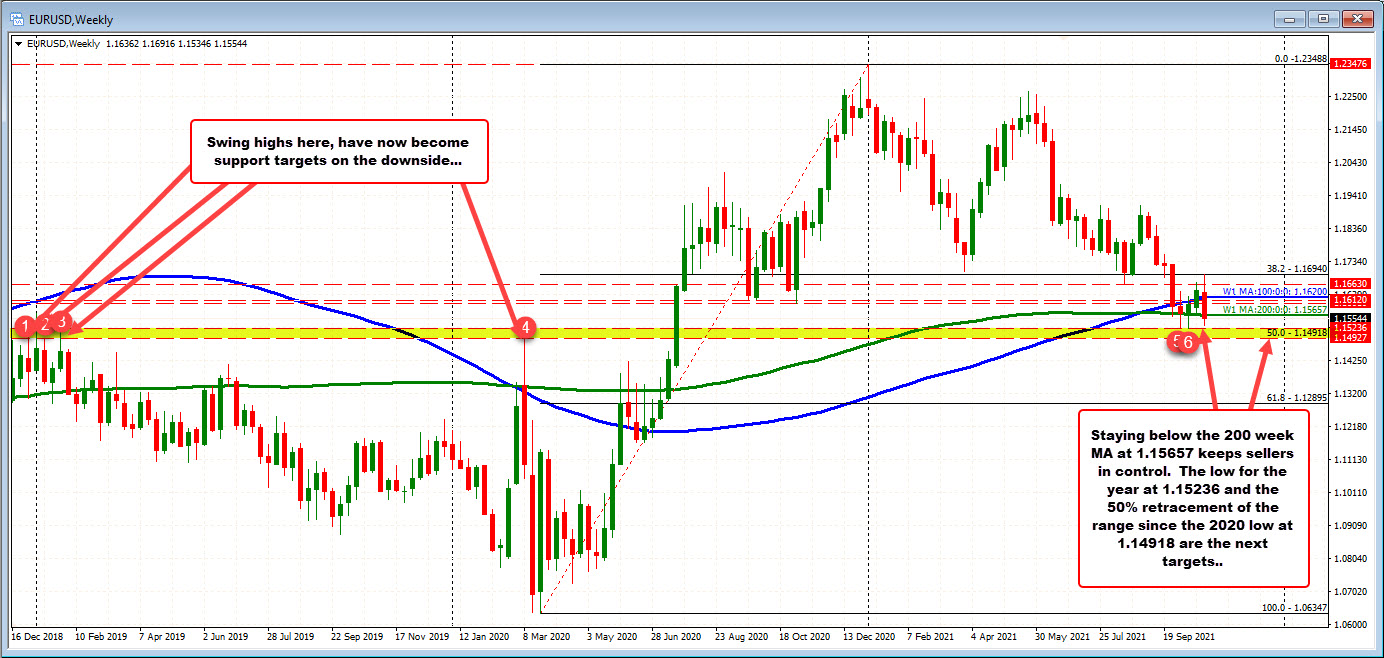

First close below MA since July 2020.

With the EURUSD trading at 1.1554, the pair is on track to close the week below the 200 week MA. That MA comes in at 1.16657.

Three weeks ago, the pair closed just above the MA level. Since then, the closing price for the week has been comfortably above the moving average level. However, of note is that the price intra- week has traded above and below the moving average level in for the last five trading weeks. A close below the moving average would be a negative bias and more bearish.

On the downside, the low price and 2021 has reached 1.15236. Not far below that level is the 50% midpoint of the range since the March 2020 low. That midpoint comes in at 1.14918. Going back to 2018, 2019 and 2020 there were a number of swing highs (see red numbered circles) that stalled within the swing area between 1.1491 and 1.15236. In effect, the price action has been divided since 2019 between being below the swing area and being above the swing area.

As a result, trading into next week will be focused on that area. Will the buyers continue to hold support and pushed the price back to the upside, or will the sellers take more control and start to trade the EURUSD below the swing area and midpoint?

RULE-BASED Pocket Option Strategy That Actually Works | Live Trading

RULE-BASED Pocket Option Strategy That Actually Works | Live Trading

This “NEW CONCEPT” Trading Strategy Prints Money!… (INSANE Results!)

This “NEW CONCEPT” Trading Strategy Prints Money!… (INSANE Results!) breakout perfect entry #forex #crypto #trading #trending

breakout perfect entry #forex #crypto #trading #trending