New lows for the greenback vs the EUR, GBP, AUD and NZD

The USD has made a break to the downside with the dollar moving to new lows verse the EUR, GBP, AUD and the NZD.

EURUSD: The EURUSD has broken above the 1.18507 to 1.18568 swing area (see earlier post). The pair has entered into the upper extreme area going back to the end of July early August between 1.18568 and 1.19081. Swing highs between 1.18928 and 1.18965 from July 29, July 30, August 2 and August 3 stalled rallies on those days from the hourly chart.

GBPUSD: The GBPUSD as broken above the 200 day moving average 1.38065. On Tuesday, the price briefly moved above that level but quickly reversed. Staying above now keeps the buyers in firm control.

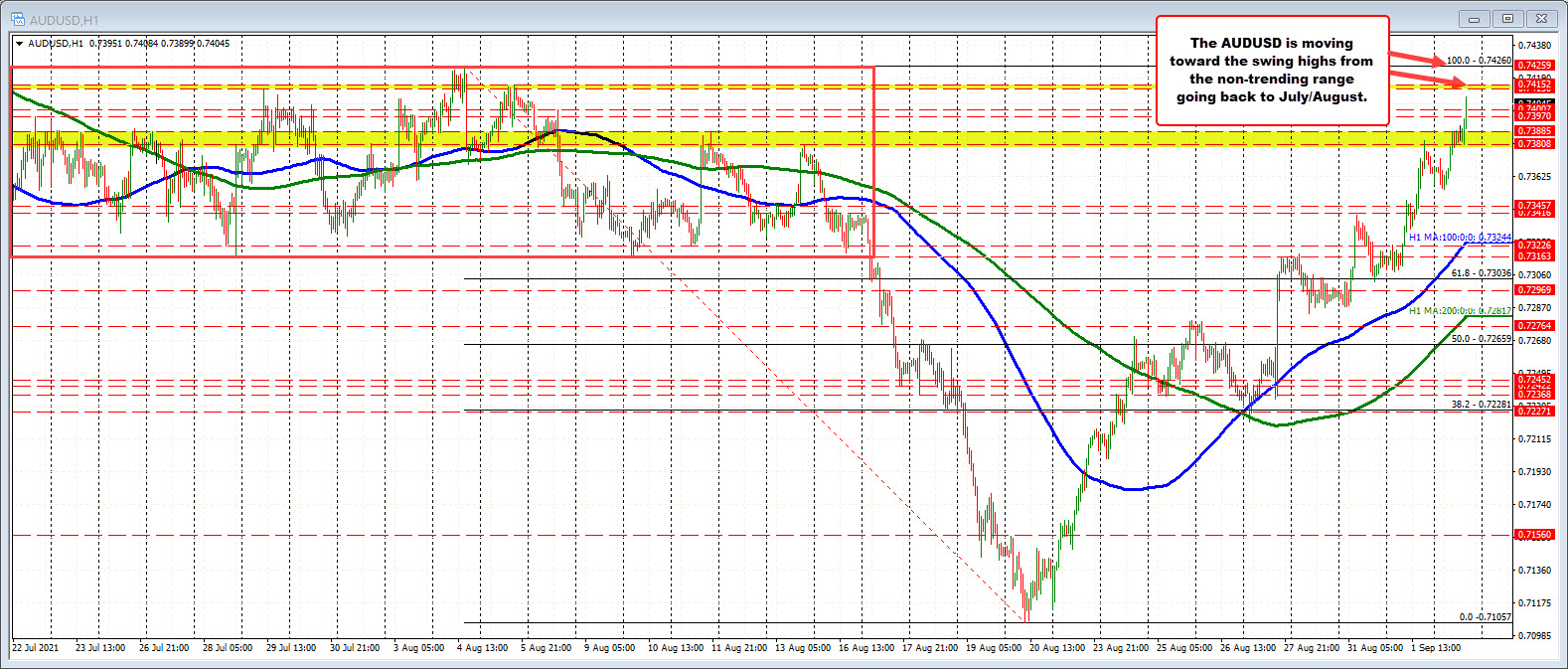

AUDUSD: The AUDUSD is trading at its highest level since August 5. The next target comes in between 0.7413 and 0.74152. Above that is the August high price at 0.7426. The pair today based against a swing area between 0.73808 and 0.7 385. Stay above that level keeps the buyers more control.

NZDUSD: THe NZDUSD as moved up to test its 200 day moving average at 0.71112. The price earlier today moved above the 100 day moving average at 0.70803 and the swing high going back to August 4 at 0.7088. A move above the 200 day moving average would increase the bullish bias technically.

Yields are lower but off their lowest levels. The 10 year is at 1.2920%. The low yield reach 1.283%.