All the balls are in motion as the Russia/Ukraine situation intensifies

- Yields are low with the 10 year down -6.1 basis points on the day at 1.968%. The high for the day reached 2.063%

- The price of

crude oil moved up to a high of $94.66. That took the price above the February 4 high at $93.14.

Gold is up $30 at $1856.63. That is up 1.68% on the day

Stocks have tumbled lower with the:

- Dow -338 points or -0.97% at 34910

- S&P -64.21 or 1.43% at 4441

- Nasdaq down -301 points or -2.12% at 13886

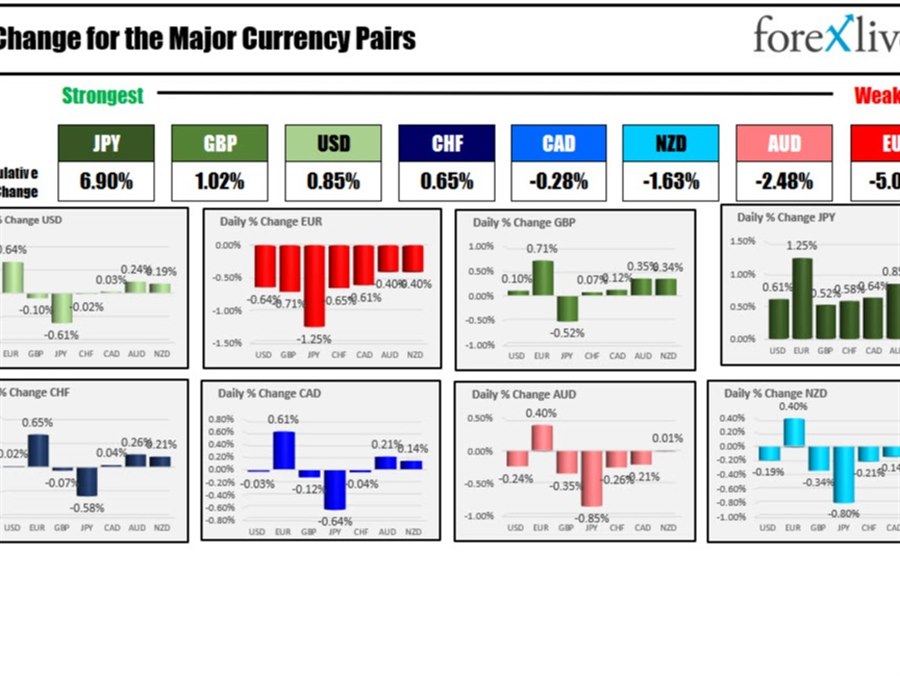

In the Forex, the dollar moves are mixed. The strongest is the JPY. The weakest is the EUR:

- EURUSD: EURUSD has moved lower and in the process has moved below the low for the day/week at 1.13684 and the lower swing area between 1.1359 to 1.13684. That area is now a risk area for shorts. Stay below is more bearish. The low has reached 1.1331 which is just short of the high from last Wednesday. The 50% of the move up from the 2022 lows come in at 1.13075

- USDJPY: The USDJPY has also moved lower (flight into the relative safety of the JPY) has seen the price tumble below teh 100 hour MA at 115.60 and the 200 hour MA and 50% of the last move higher from the February low, cuts across near 115.23 area. The current price trades at 115.16.

- EURJPY: The EURJPY has tumbled as the EUR is near the heart of the conflict and exposed to trade restrictions that could impact energy to Europe. The JPY has benefitted as it is a safe haven. The 200 hour MA was broken and 38.2% at 131.27. That is now risk. The 200 day MA comes in at 130.486. That too was broken on the fall lower but found support buyers near that MA level (PS. the 100 day MA is at 130.11 and that may have also helped the bounce from a technical perspective.

This article was originally published by Forexlive.com. Read the original article here.