New Zealand Dollar rises broadly today after a top RBNZ official indicated that the decision to refrain from rate hike was mainly due to communication difficulty. Instead, the central bank is actively considering a 50bps hike. Strong rebound in Asian stocks also supported other commodity currencies, but positive sentiment is not much carried through to European session. For the moment, Dollar and Euro are the softest ones. But Euro could eventually decide to leave the greenback behind if Gold could extend its rebound above 1800 handle.

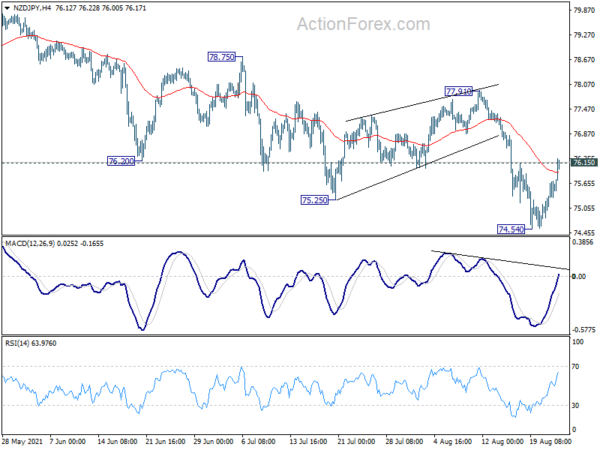

Technically, NZD/JPY’s break of 76.15 minor resistance should indicate short term bottoming at 74.54. The question is whether the rebound could power through 77.91 resistance to indicate completion of the correction pattern from 80.17. Also, to confirm such a bullish turn in Kiwi, we’d also like to see break of 0.7087 resistance in NZD/USD. Before, we’ll stay a bit cautious on New Zealand Dollar first.

In Europe, at the time of writing, FTSE is down -0.34%. DAX is up 0.29%. CAC is down -0.52%. Germany 10-year yield is up 0.002 at -0.475. Earlier in Asia, Nikkei rose 0.87%. Hong Kong HSI rose 2.46%. China Shanghai SSE rose 1.07%. Singapore Strait Times rose 0.65%. Japan 10-year JGB yield rose 0.0010 to 0.020.

Germany GDP growth finalized at 1.6% qoq in Q2, individual sectors diverged

Germany GDP growth was finalized at 1.6% qoq in Q2, revised up from 1.5% qoq. In, seasonally and calendar-adjusted gross value added increased by 1.0%. Individual sectors showed diverging trends: Up 3.8% qoq in public services, education, health; up 1.1% qoq in trade, transport, accommodation and food services; up 0.1% qoq in construction; but down -1.3% in manufacturing.

Comparing with the same quarter a year earlier, GDP grew 9.8% yoy on price-adjusted term, and 9.4% yoy on price- and calendar-adjusted term.

RBNZ Hawkesby said 50bps hike actively considered, NZD/USD jumps

RBNZ Assistant Governor Christian Hawkesby told Bloomberg that the decision to stand pat on OCR last week was mostly due to communications problem. It’s hard to explain the case when if the rate hike was delivered on the same day as New Zealand returned to pandemic lockdown.

He added that the decision was not due to risks and the policy decisions “won’t be tightly linked” to COVID -19. Demand as proven to be more resilient than anticipated.

Most surprisingly, Hawkesby also indicated that the central bank has considered a 50bps rate hike. “A 50 basis point move was definitely on the table in terms of the options that we actively considered,” he said.

New Zealand retail sales rose 3.3% qoq in Q2, above expectations

New Zealand retail sales volume rose 3.3% qoq in Q2, above expectation of 2.0% qoq. 11 of 15 industries reported growth, and the largest increases were in electrical and electronic goods retailing (up 6.9%), food and beverage services (up 5.6%), motor vehicle and parts retailing (up 3.1%), pharmaceutical and other store-based retailing (up 7.5%), and accommodation (up 11.4%).

“Most retail industries saw increases in spending, with rises across all regions. Spending on big ticket items such as electrical goods, housewares, and vehicles was a priority for many consumers during this June quarter,” retail trade manager Sue Chapman said.

USD/CHF Mid-Day Outlook

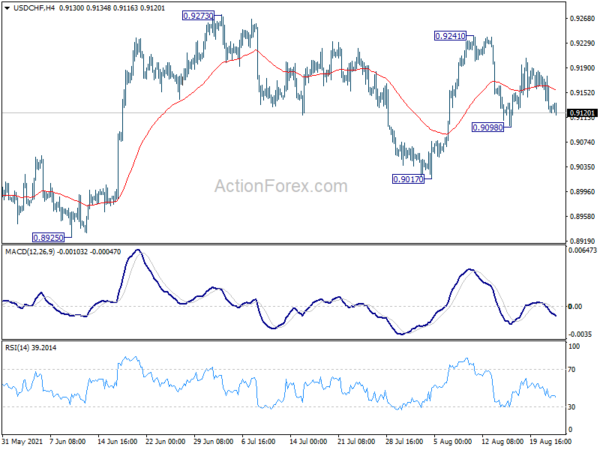

Daily Pivots: (S1) 0.9106; (P) 0.9142; (R1) 0.9161; More….

Intraday bias in USD/CHF remains neutral for the moment, and more range trading could be seen. . On the upside, break of 0.9241 resistance should resume the rise from 0.8925 through 0.9273. On the downside, break of 0.9098 will target 0.9017 support first. Further break there will likely resume the decline from 0.9471 through 0.8925 low.

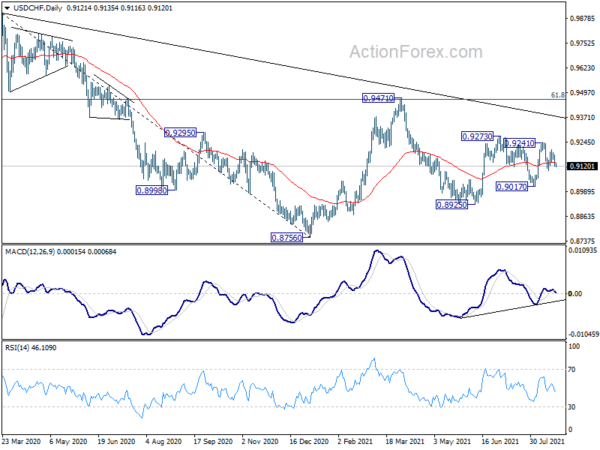

In the bigger picture, the failure to sustain above 55 week EMA (now at 0.9180) retains medium term bearishness in USD/CHF. Break of 0.8925 support should resume the whole decline form 1.0342 (2016 high) through 0.8756 low. However, break of 0.9273 resistance and sustained trading above 55 week EMA will be an early sign of bullish trend reversal. Focus will then turn to 0.9471 resistance for confirmation.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 22:45 | NZD | Retail Sales Q/Q Q2 | 3.30% | 2.00% | 2.50% | 2.80% |

| 22:45 | NZD | Core Retail Sales Q/Q Q2 | 3.40% | 1.90% | 3.20% | 3.50% |

| 6:00 | EUR | Germany GDP Q/Q Q2 F | 1.60% | 1.50% | 1.50% | |

| 14:00 | USD | New Home Sales M/M Jul | 698K | 676K |