The major US indices closed the new near session lows. The declines were across the board today as the overall market reacted to the idea that the Fed would look to run down its balance sheet in addition to increasing the taper, and starting to tighten.

- The Dow industrial average closed at record levels on the first two trading days of the year. Today the index reached a new all-time high, but started to tumble after the FOMC meeting minutes. The new all-time high for the Dow industrial average is at 36952.65

- The NASDAQ index has been on a one-way street to the downside over the last two trading days and is down nearly 7% from its all-time high. Having said that, the price is still above its December 20 low at at 14860.04. At the December 20 low the NASDAQ index was down -8.34%

- The S&P index has started to give up some of its gains today after reaching a new all-time high just yesterday at 4818.62

The final numbers are showing:

- Dow industrial average, -392.54 points or -1.07% at 36407.12

- S&P index -92.94 points or -1.94% at 4700.59

- NASDAQ index -522.53 points or -3.34% 15100.18

The move higher in interest rates, is certainly a major catalyst. The 10 year yield reached a high of 1.712%. That took the yield to the highest level since early April 2021. The largest gains were in the short end, however, where the two year yield was up nearly 6 basis points

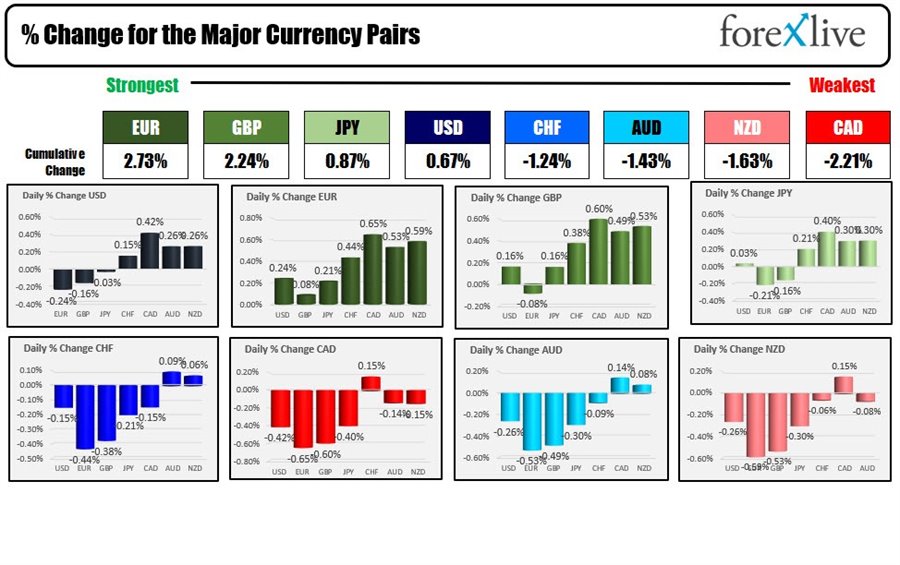

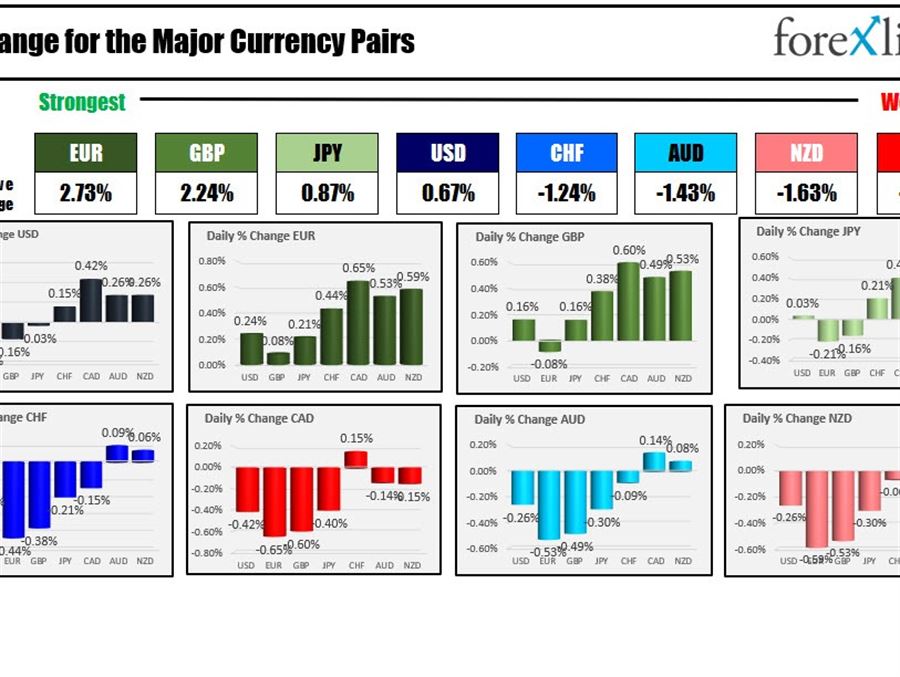

In the forex, the EUR is ending the day as the strongest of the major currencies. The CAD is the weakest. The USD is mixed with declines versus the EUR and GBP and gains vs the CHF, CAD, AUD and NZD. The greenback was near unchanged verse the JPY.