- USD/JPY bulls moving in and eye a restest towards 115.20.

- On the downside, 112.50 is an important level worth noting.

USD/JPY has corrected to into hourly support which gives rise to bullish prospects for the sessions ahead. The following illustrates, in a top-down analysis, the potential for a restest of the 114 area towards 115.20.

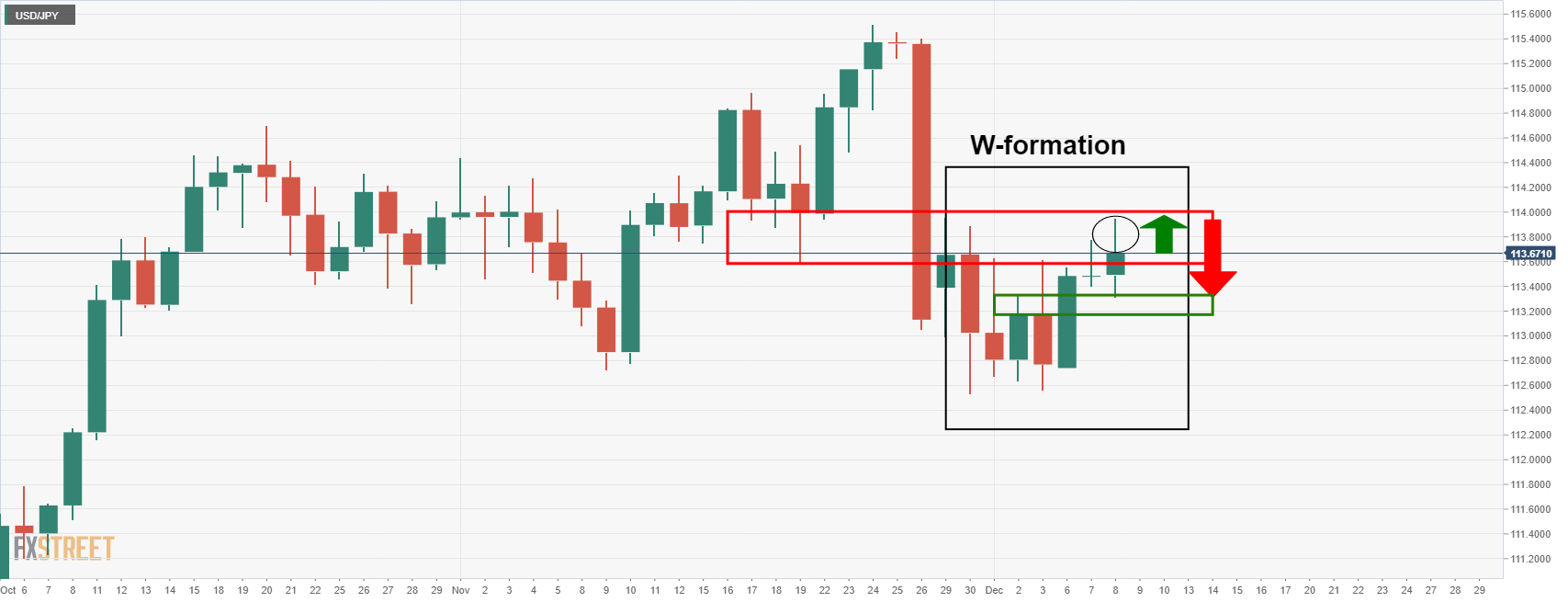

USD/JPY weekly chart

As per the weekly chart, the price has cleared last week’s opening level and the prior week’s support. This has given the bulls the edge and an upside continuation could be expected for the forthcoming days. A bullish close for the week will underpin the bullish bias.

With that being said, a break of the lows, near 112.50, will likely give rise to a downside continuation. This will bring in the July highs near 111.65 that have a confluence with the 61.8% Fibonacci retracement of the bullish weekly impulse and the 21-EMA.

USD/JPY daily chart

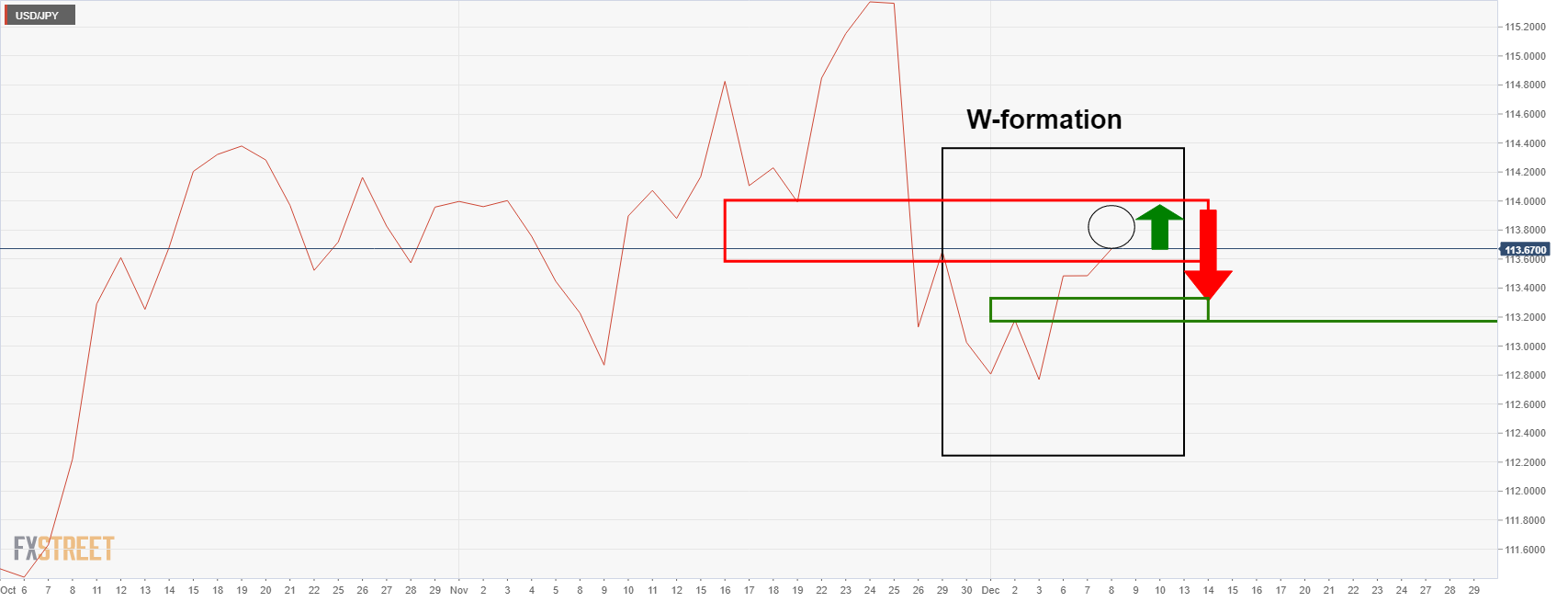

The daily chart is showing that the price has formed a W-formation, more easily visualized on a line chart, as follows:

The W-formation is a reversion bearish pattern, and the price would be expected to retest the neckline of the W which comes in near 113.20/35 (including the Dec 2 wick) in this specific case.

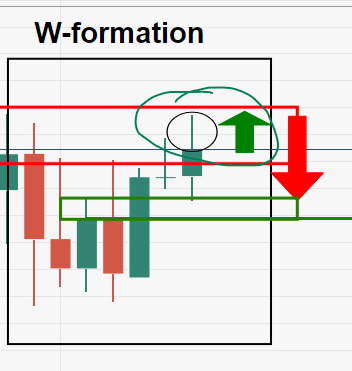

However, there is potential for the wick of today’s business and candle to be filled on the lower time frames as the eclipse in the above images show:

This gives rise to the potential for a restest of the resistance in the forthcoming sessions as follows:

USD/JPY H1 chart

The latest hourly bearish candle, however, was a strong move and close, so the bulls would be prudent to wait on the sidelines to see how the price action develops over the coming hours. If the price recovers significantly, the imbalance on the daily chart’s prior sell-off is with noting for upside potential to clear through low supply area between 114 and 115.20.