Yen is trading generally firm today as risk sentiment in Asia is decoupling from that of the US. Nikkei is so far rather resiliently holding above 30k handle, despite slight retreat. But Hong Kong HSI is having another day of heavy selling, breaking to a new low for the year. The fact that Swiss Franc is not following suggests it’s more of a problem of Asia. Meanwhile, Aussie is currently the worst performing after poor job data. Kiwi is only getting very mild support from GDP. Dollar and Euro are mixed.

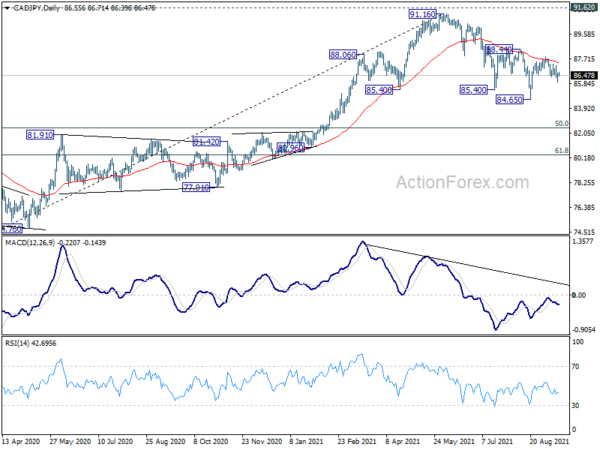

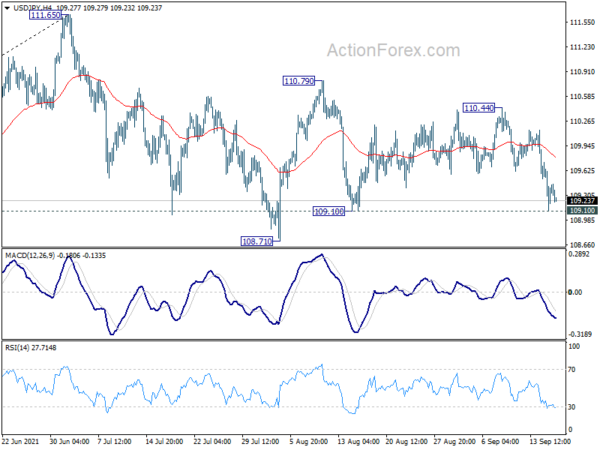

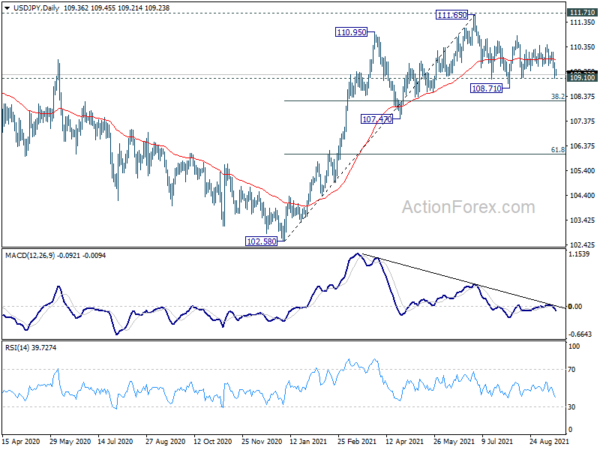

Technically, 109.10 support in USD/JPY remains a major focus, and firm break there will likely resume whole fall from 111.65 through 108.71 support. That could trigger further selloff in Yen crosses elsewhere. For example, CAD/JPY is maintaining near term bearishness after rejection by 55 day EMA. There might be downside re-acceleration ahead to 84.65 support and below, should USD/JPY also take off.

In Asia, at the time of writing, Nikkei is down -0.48%. Hong Kong HSI is down -1.97%. China Shanghai SSE is down -0.68%. Singapore Strait Times is up 0.26%. Japan 10-year JGB yield is up 0.0073 at 0.043. Overnight, DOW rose 0.68%. S&P 500 rose 0.85%. NASDAQ rose 0.82%. 10-year yield rose 0.027 to 1.304.

Japan exports grew 26.2% yoy in Aug, imports rose 44.7% yoy

Japan’s export grew 26.2% yoy to JPY 6605B in August. That’s the sixth straight month of double-digit annual growth, as boosted by strong demand for chip-making equipment. By destination, exports to China, the largest trading partner, grew 12.6% yoy. Exports to Asia as a whole rose 26.1% yoy. Exports to the US rose 22.8% yoy. Exports to EU rose 29.9% yoy.

Imports jumped 44.7% yoy to JPY 7241B, due to stronger demand for fuel and medical goods. Trade balance came in at JPY -635B deficit, the largest shortfall since December 2021.

In seasonally adjusted term, exports rose 0.8% mom to JPY 7104B. Imports rose 4.6% mom to JPY 7276B. Trade deficit came in at JPY -272B versus expectation of JPY 80B surplus.

Australia employment dropped -146.3k in Aug, people also dropping out of labor force

Australia employment dropped -146.3k in August, even worse than expectation of -70.0k. Full-time jobs dropped -68k while part-time jobs dropped -78.2k.

Unemployment rate, on the other hand, dropped -0.1% to 4.6%, versus expectation 4.9%. But that’s due to a sharp fall in participation rate by -0.8% to 65.2%. Monthly hours worked dropped -66m hours or -3.7% mom.

Bjorn Jarvis, head of labour statistics at the ABS, said: “The fall in the unemployment rate reflects a large fall in participation during the recent lockdowns, rather than a strengthening in labour market conditions.

“Throughout the pandemic we have seen large falls in participation during lockdowns — a pattern repeated over the past few months. Beyond people losing their jobs, we have seen unemployed people drop out of the labour force, given how difficult it is to actively look for work and be available for work during lockdowns.

New Zealand GDP grew 2.8% qoq in Q2, well above expectation

New Zealand GDP grew 2.8% qoq in Q2, well above expectation of 1.2% qoq. Growth was led by service industries, which rose 2.8% qoq. Primary industries rose 5.0% qoq. Goods producing industries rose 1.3% qoq.

“The June 2021 quarter experienced fewer COVID-19 restrictions than previous quarters affected by COVID-19. Many industries experienced activity at or above pre-COVID-19 levels, while some remained below,” national accounts senior manager Paul Pascoe said.

ECB Lane: Should emphasize persistence, not volume of asset purchases

ECB Chief Economist Philip Lane said in a webinar, “it’s not a good idea to identify the monetary policy stance with the volume of asset purchases.” Instead, “the efficient approach is to emphasize persistence.”

“We’re happy that our monetary accommodation is strengthening the underlying inflation dynamic and over time — this will continue to build. We have a coherent policy setting,” he added.

Looking ahead

Swiss SECO economic forecasts, Italy trade balance, and Eurozone trade balance will be released in European session. US retail sales will be the main feature later in the day, while jobless claims, Philly Fed survey and business inventories will be released. Canada will release housing starts, wholesale sales and ADP employment.

USD/JPY Daily Outlook

Daily Pivots: (S1) 109.07; (P) 109.41; (R1) 109.70; More…

Focus remains on 109.10 support in USD/JPY. Firm break there will argue that larger fall from 111.65 is resuming. Deeper decline should then be seen to 108.71 support first, and then 38.2% retracement of 102.58 to 111.65 at 108.18 next. On the upside, break of 110.44 resistance will turn bias back to the upside for 110.79 instead.

In the bigger picture, medium term outlook is staying neutral with 111.71 resistance intact. The pattern from 101.18 could still extend with another falling leg. Sustained trading below 55 day EMA will bring deeper fall to 107.47 support and below. Nevertheless, strong break of 111.71 resistance will confirm completion of the corrective decline from 118.65 (2016 high). Further rise should then be seen to 114.54 and then 118.65 resistance.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 22:45 | NZD | GDP Q/Q Q2 | 2.80% | 1.20% | 1.60% | 1.40% |

| 23:50 | JPY | Trade Balance (JPY) Aug | -0.27T | 0.08T | 0.05T | -0.01T |

| 01:00 | AUD | Consumer Inflation Expectations Sep | 4.40% | 3.30% | ||

| 01:30 | AUD | Employment Change Aug | -146.3K | -70.0K | 2.2K | 3.1K |

| 01:30 | AUD | Unemployment Rate Aug | 4.50% | 4.90% | 4.60% | |

| 01:30 | AUD | RBA Bulletin Q2 | ||||

| 05:45 | CHF | SECO Economic Forecasts | ||||

| 08:00 | EUR | Italy Trade Balance (EUR) Jul | 6.22B | 5.68B | ||

| 09:00 | EUR | Eurozone Trade Balance (EUR) Jul | 16.8B | 12.4B | ||

| 12:15 | CAD | Housing Starts Y/Y Aug | 270K | 272K | ||

| 12:30 | CAD | ADP Employment Change Aug | 221.3K | |||

| 12:30 | CAD | Wholesale Sales M/M Jul | -2.00% | -0.80% | ||

| 12:30 | USD | Retail Sales M/M Aug | -0.70% | -1.10% | ||

| 12:30 | USD | Retail Sales ex Autos M/M Aug | -0.10% | -0.40% | ||

| 12:30 | USD | Initial Jobless Claims (Sep 10) | 316K | 310K | ||

| 12:30 | USD | Philadelphia Fed Manufacturing Sep | 18.9 | 19.4 | ||

| 14:00 | USD | Business Inventories Jul | 0.50% | 0.80% | ||

| 14:30 | USD | Natural Gas Storage | 76B | 52B |