Markets:

- Gold up $2.50 to $1935

- WTI crude down $7.01 to $100.85

- US 10-year yields down 3 bps to 2.327%

- S&P 500 down

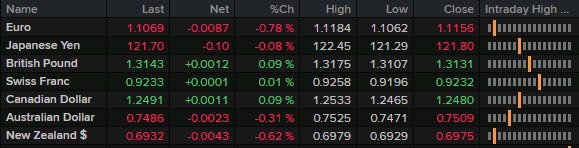

- CHF leads, EUR lags

The US PCE inflation report was a tad cooler than the consensus but the market took little comfort in that with the Ukraine war sparking a fresh spike in March. It would have been interesting to see how the market reacted to a print like that if there had been no conflict as it could have marked a crest in monthly price rises. Alas, war rages and Biden announced the largest-ever SPR release. The move and lockdowns in China knocked $7 off the price of front-month crude, but much less further out the curve.

USD/CAD took it in stride, finishing mostly unchanged.

The largest moves within the day were around the London fix (when the dollar dropped) and into the equity close when US stocks dumped. The dollar move into the fix reversed over the subsequent hour while we will have to wait and see how stocks do in April (seasonals offer a clue).

The euro finished the day on the lows and down by 90 pips, giving back about half of this week’s pop. It had made a new four-week high earlier in the session but worries about Putin turning off the natural gas taps weighed in a slide to 1.1067.

Cable was quieter. Aside from the pop into the fix, it mostly traded sideways around 1.3140.

USD/JPY fell as low as 121.27 but rebounded 50 pips from there to finish the day largely unchanged. Fundamentals weren’t a big factor as Japan closed out the fiscal year.

This “NEW CONCEPT” Trading Strategy Prints Money!… (INSANE Results!)

This “NEW CONCEPT” Trading Strategy Prints Money!… (INSANE Results!) RULE-BASED Pocket Option Strategy That Actually Works | Live Trading

RULE-BASED Pocket Option Strategy That Actually Works | Live Trading