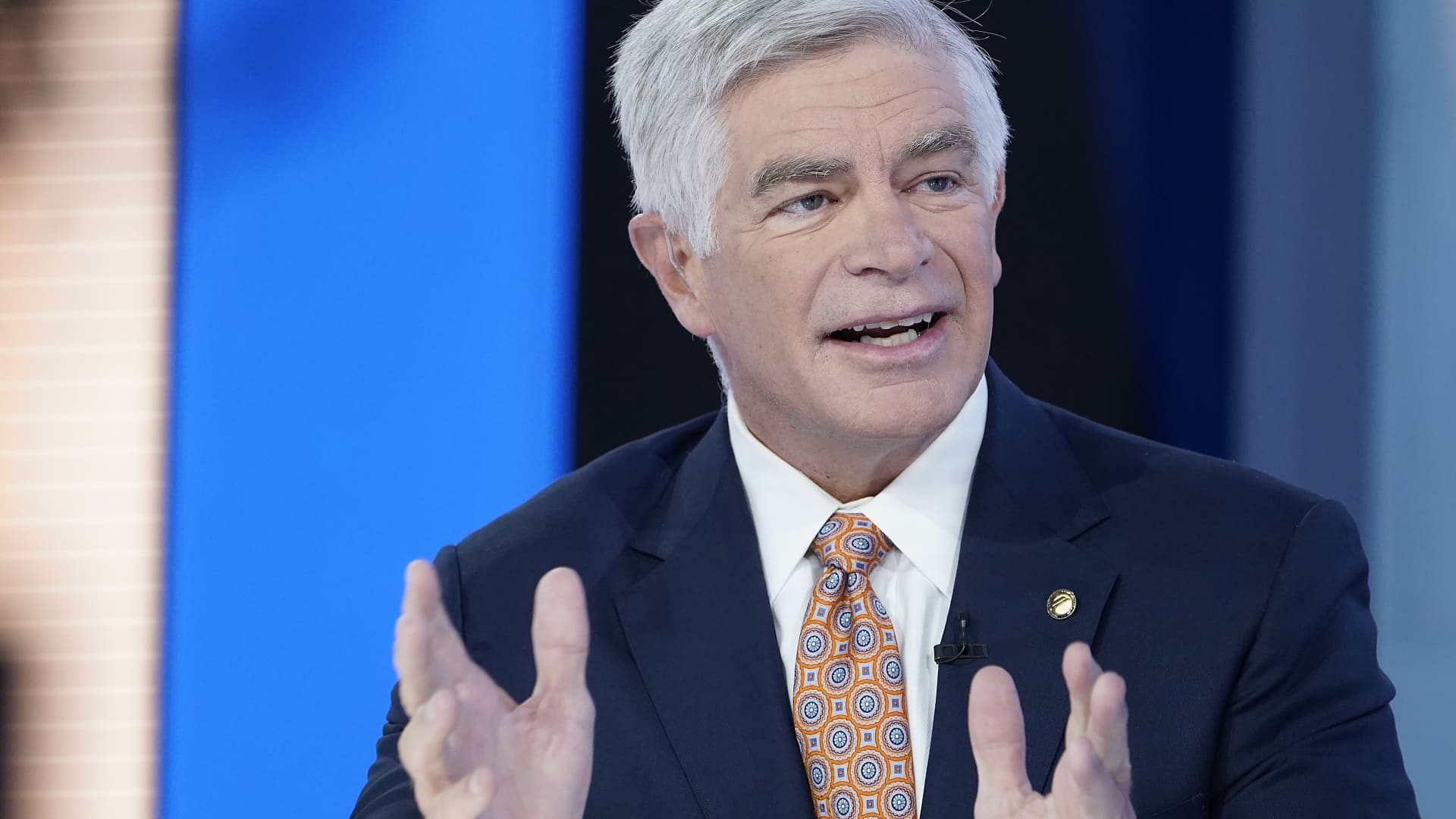

Philadelphia Federal Reserve President Patrick Harker joined the chorus of central bankers warning about inflation and the interest rate hikes needed to control rising prices.

In remarks Wednesday, the policymaker said he is worried about an inflation rate running at its highest level in 40 years. He anticipates the Fed will respond by raising rates and reducing the level of bonds it is holding on its balance sheet.

“Inflation is running far too high, and I am acutely concerned about this,” Harker told the Delaware State Chamber of Commerce.

“The bottom line is that generous fiscal policies, supply chain disruptions and accommodative monetary policy have pushed inflation far higher than I — and my colleagues on the [Federal Open Market Committee] — are comfortable with,” he said. “I’m also worried that inflation expectations could become unmoored.”

The cautionary tone comes the day after two of his colleagues, Governor Lael Brainard and San Francisco Fed President Mary Daly, also expressed concern over inflation. Brainard, an influential policy “dove” who generally favors lower rates and less restrictive monetary policy, said reducing inflation is “of paramount importance” and would require “a series of interest rate hikes” and a “rapid” reduction of the balance sheet.

Stocks dropped and bond yields rose following the comments.

Harker’s comments closely resembled Brainard’s view on rate hikes.

He said he expects “a series of deliberate, methodical hikes as the year continues and the data evolve,” though he wasn’t quite as emphatic about the issue of balance sheet reductions.

Harker is a nonvoting FOMC member who nonetheless has input into the committee’s final decisions. On the broader economy, he sees growth as “robust” and anticipates inflation ultimately coming down to the Fed’s 2% goal.

At its March meeting, the FOMC approved its first rate increase in more than three years. Markets expect a succession of increases that ultimately could take short-term borrowing rates to 3% or above.

Wall Street will be watching Wednesday as minutes from that meeting are released at 2 p.m. ET. Following the meeting, Chair Jerome Powell said the summary will reflect discussions on the bond holdings, which have brought the balance sheet to about $9 trillion.