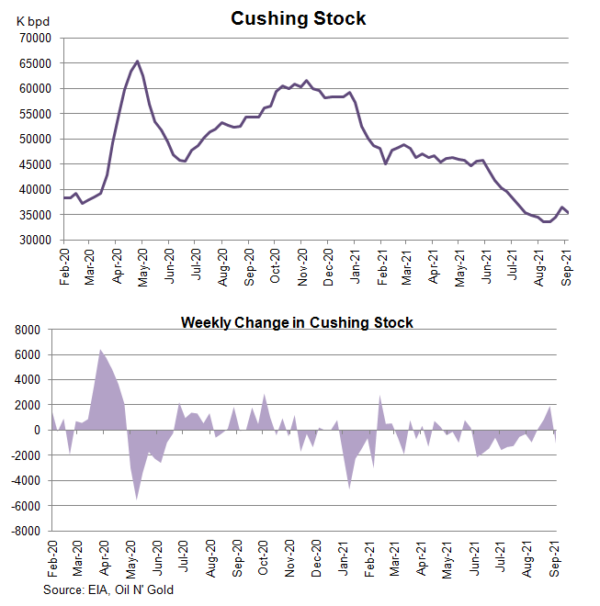

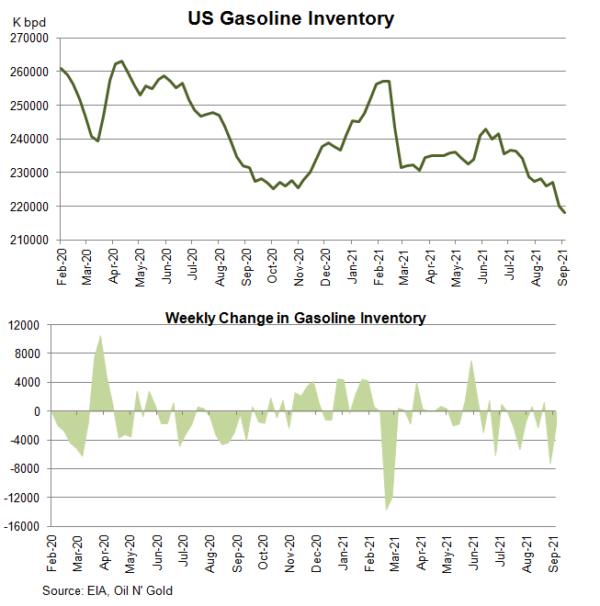

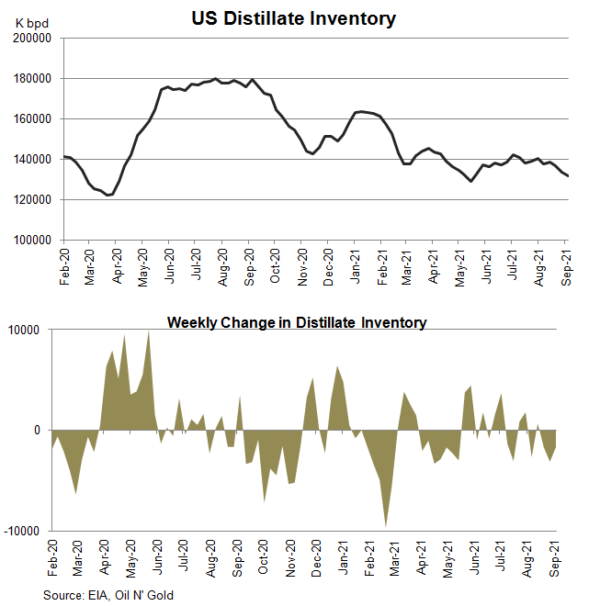

The report from the US Energy Information Administration (EIA) shows that total crude oil and petroleum products (ex. SPR) stocks fell -8.78 mmb to 1234.64 mmb in the week ended September 10. Crude oil inventory sank -6.42 mmb (consensus: -3.54 mmb) to 417.45 mmb. Stockpile fell in 4 out of 5 PADDs. PADD 3 (Gulf Coast) alone saw -3.85 mmb decline during the week. Cushing stock dropped -1.1 mmb to 35.32. This marks the first decline in 4 weeks. Utilization rate added +0.2 percentage points to 82.1% while crude production edged +0.1 mmb higher to 10.1M bpd for the week. Crude oil imports decreased -0.05M bpd to 5.76M bpd in the week.  Concerning refined oil product inventories, gasoline inventory slipped -1.86 mmb to 218.14 mmb although demand declined -7.45% to 8.89M bpd. The market had anticipated a -1.96 mmb fall in stockpile. Production plunged -8.41% to 9.27M bpd while imports slumped -29% to 0.64M bpd during the week. Distillate stockpile dropped -1.69 mmb to 131.9 mmb. The market had anticipated a -161 mmb decrease. Demand gained +2.99% to 3.8M bpd. Imports slipped -0.69% to 4.16 mmb while production jumped +15.49% to 0.16M bpd during the week.

Concerning refined oil product inventories, gasoline inventory slipped -1.86 mmb to 218.14 mmb although demand declined -7.45% to 8.89M bpd. The market had anticipated a -1.96 mmb fall in stockpile. Production plunged -8.41% to 9.27M bpd while imports slumped -29% to 0.64M bpd during the week. Distillate stockpile dropped -1.69 mmb to 131.9 mmb. The market had anticipated a -161 mmb decrease. Demand gained +2.99% to 3.8M bpd. Imports slipped -0.69% to 4.16 mmb while production jumped +15.49% to 0.16M bpd during the week.

A day earlier, the industry-sponsored API estimated that crude oil inventory was sank -5.44 mmb. Gasoline stockpile dropped -2.76 mmb, while that for distillate dipped -2.89 mmb.