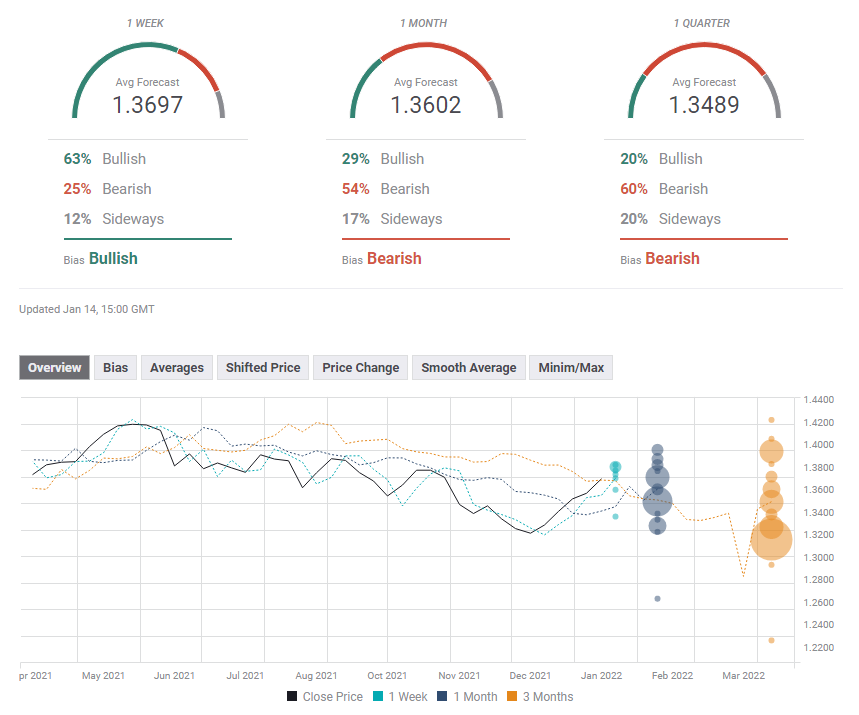

GBP/USD bulls unable to break above the 200-DMA and defend the 1.3700 figure

On Friday, a pack of solid UK macroeconomic data failed to underpin the British pound, which struggled to cling to the 1.3700 figure, falling during the New York session. At press time, the GBP/USD is trading at 1.3670. It is worth noting that in the last hour, the US Dollar Index reclaimed the 95.00 level, up some 0.25%, sitting at 95.05, underpinned by the rise of the US 10-year T-bond yield, up to 1.75%, a three basis points gain. Read more…

GBP/USD Weekly Forecast: Fired up by the Fed, focus now shifts to top-tier UK data

How low can the dollar go? The greenback tumbled in response to soothing words from the Federal Reserve and falling bond yields, an indirect result of warning words from other Fed officials. The focus now shifts to the UK, with economic indicators competing with the political drama. Read more…

GBP/USD Forecast: Pound approaches key resistance amid persistent dollar weakness

GBP/USD has reached its highest level since late October at 1.3750 on Thursday but erased a large portion of its daily gains before closing flat near 1.3700. The pair is edging closer to 1.3750 early Friday and additional gains could be witnessed if this level turns into support. The data published by the UK’s Office for National Statistics revealed on Friday that the economic activity in November expanded by 0.9%, compared to the market expectation of 0.2%. On a negative note, Industrial Production increased by only 0.1% on a yearly basis, falling short of analysts’ estimate of 0.5%. Read more…