Although the US markets were open, Canada was mostly closed as was Europe. So in essence it was a semi-holiday in the markets today by virtue the fact that a good bit of the large traders were off.

Nevertheless, there were some moves and stories.

- Ukraine remains a hotbed and helped contribute to oil prices moving higher. There was also issues in Libya as they said that it could not make deliveries from its Zueitina terminal or the Sharara oil field. WTI crude oil settled $1.26 higher at $108.21 per barrel. Natural gas meanwhile rose above $8.00 (high reached $8.18) on cold weather expectations and increased demand out of Europe. The price has since moved back below the $8 level at $7.82. The spike higher was the highest level since October 2008

- The US 10 year yield reached another cycle high and traded at the highest level since December 2018. The yield reached 2.884% before rotating back down. The current yield is at 2.855%. Looking at the other yields on the curve, the two year yield is trading down one basis point. The five year is up about 0.9 basis points, while the 10 year is up 2.6 basis points

- US stocks had an up and down trading session, and closed with modest declines. The S&P was unchanged on the day. The Dow industrial average fell -0.11% and the NASDAQ index fell -0.14%

- the price of gold moved higher into the New York session reaching a high just under the $2000 level at $1998.39. However the price started to rotate down in the US session as markets calmed down a bit and the price is trading near the low for the day at $1977. The low for the day reached $1971.22

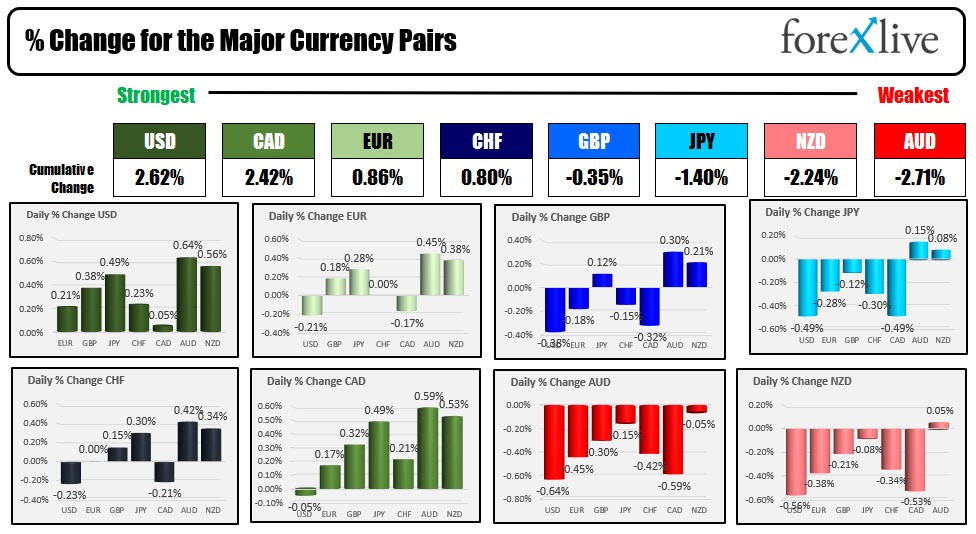

In the forex market, the USD and CAD are closing as the strongest of the majors, while the AUD and NZD are battling it out for the weakest of the majors.

- USDJPY: The USDJPY traded to yet another cycle high and 20 year high in the process. The Friday high reached 126.67. The Asian session high moved to 126.784. The New York session has extended to 126.977. The price remains well above its 100 hour moving average at 126.04 and moving higher. In the new trading day, moving back below the low from Friday at 126.67 could see some selling on the disappointment. However it ultimately would take a move below the 100 hour moving average to tilt the bias more comfortably in the favor of selling as the market continues to trend in that currency pair.

- EURUSD. The EURUSD moved to a low of 107.69 in the US session. That low took the price between a swing area on the daily chart going back to 2020 between 1.0764 and 1.0777. The current price is trading at 1.0780. In the new trading day if the price moved below 1.07642 and then the swing low from last week at 1.07568, it would open the door for more selling to the downside. On the topside traders will watch the 1.0805 level. That was the swing low going back to March 7. On Thursday last week, the price moved below that level after the more dovish ECB statement and press conference. However, the price did bounce into the close on that day (and back above the 1.0805 level). After trading above and below the 1.0805 level into the New York session today, the sellers started to take more control and pushed price lower away from the level. On a move above 1.0805, the falling 100 hour moving average at 1.08285 would be another key target to get above and stay above if the buyers are to take more control

- USDCAD: The USDCAD moved higher in the Asian session into resistance between 1.26396 and 1.26452. Then in the New York session, the price moved lower and retested the 100 hour moving average 1.2606. The prices trading right around that level is the day comes to an end. The move lower today moved back below the 200 day moving average at 1.25239. That moving average will be close resistance in the new trading day. A move below the 100 hour moving average 1.2606 followed by a move below the 200 hour moving average 1.25980 should open up the door for further downside momentum in the USDCAD pair.

- AUDUSD: The AUDUSD fell in the Asian session but found some support buying near the 61.8% retracement of the move up from the March 15 low. That level comes in at 0.73536. The corrective high took the price back to 0.7378 which was near the high of a swing area between 0.73675 at 0.73799. Sellers returned and in the US session the price move below the 61.8% retracement and is closing at 0.73457. The move below that retracement level should give the sellers more confidence to push lower in the new day. The 200 day moving average at 0.72933 is the next major target on the downside.

.

This article was originally published by Forexlive.com. Read the original article here.