U.S. Treasury sells $25 billion of 30 year bonds

The U.S. Treasury sold 25,000,000,030 year bonds at a high yield of 1.94%. That was a whopping 5.2 basis points above the WI level of 1.888% just before the auction:

- High yield 1.94%

- WI yield 1.888%

- Bid to cover 2.2X vs 2.29X six month average

- Tail 5.2 basis points

- dealers 25.23% versus 17.3% six month average

- indirect 59.0% versus 64.3% six month average

- directs 15.8% versus 18.4% six month average

Auction grade: F

There was nothing good about the new 30 year bond auction as it tailed by 5.2 bps. The average of the last six months was a scant 0.5 basis points. Bid the cover was low. Dealers are left with a big percentage. International demand was week as was the domestic demand.

US stocks are moving lower with the NASDAQ index now down near 1% at 15733.83.

The US dollar is moving higher.

- The EURUSD has moved below the 50% midpoint of the move up from the 2020 low at 1.1489. It traded down to a low of 1.14811

- The USDJPY is moving toward the 114.00 level. Last Friday the high levels moved up to 114.023 after the jobs report

- The GBPUSD has moved down to a new low going back to September 30 at 1.3167. The swing lows from September 29 and September 30 between 1.3411 and 1.34149 is all that stands between the current level and the lowest level since December 23, 2020

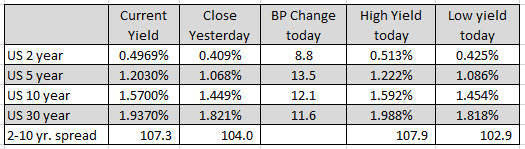

Looking at the US debt market, the yields have moved sharply higher.

This article was originally published by Forexlive.com. Read the original article here.