Dollar dropped notably overnight together with pull back in benchmark treasury yield. The selling of the greenback continued in Asian session today. Even the weak Yen is recovering against Dollar, but it’s still, for now, the worst performing one for the week. On the other hand, European majors are making a comeback, with Sterling leading Euro and Swiss Franc higher. Commodity currencies are mixed for now.

Technically, Euro will be the main focus for today. For EUR/USD break of 1.0937 will bring stronger recovery, possibly towards 1.1184 resistance. Break of 0.8379 in EUR/GBP will bring stronger rebound back to 0.8511 resistance. Meanwhile, break of 137.49 resistance in EUR/JPY will resume larger up trend.

In Asia, Nikkei closed up 1.22%. Hong Kong HSI is up 0.92%. China Shanghai SSE is up 1.53%. Singapore Strait Times is down -0.04%. Japan 10-year JGB yield is down -0.0012 at 0.239. Overnight, DOW rose 1.01%. S&p 500 rose 1.12%. NASDAQ rose 2.03%. 10-year yield dropped -0.038 to 2.687.

Fed Waller: It’s a good time to do aggressive actions

Federal Reserve Governor Christopher Waller said in a CNBC interview that preferred a “front-loading approach” on tightening. So, “a 50-basis-point hike in May would be consistent with that, and possibly more in June and July.”

“I think we’re going to deal with inflation. We’ve laid out our plans,” he said. “We’re in a position where the economy’s strong, so this is a good time to do aggressive actions because the economy can take it.”

“I think we want to get above neutral certainly by the latter half of the year, and we need to get closer to neutral as soon as possible,” Waller added.

Australia employment rose 17.9k in Mar, unemployment rate unchanged at 4%

Australia employment grew 17.9k in March, below expectation of 30.0k. Full-time jobs rose 20.5k while part-time jobs dropped -2.7k. Unemployment rate was unchanged at 4.0%, above expectation of 3.9%. Participation rate was unchanged at 66.4%. Monthly hours worked dropped -0.6% mom.

Bjorn Jarvis, head of labour statistics at the ABS, said: “With employment increasing by 18,000 people and unemployment falling by 12,000, the unemployment rate decreased slightly in March, though remained at 4.0 per cent in rounded terms.

“4.0 per cent is the lowest the unemployment rate has been in the monthly survey. Lower rates were seen in the series before November 1974, when the survey was quarterly.”

New Zealand BNZ manufacturing rose to 53.8

New Zealand BNZ Performance of Manufacturing Index rose slightly from 53.6 to 53.8 in March. Production dropped from 51.7 to 50.9. Employment rose from 52.0 to 52.4. New orders rose from 58.6 to 61.0. Finished stocks rose from 50.2 to 53.5. Deliveries dropped from 53.1 to 51.9.

BNZ Senior Economist, Doug Steel stated that “Omicron’s impact may not be as harsh as the first 2020 COVID lockdown or last year’s Delta lockdown, but it’s there. Production has struggled, with the index slipping to 50.9 in March and a bit further below its long-term average.”

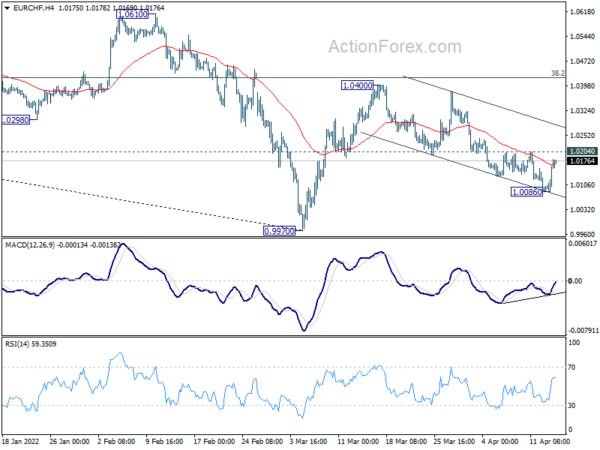

ECB to turn more hawkish, EUR/CHF recovering

ECB is widely expected to keep monetary policy unchanged today. But with inflation at a record high of 7.5%, the central bank is also expected to sing a more hawkish tune. There should be an announcement to put a firm end date to the asset purchase program. Interest rate hike will only come “some time” after ending the purchases.

There are talks that putting an end date to asset purchases in June would open up the possibility of a rate hike in September, followed by another in December. But President Christine Lagarde will certainly continue to sound non-committal, but emphasize the importance of graduality, optionality and flexibility for the policy path ahead.

Here are some previews on ECB:

EUR/CHF’s reaction to ECB decision and press conference is worth some attention. So far, the decline from 1.0400 is not impulsive looking. The cross has also started to lose downside momentum as seen in 4 hour MACD. A break above 1.0204 minor resistance today will suggest that such pull back is finished. More importantly, in this case, rebound from 0.9970 is likely ready to resume through 1.0400. That, if happens, could give Euro a helping hand elsewhere.

On the data front

US data is on the spotlight today, with retail sales, jobless claims, import price, U of Michigan consumer sentiment and business sentiment featured. Canada will release manufacturing sales and wholesale sales.

EUR/USD Daily Outlook

Daily Pivots: (S1) 1.0836; (P) 1.0865 (R1) 1.0921; More…

Intraday bias in EUR/USD remains neutral for the moment. On the upside, break of 1.0937 minor resistance will extend the consolidation pattern from 1.0805 with another rising leg. Intraday bias will be back on the upside for stronger rebound. But overall outlook will stay bearish as long as 1.1184 resistance holds. On the downside, sustained break of 1.0805 low will resume larger down trend to 61.8% projection of 1.1494 to 1.0805 from 1.1184 at 1.0758, and then 100% projection at 1.0495.

In the bigger picture, the decline from 1.2348 (2021 high) is expected to continue as long as 1.1494 resistance holds. Firm break of 1.0635 (2020 low) will raise the chance of long term down trend resumption and target a retest on 1.0339 (2017 low) next. Nevertheless, break of 1.1494 will maintain medium term neutral outlook, and extending term range trading first.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 21:30 | NZD | BusinessNZ Manufacturing Index Mar | 53.8 | 53.6 | ||

| 23:01 | GBP | RICS Housing Price Balance Mar | 74% | 78% | 79% | |

| 01:00 | AUD | Consumer Inflation Expectations Apr | 5.20% | 4.90% | ||

| 01:30 | AUD | Employment Change Mar | 17.9K | 30.0K | 77.4K | |

| 01:30 | AUD | Unemployment Rate Mar | 4.00% | 3.90% | 4.00% | |

| 06:30 | CHF | Producer and Import Prices M/M Mar | 0.80% | 0.00% | 0.40% | |

| 06:30 | CHF | Producer and Import Prices Y/Y Mar | 6.10% | 4.90% | 5.80% | |

| 11:45 | EUR | ECB Interest Rate Decision | 0.00% | 0.00% | ||

| 12:30 | EUR | ECB Press Conference | ||||

| 12:30 | CAD | Manufacturing Sales M/M Feb | 0.00% | 0.60% | ||

| 12:30 | CAD | Wholesale Sales M/M Feb | 0.70% | 4.20% | ||

| 12:30 | USD | Initial Jobless Claims (Apr 8) | 175K | 166K | ||

| 12:30 | USD | Retail Sales M/M Mar | 0.60% | 0.30% | ||

| 12:30 | USD | Retail Sales ex Autos M/M Mar | 0.70% | 0.20% | ||

| 12:30 | USD | Import Price Index M/M Mar | 2.30% | 1.40% | ||

| 14:00 | USD | Michigan Consumer Sentiment Index Apr P | 58.8 | 59.4 | ||

| 14:00 | USD | Business Inventories Feb | 1.00% | 1.10% | ||

| 14:30 | USD | Natural Gas Storage | 15B | -33B |