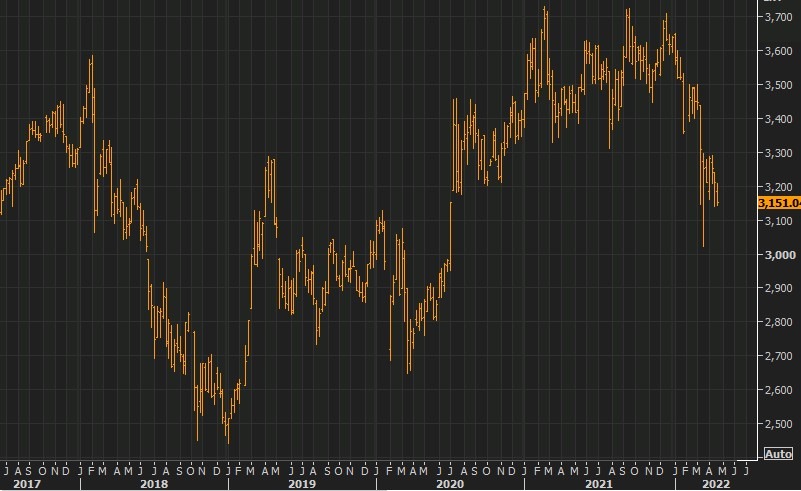

Shanghai Comp – weekly bars:

This article was originally published by Forexlive.com. Read the original article here.