In a Wall Street Journal publication on Wednesday, entitled, ”Democrat’s Split Over Powell Fed Reappointment”, markets are again contemplating his replacement next year.

Progressive Democrats have been urging US president Joe Biden to replace the Federal Reserve’s chairman, Jerome Powell.

Such reps as New York Rep. Alexandria Ocasio-Cortez are looking for a sweeping makeover at the Fed so that it can come more in line with the task of mitigating climate change.

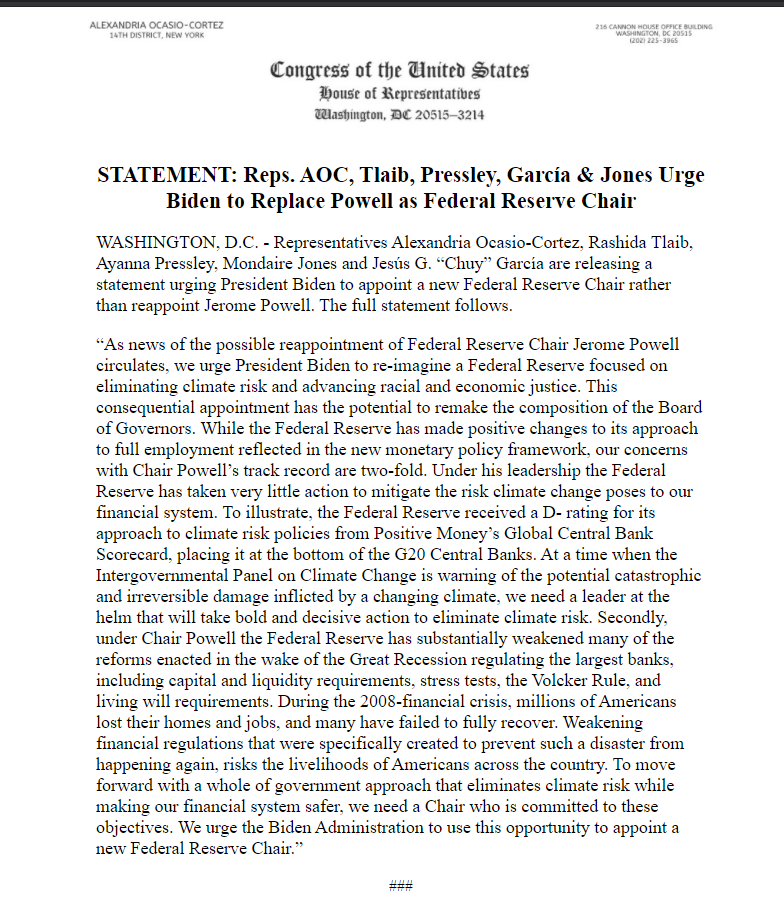

In addition to Ocasio-Cortez, the above statement was issued at the end of August by Reps. Rashida Tlaib of Michigan, Ayanna Pressley of Massachusetts, Mondaire Jones of New York and Chuy Garcia of Illinois, all members of the Congressional Progressive Caucus.

“Under his leadership, the Federal Reserve has taken very little action to mitigate the risk climate change poses to our financial system,” the lawmakers said in the statement.

The statement has criticized the Fed for “weakening” financial regulations enacted after the Great Recession, including capital and liquidity requirements, stress tests and the Volcker Rule.

Powell has previously disputed the argument that the Fed has weakened regulations.

The Federal Reserve declined to comment any further.

Jerome Powell took office as chairman of the Board of Governors of the Federal Reserve System in February 2018, for a four-year term ending in February 2022.

His term as a member of the Board of Governors will expire on January 31, 2028.

Federal Reserve Chairman Jerome Powell had a rocky start and a cool reception when he took the central bank helm, but he has been since well-received due to the fashion for which the Fed has steered the US economy through the US coronavirus epidemic to date.

However, Fed watchers say Joe Biden has a unique opportunity to reshape the Fed’s influential board of governors to align more with his administration’s priorities, not just in the classic hawkish vs dovishness, but also thinking about those broader issues, such as climate change and its implications for the financial industry.

The WSJ article has, however, highlighted the divide among Democrats.

”One group wants the central bank to be reoriented more explicitly to address priorities such as climate change and are pressing the White House to replace Mr Powell when his term expires,” the article read.

On the other hand, the news agency quotes a centrist Democrat on the Senate Banking Committee, Montana Sen. Jon Tester.

”Tester said in an interview Wednesday that he was concerned by recent calls from progressive House Democrats to replace Mr Powell with someone who would focus the Fed on advancing liberal political priorities, including climate change.”

”Mr Tester said he worried doing that would harm the economy by politicizing the central bank. Mr Tester said he didn’t think the Fed should be wading into hot-button political issues like climate change, in which the central bank doesn’t have a formal mandate.”

“’They should not be involved in the political footballs thrown around on CapitolHill. That’s the reason I want Jerome Powell. He’s proven he can maintain the independence of the Fed,’ said Mr Tester.”

Nevertheless, the markets are more focussed on the here and now which is all about one of the Fed’s mandates on reaching maximum employment.

In doing so, the Fed is expected to taper its Coronavirus quantitive easing programme, potentially as soon as before the year is out.

Such sentiment amidst renewed growth concerns globally is weighing on risk assets and supporting the US dollar.

The DXY is on the verge of a retest of the counter trendline as follows:

A test of the 50% mean reversion is bullish while the index is above the 50-day EMA.

The bigger test for the bulls will be the counter trendline.