Canadian Dollar tumbles notably in early US session after much less hawkish then expected BoC rate decision. The central bank stands pat while lowering both inflation and growth forecasts. Elsewhere in the currency markets, Yen is trading broadly lower with Swiss Franc as stock markets are staging a strong rebound. Meanwhile, Aussie is also trying to extend recovery. But then, the next moves will firstly depend on FOMC later in the day and development surrounding Ukraine.

Technically, we’re maintain that some resistance levels in Yen crosses should be taken out with conviction if sentiment is truly turning risk-on again. The levels include 115.05 minor resistance in USD/JPY, 130.07 minor resistance in EUR/JPY, 155.38 minor resistance in GBP/JPY, 82.07 minor resistance in AUD/JPY.

At the time of writing, DOW is up 1.11%. S&P 500 is up 1.61%. NADSAQ is up 2.19%. 10 year yield is flat at 1.776. In Europe, FTSE is up 2.01%. DAX is up 2.63%. CAC is up 2.63%. Germany 10-year yield is up 0.0086 at -0.068. Earlier in Asia, Nikkei dropped -0.44%. Hong Kong HSI rose 0.19%. China Shanghai SSE rose 0.66%. Singapore Strait Times rose 0.73%. Japan 10-year JGB yield dropped -0.0009 to 0.140.

Some previews on Fed:

BoC keeps overnight rate at 0.25%, lowers GDP and CPI forecasts

BoC left overnight rate unchanged at effective lower bound of 0.25% today. Bank rate is held at 0.50% while deposit rate is kept at 0.25%. The central bank also said, “with overall economic slack now absorbed, the Bank has removed its exceptional forward guidance on its policy interest rate”.

The central bank adopts a hawkish bias and said “the Governing Council expects interest rates will need to increase, with the timing and pace of those increases guided by the Bank’s commitment to achieving the 2% inflation target.”

The reinvestment phase of bond holdings will continue. Holdings of government bonds will be “roughly constant at least until it begins to raise the policy interest rate.”

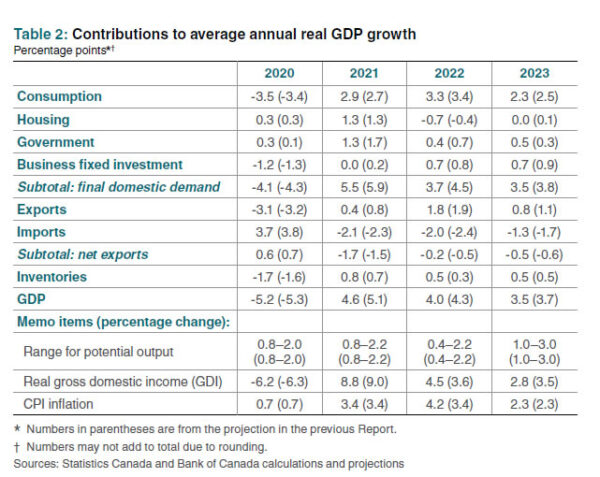

In the new economic projections, BoC lowered 2022 GDP growth forecasts from 4.3% to 4.0%, and 2023 from 3.7% to 3.5%. BoC said economic impact of Omicron is expected to be less severe than previous waves. “Economic growth is then expected to bounce back and remain robust over the projection horizon, led by consumer spending on services, and supported by strength in exports and business investment.”

CPI forecasts was lowered for 2022 from 4.2% to 3.4%, but kept unchanged at 2.3% for 2023. BoC said, “as supply shortages diminish, inflation is expected to decline reasonably quickly to about 3% by the end of this year and then gradually ease towards the target over the projection period.”

US goods trade deficit widened to USD 101B in Dec

US exports of goods rose USD 2.2B to USD 157.3B in December. Imports of goods rose USD 5.1B to 258.3B. Goods trade deficit widened to USD -101.0B, versus expectation of USD -96.1B.

Whole sale inventories rose 2.1% mom to USD 789.4B. Retail inventories rose 4.4% mom to USD 643.8B.

German government slashes 2022 growth forecast to 3.6%

The German government lowered 2022 growth forecast to 3.6%, down from October’s projection of 4.1%. That’s still notably higher that 2021’s preliminary figure of 2.7%.

“The consequences of the corona pandemic are still noticeable and many companies still have to struggle with them,” Economy Minister Robert Habeck said . “Nevertheless, our economy is still robust.”

“During the still-difficult economic rebound phase, we will continue aid programs for companies and furlough policies,” he noted. “With an increasing vaccination rate, it should soon be possible to contain the pandemic in a sustainable manner and to reduce crisis aid. Then the economic recovery will accelerate noticeably.”

BoJ: Economy to grow well above potential in 2022

In the Summary of Opinions at the January 17-18 meeting, BoJ said, “a pick-up in Japan’s economy has become evident” and the economy is “likely to continue recovering moderately”. In fiscal 2022, it’s “highly likely to grow at a pace that is well above its potential growth rate”.

Though, attentions should be paid to risk of COVID-19 spread in China and that could have a “negative impact on Japan’s economy through downward pressure on external demand and amplification of supply-side constraints.”

CPI is expected to “exceed 1 percent” and may “momentarily rise to a level close to 2 percent” from April 2022 onward. It will then be “important to analyze what lies behind this inflation and whether it turns out to be sustainable.”

A member noted “the key factor in assessing the underlying trend in the CPI is developments in wages. In order for the CPI to increase as a trend, it is necessary that services prices rise along with wage increases.

Also from Japan, corporate service price index rose 1.1% yoy in December, matched expectations.

USD/CAD Mid-Day Outlook

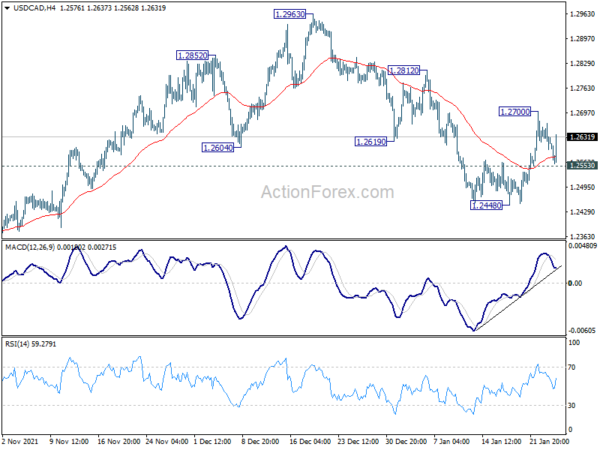

Daily Pivots: (S1) 1.2595; (P) 1.2632; (R1) 1.2666; More…

Intraday bias in USD/CAD remains neutral and further rise is mildly in favor with 1.2553 minor support intact. Pull back from 1.2964 should have completed with three waves down to 1.2448. Above 1.2700 will target 1.2812 resistance first, and then 1.2963. On the downside, below 1.2553 minor support will turn bias back to the downside for 1.2448 instead.

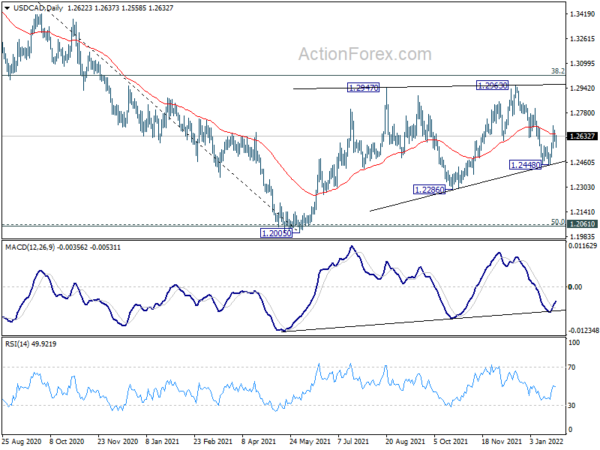

In the bigger picture, focus stays on 38.2% retracement of 1.4667 (2020 high) to 1.2005 (2021 low) at 1.3022. Sustained break there should confirm that the down trend from 1.4667 has completed after defending 1.2061 long term cluster support. Further rise would then be seen towards 61.8% retracement at 1.3650. However, rejection by 1.3022 will maintain medium term bearishness. Break of 1.2005 will resume the down trend form 1.4667 and that carries larger bearish implications too.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 23:50 | JPY | Corporate Service Price Index Y/Y Dec | 1.10% | 1.10% | 1.10% | |

| 23:50 | JPY | BoJ Summary of Opinions | ||||

| 09:00 | CHF | Credit Suisse Economic Expectations (Jan) | 9.5 | 0 | ||

| 13:30 | USD | Wholesale Inventories Dec P | 2.10% | 1.30% | 1.40% | |

| 13:30 | USD | Goods Trade Balance (USD) Dec P | -101.0B | -96.1B | -98.0B | |

| 15:00 | USD | New Home Sales Dec | 811K | 766K | 744K | |

| 15:00 | CAD | BoC Interest Rate Decision | 0.25% | 0.25% | 0.25% | |

| 15:30 | USD | Crude Oil Inventories | 1.0M | 0.5M | ||

| 19:00 | USD | FOMC Rate Decision | 0.25% | 0.25% | ||

| 19:30 | USD | FOMC Press Conference |