The NASDAQ index is trading up around 232 points or 1.75% at 13565. The high price reached 13608.25. The low price was down to 13281.22.

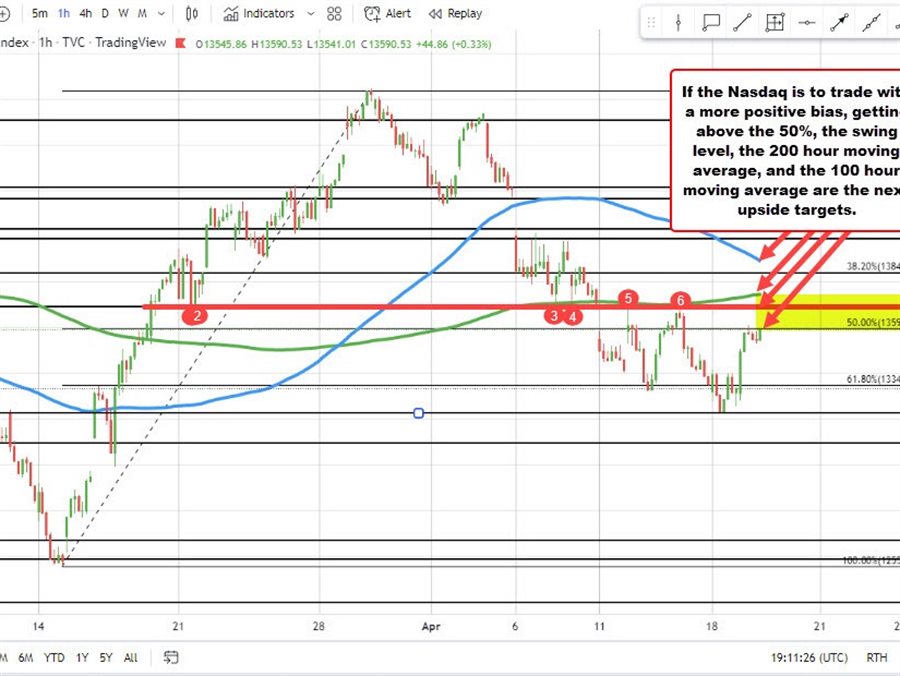

Looking at the hourly chart, the most recent cycle low was on March 15 at 12555.35. The price moved up 14634.22 on March 29. Since then, the price has rotated to the downside with the pair reaching a low at 13225.29 during trading yesterday.

The move to the upside today has seen the price move up to retest its 50% midpoint of the range since the March 15 low. That level comes in at 13594.78. If the price can get above that level traders will then look toward the swing lows/highs near 13689.23 followed by the now rising 200 hour moving average at 13744.23.

Getting above the 50% retracement, the swing level at 13689.23 (see red numbered circles) and the 200 hour moving average are the steps needed to give the bias more of a positive/bullish boost. The 100 hour moving average at 13892.24 would also need to be broken to increase the bullish bias. The last time the price traded above that level was on April 5.

After the close, Netflix earnings will be released. The price of the media company is down nearly 42% from the end of year level, and trades near start of the Covid levels from March 2020. The high price reached $700.05 on November 17. The current price today is up $13.29 or 3.64% at $350. That’s half of the $700 high price back in November. Ouch.

The expectations are for net subscriber additions of 2.5 million. Earnings per share are expected at $2.89 with revenues of a $7.93 billion

Q2 earnings-per-share guidance are expected at around $3.01 and for the fiscal year at $10.98. The revenue guidance for Q2 is expected at a $0.2 billion with the revenue guidance for the fiscal year of 2022 expected at $33.34 billion and four 2023 at $37.47 billion.

As I type, the NASDAQ has moved to a new session high of 13625.93. And has moved back above the 50% retracement level at 13594.78.