The tumble yesterday continued

The GBPUSD fell sharply yesterday from the week’s high at 1.36972 helped by the BOE decision which did not show the hawkish bias that the market was looking for.

The price tumbled down to an intraday low of 1.34707, before rebounding back toward the 1.3500 level going into the close.

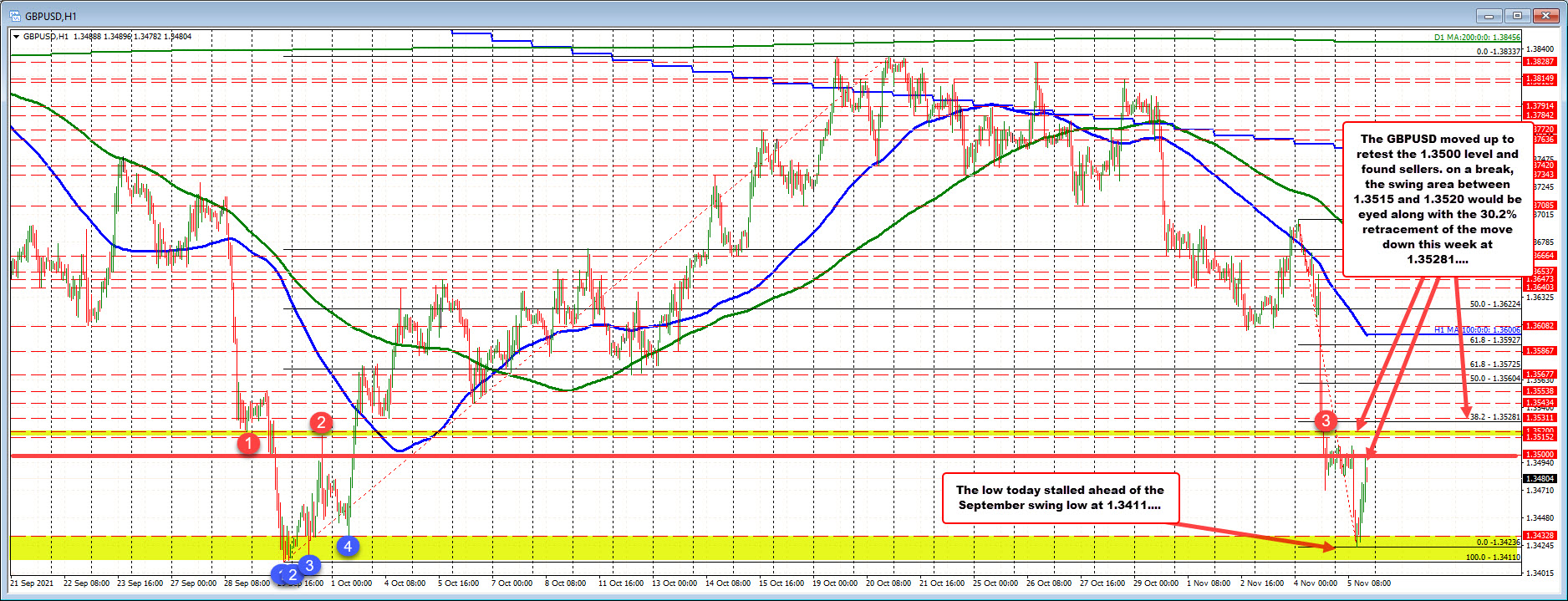

In trading today, the Asian session high reach 1.35073. The early European high reach 1.3508. Although the price was able to get above 1.3500, there was some reluctance ahead of an old swing area from the end of September early October between 1.3515 at 1.3520 (see red numbered circles).

The pair reversed lower and traded as low as 1.34236 in the London morning session. That took the price below the October 1 low at 1.34328, but stayed above the September 29 low of 1.34110. A move below 1.3411 would take the pair the lowest level since December 2020.

Since bottoming, the price has seen some covering. The biggest clue was perhaps the inability of the GBPUSD to move below the London morning session low after the better than expected US jobs report. Lower US yields also are helping to weaken the USD in the US morning session.

Having said that, the price rise has plenty of work to do before calling a low. The rise has so far taken the price back up toward the 1.3500 level with a high of 1.34986 so far. The price currently trades at 1.34872.

If the buyers are to take more control, it would take a move back above the 1.3500 level followed by a move above 1.3515-1.3520, to give more comfort. A move above the 38.2% retracement of the week’s trading range at 1.35281 is also a level to get to and through if traders are to call the bottom for the pair (at least in the short term).