Dollar initially dipped after FOMC overnight, but quickly found its footing. Overall market reaction was positive, but insufficient to alter the near term outlook. Sterling remains the worst performing one for the week while Swiss Franc is the strongest. Both will look into BoE and SNB policy decision today. Commodity currencies are on the softer side for now, while Yen is the firmer one.

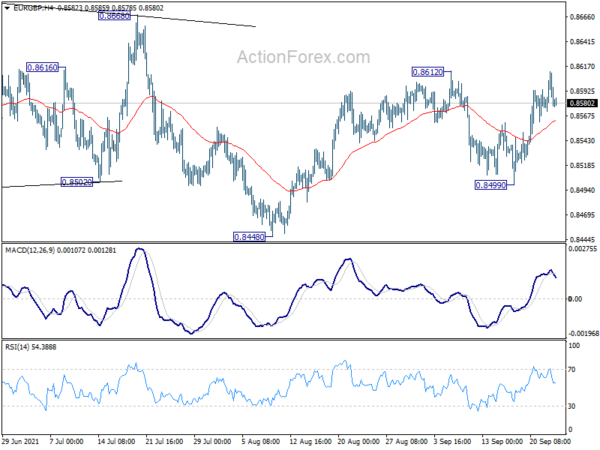

Technically, we’ll keep a close eye on Sterling pairs for today. In particular, EUR/GBP failed to break through 0.8612 resistance on the first attempt. GBP/JPY also stabilized after hitting 149.03 key support level. Meanwhile, GBP/USD lost some downside momentum after breaching 1.3601 support. We’d see if Pound sellers would come back after BoE, or the currency would rebound from current levels.

In Asia, at the time of writing, Hong Kong HSI is up 0.69%. China Shanghai SSE is up 0.58%. Singapore Strait Times is up 0.86%. Japan is on holiday. Overnight, DOW rose 1.00%. S&P 500 rose 0.95%. NASDAQ rose 1.02%. 10-year yield rose 0.012 to 1.336.

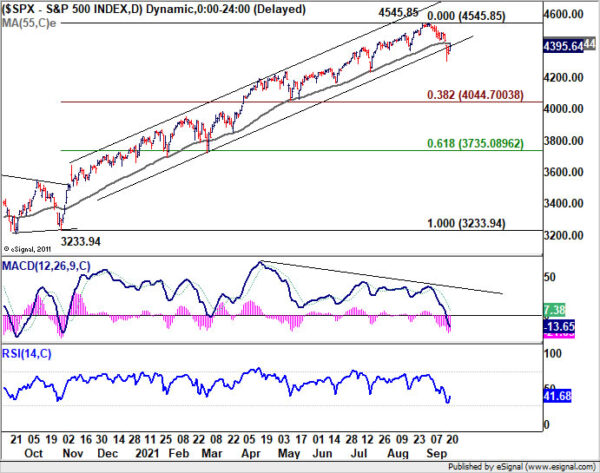

S&P 500 closed up after FOMC, but risk stays on downside

Overall response to Fed’s announcement overnight was positive, with major stock indexes closed higher. In short, Fed indicated that tapering will come “soon”. Members have also pushed forward the timing of the first rate hike. The median dot plots showed that 9 out of 18 members projected it to happen in 2022.

Suggested readings on Fed:

S&P 500 gained 0.95% to close at 4395.64. But it struggled to break through 55 day EMA (now at 4412.38). Near term risk will remain on the downside unless SPX could sustain above the EMA in the next few days. Indeed, a break of this week’s low at 4305.91 will further affirm that it’s already in correction to whole up trend from 3233.94. Deeper fall would be seen to 38.2% retracement at 4044.70 before SPX finds a bottom.

Australia PMI composite rose to 46.0, early signs of a turning point

Australia PMI Manufacturing rose from 52.0 to 57.3 in September, hitting a 3-month high. PMI Services also rose from 42.9 to 44.9, staying in contraction but hit a 3-month high. PMI Composite rose from 43.3 to 46.0.

Jingyi Pan, Economics Associate Director at IHS Markit, said: “The extension of COVID-19 restrictions into September continued to dampen business conditions in the Australian private sector, although the slight easing of restrictions was picked up in the latest IHS Markit Flash Australia Composite PMI, seeing the overall Composite Output Index contracting at a slower rate in September. This may also be suggesting that we are looking at early signs of a turning point.

“The employment index meanwhile pointed to higher workforce levels, which was a positive sign following the decline recorded in August, driven by the severe COVID-19 disruptions. That said, price pressures intensified once again for Australian private sector firms while evidence of worsening supply constraints gathered, all of which remains a focal point for the Australian economy.”

Looking ahead

BoE and SNB policy decisions are the major focuses in European session. BoE is is expected to keep Bank rate unchanged at 0.1% by unanimous vote. Asset purchase target will also be held at GBP 875 with 8-1 vote. The focus will indeed be on how two new MPC member would shift the hawk/dove balance. SNB is widely expected to make no change to policy, and reiterate the necessity of negative rate and readiness for currency intervention.

Suggested readings:

On the data front, Eurozone PMIs, UK PMIs, US PMIs and jobless claims, and Canada retail sales will be featured.

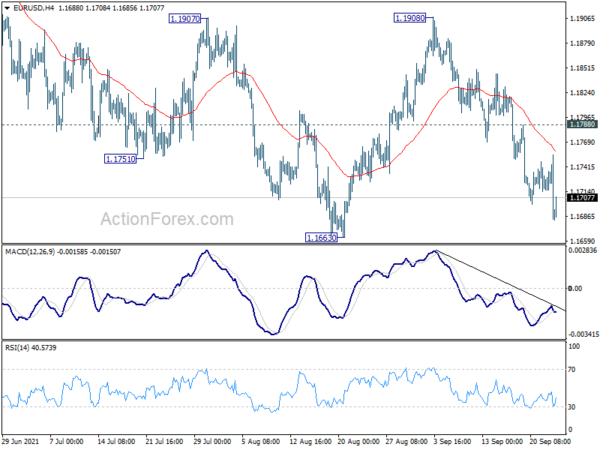

EUR/USD Daily Outlook

Daily Pivots: (S1) 1.1665; (P) 1.1710; (R1) 1.1735; More…

EUR/USD’s fall from 1.1908 is still in progress and intraday bias remains on the downside for 1.1663 low. Decisive break there will resume the fall from 1.2265, and the pattern from 1.2348, to 1.1602 key support next. On the upside, above 1.1788 minor resistance will turn bias back to the upside for 1.1908 again.

In the bigger picture, rise from 1.0635 is seen as the third leg of the pattern from 1.0339 (2017 low). Further rally remains in favors long as 1.1602 support holds, to cluster resistance at 1.2555 next, (38.2% retracement of 1.6039 to 1.0339 at 1.2516). However sustained break of 1.1602 will argue that the rise from 1.0635 is over, and turn medium term outlook bearish again. Deeper fall would be seen to 61.8% retracement of 1.0635 to 1.2348 at 1.1289 and below.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 23:00 | AUD | Manufacturing PMI Sep P | 57.3 | 52 | ||

| 23:00 | AUD | Services PMI Sep P | 44.3 | 42.9 | ||

| 7:15 | EUR | France Manufacturing PMI Sep P | 57.3 | 57.5 | ||

| 7:15 | EUR | France Services PMI Sep P | 56.1 | 56.3 | ||

| 7:30 | CHF | SNB Interest Rate Decision | -0.75% | |||

| 7:30 | EUR | Germany Manufacturing PMI Sep P | 61.3 | 62.6 | ||

| 7:30 | EUR | Germany Services PMI Sep P | 60.3 | 60.8 | ||

| 8:00 | EUR | Eurozone Manufacturing PMI Sep P | 60.4 | 61.4 | ||

| 8:00 | EUR | Eurozone Services PMI Sep P | 58.4 | 59 | ||

| 8:00 | EUR | ECB Economic Bulletin | ||||

| 8:30 | GBP | Manufacturing PMI Sep P | 59 | 60.3 | ||

| 8:30 | GBP | Services PMI Sep P | 55 | 55 | ||

| 11:00 | GBP | BoE Interest Rate Decision | 0.10% | 0.10% | ||

| 11:00 | GBP | BoE Asset Purchase Facility | 875B | 875B | ||

| 11:00 | GBP | MPC Official Bank Rate Votes | 0–0–9 | 0–0–8 | ||

| 11:00 | GBP | MPC Asset Purchase Facility Votes | 0–1–8 | 0–1–7 | ||

| 12:30 | CAD | Retail Sales M/M Jul | 2.50% | 4.20% | ||

| 12:30 | CAD | Retail Sales ex Autos M/M Jul | 2.70% | 4.70% | ||

| 12:30 | USD | Initial Jobless Claims (Sep 17) | 317K | 332K | ||

| 13:45 | USD | Manufacturing PMI Sep P | 61.1 | 61.1 | ||

| 13:45 | USD | Services PMI Sep P | 55.1 | 55.1 | ||

| 14:30 | USD | Natural Gas Storage | 83B |