The forex markets are rather steady in Asian session today. Focuses will turn to Eurozone CPI flash and US non-farm payrolls employment. Euro is so far still the strongest one for the week, but it will need some inspiration from inflation data to give it another lift. Dollar will particularly look into wage growth data to solidify Fed hike expectations. But the net movement will eventually depend on the overall risk sentiment.

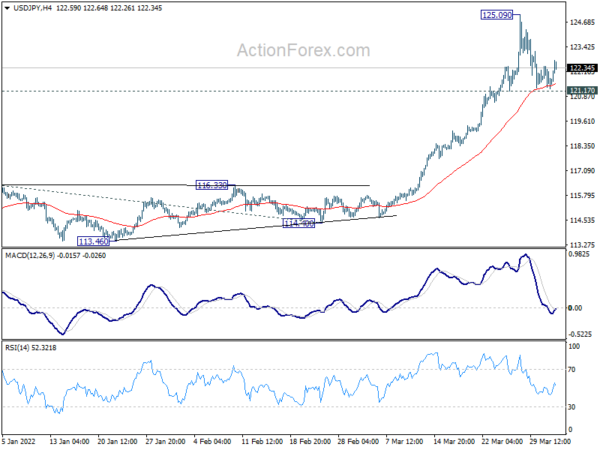

Technically, USD/JPY recovers just ahead of 121.17 minor support, after drawing support from 4 hour 55 EMA too. The development is keeping corrective pattern from 125.09 brief. That is, another rise through 125.09 should come sooner rather than later. However, firm break of 121.17 will indicate that it’s already in a deeper near term correction. Reactions to NFP report today would reveal which case it is.

In Asia, Nikkei closed down -0.49%. Hong Kong HSI is down -0.92%. China Shanghai SSE is up 0.78%. Singapore Strait Times is up 0.31%. Japan 10-year JGB yield is up 0.0020 at 0.218. Overnight, DOW dropped -1.56%. S&P 500 dropped -1.57%. NASDAQ dropped -1.54%. 10-year yield dropped -0.031 to 2.327.

China Caixin PMI manufacturing dropped to 48.1, fastest contraction in two years

China Caixin PMI Manufacturing dropped from 50.4 to 48.1 in March, below expectation of 49.7. The pace of contraction was quickest since February 2020. Caixin said production fell at quickest rate for just over two years amid tighter pandemic restrictions. Total new work and foreign demand had steep declines. Suppliers’ delivery times worsened while cost pressures intensified.

Wang Zhe, Senior Economist at Caixin Insight Group said: “Overall, impacted by factors including the Covid-19 outbreaks in multiple parts of China, manufacturing activity largely weakened in March. Supply contracted. Demand was also under pressure, and external demand worsened. The job market was more or less stable. Inflationary pressure continued to rise. And market optimism weakened.”

Japan PMI manufacturing finalized at 54.1, improvement in operation but subdued international markets

Japan PMI Manufacturing was finalized at 54.1 in March, up from February’s 52.7. Markit said there was renewed rise in output and stronger new order growth. But export orders had sharpest fall for 20 months. Stocks of raw materials had record rise amid higher prices and delays.

Usamah Bhatti, Economist at S&P Global, said:

“The Japanese manufacturing sector saw an improvement in operating conditions at the end of the first quarter of 2022… new order inflows saw a quickening in growth… international markets were subdued, following the reintroduction of strict restrictions across parts of China and the outbreak of war between Russia and Ukraine. As a result, new export orders fell at the sharpest rate since July 2020….

“Beyond the immediate future, firms remained confident about the year-ahead outlook for output, though the downside risks led to the softest degree of optimism for seven months. This is in line with current estimates for industrial production to rise 3.7% in 2022, meaning that output lost to the pandemic is unlikely to be recovered until 2023.”

Australia AiG manufacturing rose to 55.7, price pressures stepped up

Australia AiG Performance of Manufacturing Index rose from 53.2 to 55.7 in March. Looking at some details, production dropped -1.2 to 53.4. Employment rose 9l9 to 53.4. New orders rose 5.2 to 65.0. Input prices rose 6.8 to 82.4. Selling prices rose 0.4 to 72.0. Average wages rose 1.7 to 66.6.

Innes Willox, Chief Executive of Ai Group said: “The Australian manufacturing sector grew faster in March as manufacturers added new staff, lifted sales and continued to expand production (although at a slower pace than in February)… Across manufacturing pressures from wages and input prices stepped up while selling prices growth saw manufacturers recover some cost increases in the market. There was an encouraging rise in new orders in March although with labour and input supply constraints growing, manufacturers will be stretched to fill orders in a timely way.”

US NFP unlikely to alter Fed hike

US non-farm payrolls report is expected to show 488k job growth in March. Unemployment rate is expected to tick down further from 3.8% to 3.7%. Average hourly earnings are expected to return to growth at 0.4% mom.

Looking at related data, ADP report showed 455k private job growth in the same month, which was strong. Four-week moving average of initial jobless claims dropped notably from 208.5k to 230.5k. The employment data from ISM indexes are not available yet.

Markets are pricing in more than 70% chance of a 50bps rate hike by Fed in May. Even a moderate miss in the headline NFP number is not going to alter such expectations much. On the other hand, solid wages growth would leave less room for the Fed doves to argue for a small hike.

Some previews on NFP:

Elsewhere

Swiss CPI and PMI manufacturing, Eurozone PMI manufacturing final and CPI flash, UK PMI manufacturing final will be featured in European session. Later in the day, US will release non-farm payrolls, ISM manufacturing and construction spending.

EUR/USD Daily Outlook

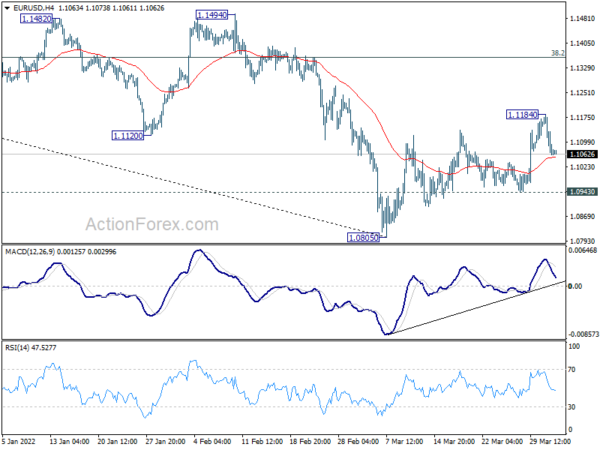

Daily Pivots: (S1) 1.1024; (P) 1.1104 (R1) 1.1148; More…

Intraday bias in EUR/USD remains neutral at this point, but further rally is mildly in favor as long as 1.0943 support holds. Break of 1.1184 will resume the rebound from 1.0805 to 38.2% retracement of 1.2265 to 1.0805 at 1.1363. However, break of 1.0943 will revive near term bearishness and bring retest of 1.0805 low first.

In the bigger picture, the decline from 1.2348 (2021 high) is expected to continue as long as 1.1494 resistance holds. Firm break of 1.0635 (2020 low) will raise the chance of long term down trend resumption and target a retest on 1.0339 (2017 low) next. Nevertheless, break of 1.1494 will maintain medium term neutral outlook, and extending term range trading first.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 21:30 | AUD | AiG Performance of Mfg Index Mar | 55.7 | 53.2 | ||

| 23:50 | JPY | Tankan Large Manufacturing Index Q1 | 14 | 12 | 18 | |

| 23:50 | JPY | Tankan Large Manufacturing Outlook Q1 | 9 | 10 | 13 | |

| 23:50 | JPY | Tankan Non – Manufacturing Index Q1 | 9 | 5 | 9 | |

| 23:50 | JPY | Tankan Non – Manufacturing Outlook Q1 | -10 | 8 | 8 | |

| 23:50 | JPY | Tankan Large All Industry Capex Q1 | 2.20% | 4.40% | 9.30% | |

| 00:30 | JPY | Manufacturing PMI Mar F | 54.1 | 53.2 | 53.2 | |

| 01:45 | CNY | Caixin Manufacturing PMI Mar | 48.1 | 49.7 | 50.4 | |

| 06:30 | CHF | CPI M/M Mar | 0.50% | 0.70% | ||

| 06:30 | CHF | CPI Y/Y Mar | 2.40% | 2.20% | ||

| 07:30 | CHF | SVME PMI Mar | 61 | 62.6 | ||

| 07:45 | EUR | Italy Manufacturing PMI Mar | 57 | 58.3 | ||

| 07:50 | EUR | France Manufacturing PMI Mar F | 54.8 | 54.8 | ||

| 07:55 | EUR | Germany Manufacturing PMI Mar F | 57.6 | 57.6 | ||

| 08:00 | EUR | Eurozone Manufacturing PMI Mar F | 57 | 57 | ||

| 08:30 | GBP | Manufacturing PMI Mar F | 55.5 | 55.5 | ||

| 09:00 | EUR | Eurozone CPI Y/Y Mar P | 6.50% | 5.90% | ||

| 09:00 | EUR | Eurozone CPI Core Y/Y Mar P | 3.10% | 2.70% | ||

| 12:30 | USD | Nonfarm Payrolls Mar | 488K | 678K | ||

| 12:30 | USD | Unemployment Rate Mar | 3.70% | 3.80% | ||

| 12:30 | USD | Average Hourly Earnings M/M Mar | 0.40% | 0.00% | ||

| 13:30 | CAD | Manufacturing PMI Mar | 56.5 | 56.6 | ||

| 13:45 | USD | Manufacturing PMI Mar F | 58.5 | |||

| 14:00 | USD | ISM Manufacturing PMI Mar | 58.4 | 58.6 | ||

| 14:00 | USD | ISM Manufacturing Prices Paid Mar | 76 | 75.6 | ||

| 14:00 | USD | ISM Manufacturing Employment Index Mar | 53.7 | 52.9 | ||

| 14:00 | USD | ISM Manufacturing New Orders Index Mar | 59.8 | 61.7 | ||

| 14:00 | USD | Construction Spending M/M Feb | 0.90% | 1.30% |